** Transcript Auto-generated**

00:00:08 Erwin

Are we in a buyers?

00:00:09 Erwin

Market why more landlords are converting units into short term rentals, seeing as she’s making apartment building by buying harder, especially refinance part and lessons.

00:00:20 Erwin

From Engine 30, Airbnb.

00:00:22 Erwin

All this and more on the truth about real estate investment show for Canadians. I’m your host German sito of the number 81 ranked business podcast in all of iTunes Globally. Somehow we cracked algorithm and we achieved top top like .1% status. This show is for open minded individuals who love to learn and open to questioning norms and authorities including.

00:00:42 Erwin

Whatever has been sold by influencers in and those in the investment community.

00:00:46 Erwin

I see all those emails and Facebook ads about courses for college rental, investing or short term rental or mid term rental with promises of easy 6 figure cash flow. So when I read these things I put in calls to my friends including Jonathan and my who are full time in the same space and I asked them for their experience and my search for the truth about real estate.

00:01:08 Erwin

Hence mine. Jonathan, you’re here today on the show as they managed like. Like I said, repeat it a couple of times. They want a couple and they’re total portfolio management includes 30 air B.

00:01:19 Erwin

They’ll be on today’s show before we get to them. The City of Toronto has a $1.5 billion shortfall, and if you’ve been following the news, they’re not the only missing miscibility with financial trouble. I’m seeing news across the country with above inflation, property tax increases expected, with more on the way.

00:01:41 Erwin

Town of Markham. I’m not sure why only telling Markham is, uh, making the news. I think maybe because they’re the only ones who are projecting further ahead a little bit. But anyways. And the town markets staff 2023 budget.

00:01:53 Erwin

Overview They proposed an A tax increase of 93.3%. That’s right, 93. So it’s almost 100% starting next year to 2026, so about three-year period, the proposed tax increase is almost 100% and they’re blaming the Bill 23, the more homes.

00:02:13 Erwin

Little faster act.

00:02:15 Erwin

City of Hamilton is closer to home for me is already considering a 14% property tax increase next year, which translates to about $500 per house that my clients and I own. On top of that, my student rentals went up $500.00, so that’s an increase between tax and property, between tax and insurance is the increase of $1000 per year.

00:02:35 Erwin

But cash were already tight. Many properties out there, and many people are negative, with rates already out of rent control, so we can’t pass these costs on without a lot of pain. Above guideline increases often take a couple of years, sometimes around 3:00 to get done, and even then tenants and to fight them.

00:02:52 Erwin

Following the news through our red stripes all over Toronto for above time rental increases anyways, this is a tough business to be in, hence more landlords quote UN quote. More landlords are converting units into shorter rentals. End Quote is the latest article on Bloomberg Canada and the reason our guests our guests are here today.

00:03:12 Erwin

What’s real estate?

00:03:13 Erwin

Going to do with rising costs and long term tenants rents capped naturally, they’ll pick toward the RB for the usually higher income and avoidance of the landlord.

00:03:24 Erwin

Board where my experience it takes about seven months just to get a hearing. Real estate owners, they don’t feel they have enough control and they don’t feel protected by the laws in our systems and in the same article and they kill University professor who is a chair in urban governance has reached says shows that short term rentals increase.

00:03:44 Erwin

Housing costs and recommends that cities with housing charges and short term rentals, except for those in the islands, only primary residences. What’s not mentioned by the same university professor is the effect on the 500,000 or so new international students that came to Canada last year.

00:04:02 Erwin

This year we’re looking to get over well over 600,000 international visa students and many of them attend post secondary schools like McGill U, and you better believe they have an effect on housing costs as well. In my experience, I have a couple of national students myself in houses and they’re from minor. My students are from India and they all work in the restaurant.

00:04:22 Erwin

On the street, their job is actually as cooks, similar to so the story that I see with my smiling experience is very similar to what I’m reading.

00:04:31 Erwin

Media now the testament tenant crisis is legit again, article to the Bloomberg article in the short notes on to next is seeming she is making Burr apartment strategy is much more difficult that’s buy, renovate, refinance, rent out repeat. So I can’t find anything online on this news.

00:04:51 Erwin

I spoke to three investor friends, each of whom owned millions upon millions. Several of these folks, they buy apartment buildings, they own apartment buildings, but basically CMHC on refinance wants to see the funds going into buying more rental stock or improving existing rental buildings.

00:05:09 Erwin

They don’t just want to see equity takeouts to repair shareholders or repay the real estate master. Add that one must already be with an approved approved lender in order refinance. So private lending or render take back mortgages, those investors will need to will need to be with an approved bridge lender. Often they might.

00:05:29 Erwin

Or require you to be with that approved lender for two years before you able to refinance. So leading to that is meaning more hoops and more cost. This is a big deal to many small real estate masters since cash flow is extremely limited. Think there’s actually much at all in apartment building investing since.

00:05:47 Erwin

Cap rates are low and interest rates are already high. Small investment they tend to depend on the refinance money for their to cover their daily expenses in their living. So apartment building investors please keep an eye on the space. Uh, it sounds like CMHC wants to focus more on developments that creates more housing supply.

00:06:05 Erwin

On that personal investment fund, my flight to Atlanta.

00:06:07 Erwin

Booked to tour, some properties meet with property managers. One of them has 800 doors under management, which is unheard of here in Ontario. Probably BC two, unless it’s a institutional investor like elite and it’s an in house PR.

00:06:22 Erwin

Of course, like in Hamilton, Effort Trust has something like that has 800. I don’t know thousands of doors, but they only manage their own. I’m talking about property management companies that manage for other customers. So learning what the states has been very fascinating when the laws favor the landlord, more and more law and pop investors own rental properties. So.

00:06:42 Erwin

That’s about the.

00:06:43 Erwin

Investment is very common in those states for my for my research. Hence there’s need for a lot for large property management firms and these property management firms can actually make a living, can do good business because the laws.

00:06:57 Erwin

You are not in favor of the tenants. Clientele is not at risk of being uh without rent for months while they battle things out in the land at the landlord tenant board. I do. Don’t start investing in the USA continues. I’ve printed off my old friend friends. We’ll see. Vestment network friends. You’ll remember the property gold mine scorecard. So I printed.

00:07:17 Erwin

Well, goes off. I’m going to do my diligence. The old school way, and make sure I put I check.

00:07:22 Erwin

Off all the rights.

00:07:24 Erwin

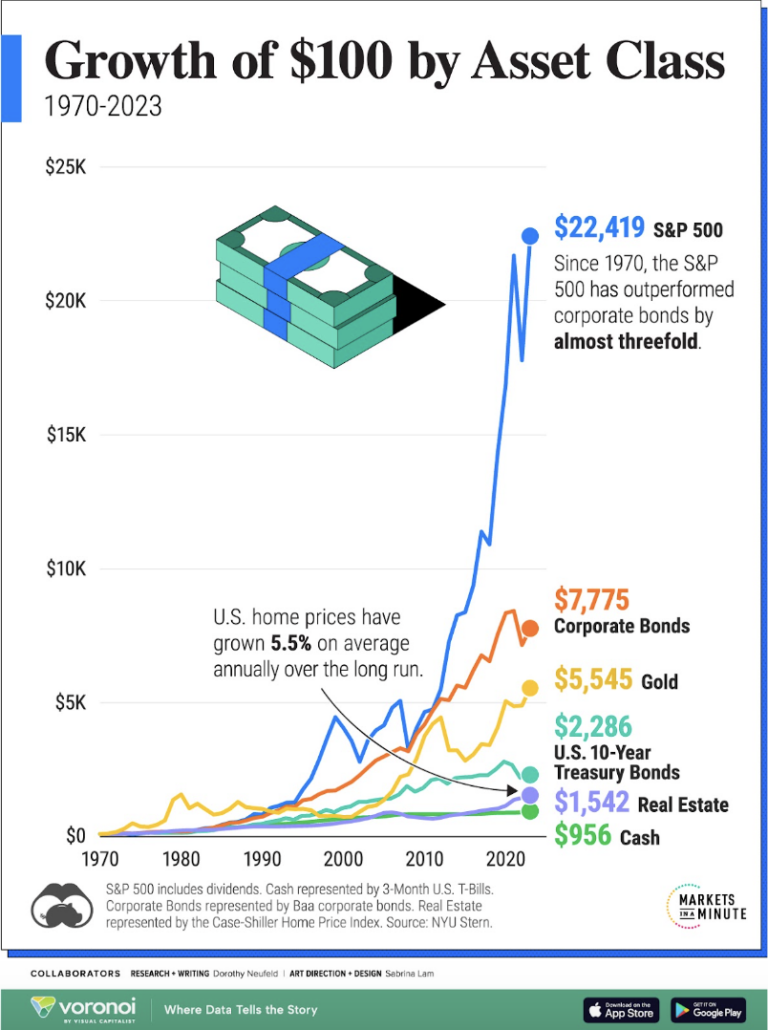

Make sure I complete my diligence correctly in again to look for the best areas to invest in the United States of America. There’s no doubt in my mind, so I love Canada. I love being loving, loving here. It’s meant so much to me and my family to be, to be Canadians. It’s no doubt in my mind that the Golden Horseshoe of Ontario will increase in price when interest rates are cut.

00:07:45 Erwin

But the same will be happening as well and if you buy it correctly in the US, So Shane and I are selling some of our properties here in Canada here locally and we allocate some of that capital payoff.

00:07:55 Erwin

Let’s buy some and then buy some houses that cash flow and and landlord friendly states using easy commercial style mortgages. So this is something that’s new to me. I did not know that these that you could get commercial style mortgages in the states. So qualification is way easier than my experience here. Institutional grade property managers exist, they’ll manage my properties for me and there’s no right.

00:08:17 Erwin

I haven’t been into 600, but real estate investing in a really long time, way more excited about this than garden suites. To be honest, we’re going to make real estate vesting great again and I’ll bring you the listener along for our journey if you like to learn more, how can other Canadians are diversified with their portfolios online? Only Island meeting is Tuesday, October 17th.

00:08:37 Erwin

We have us invest in the expert, Andrew Kim, who will be on the show. He owns properties in Sunbelt states like Florida, Texas, Georgia, New York and we’ll also have my old friends and columns. So if you’re interested in.

00:08:51 Erwin

What’s the stock worth? Stocks? My old friends in cones will be detailing how he cashed those over $10,000 per month with the proceeds of his real estate portfolio after he took profits. Like we’re doing all of its real estate in 23 one, he now earns and passive income as both a realtor and also via state Stock ETF.

00:09:11 Erwin

And high yield ETFs. So he’s gonna get into more detail into that as well as sharing about how he’s going to save a lot of his costs by being at one of these newest tech based real estate brokerages. That’s all on the Tuesday nights then following. That’s all in October.

00:09:30 Erwin

17th Tuesday night and then immediately the following Saturday morning. We are hosting our first ever investing in US real estate workshop. Our guest speakers are from share who are Canadian, so we have their Chief Investment officer and to be true we have their CFO as well. Their CFO is a Sir Charter professional accountant in both Canada.

00:09:52 Erwin

Dimitri beside Chief Investment Officer, he has experience managed acquiring and managing over 20,000 units in Sunbelt states. So and also my good friend Scott billion Loveland City who’s a dual citizen and so he’s a guy who, yes, we’re us Canadians were some mortgages on income.

00:10:11 Erwin

Properties in the US.

00:10:12 Erwin

So the costs are nominal, it’s less than $40 because my friends from share immensity are donating their time to educate all of us on how we can make real estate investing great again without rent control without the landlord tenant board.

00:10:25 Erwin

We’re almost sold at the in person.

00:10:27 Erwin

Venue. I think we maybe have three tickets left. We have a capable 100 tickets in total, so.

00:10:32 Erwin

We’re getting close to that.

00:10:33 Erwin

Already, I think we’re getting close to. I think we have sold out about 80 tickets already. So do not wait. I have links in the show notes for both the island meeting and for the US Investing Workshop. You don’t want to miss it.

00:10:44 Erwin

On since we.

00:10:45 Erwin

Show we have my old friends, my mind, the Yuan and Jonathan Lim, whose travel agency business was hit pretty hard by COVID. But thanks to their experience as early adopter B host, they were successfully able to pivot into short term rental management and ownership. Specifically, B now the couple owns and manages.

00:11:05 Erwin

A total of 30 everyday properties from Muskoka colleges, two hours north of Toronto to downtown Toronto, condominiums to recreational properties in Niagara.

00:11:15 Erwin

They have quite a bit of experience on what works, what doesn’t work, the good, the bad and the ugly. The truth about short term rentals is that they are a hospitality business. That means a lot of customer service cleaners are absolutely critical to the business. Location and amenities mean the difference between success and failure. It’s totally doable. We’ve had several guests on the show.

00:11:35 Erwin

More success.

00:11:36 Erwin

Doing this but it does come down to education and execution. Hence my Jonathan are here to share how to do it, tell like it is including the mistakes we made when they first listened, their property, their own home. Sorry, their own home on air B. It’s actually a pretty funny story. Again, they were early adopters before. Before many of us knew what everybody was.

00:11:56 Erwin

So they’re going to share how they’ve used Airbnb to fund their travel, what types of properties to buy red flags of for potential guests and games, especially scams. I’m sure you’ve read about scams in the in the paper, they’re pretty awful. And then they answer the question, should you be buying a property today for the purposes of the air?

00:12:16 Erwin

So before buying a recreational property course or property, I highly recommend you giving this episode list. Please enjoy the show all the information on the show notes the company has told Short Stay International and that’s www.short stays IMTL, which is short for international.com you can find them on Instagram.

00:12:37 Erwin

And also if you could be so kind if you’re interested in becoming a host minded post her referral link for every B which gets you which saves you some money and and it’s all the short notes please enjoy the show. Hi my. Hi Jonathan. Thanks for coming in.

00:12:53 Erwin

How did you get started? In short term property management?

00:12:57 Speaker 3

The short story of it is we actually tested out managing our own property during Airbnb years back. I would say about 8-10 years back. One day I remember I’m in the travel business and I’m always online searching for different pool apps and one day I was doing a presentation on like the online world.

00:13:18 Speaker 3

And there is the Airbnb app and what it’s doing. I think a lot of people in Canada doesn’t even know about Airbnb.

00:13:24 Speaker 3

Then and when we talked about it, it was so interesting. However, we never experienced ebb ourselves, and then I remember one day we took a trip to Montreal and we were about to. It’s a last minute trip and we’re like, let’s look at a hotel. So we went on booking.com.

00:13:39 Speaker 3

And then we’re like, you know what, what are we?

00:13:40 Speaker 4

Why don’t try?

00:13:41 Speaker 3

This Airbnb thing out every I think we should. And so we found a last minute Airbnb that was available.

00:13:47 Speaker 3

We went to.

00:13:48 Speaker 3

Montreal, we got in and the host was really nice. He owned the condo. He doesn’t live there and just throughout the whole process.

00:13:56 Speaker 3

We’re like, oh.

00:13:56 Speaker 3

This is cool. We should.

00:13:57 Speaker 3

Test it out. When we come back home.

00:13:59 Speaker 3

So but we set that, but we never thought about it. I guess a couple of years later, one day we looking to make some extra cash or we were traveling anyways, we weren’t gonna be around and then we.

00:14:11 Speaker 2

We we were traveling like every other month. We take a trip for a long weekend or we take a week. You know, we take off for a week and we only had one kid at the time, so it.

00:14:22 Speaker 2

Was a lot easier to travel and I guess.

00:14:23 Erwin

Yeah, I remember. I remember the emails like you guys are.

00:14:25 Erwin

Doing some pretty skiing and surfing with Mike Major, yeah.

00:14:28 Speaker 3

Yeah, yeah, yeah, we’re doing snowboarding, skiing trips. And we, we would go on all.

00:14:34 Speaker 3

These trips and.

00:14:35 Speaker 3

We’re always looking to be out and about anyways and we thought about it and we’re all about multiple streams of.

00:14:41 Speaker 3

Income. So we’re like, hey.

00:14:42 Speaker 3

There’s people renting out their.

00:14:43 Speaker 3

Own home? I was hesitant at first, right?

00:14:47 Speaker 3

But I was.

00:14:47 Speaker 3

Like let’s test it out. You know, let’s make sure our place we had an apartment in.

00:14:52 Speaker 3

Toronto let’s just clean it up and.

00:14:54 Speaker 3

I remember I put it online while we were still living there because our plan is as soon as someone booked, we’re flexible. We’ll just travel somewhere.

00:15:03 Speaker 4

Whenever it’s someone booked again, we’ll.

00:15:05 Speaker 4

Just go somewhere.

00:15:06 Speaker 4

And that’s our.

00:15:09 Speaker 2

Life I usually find, like really good deals like last minute.

00:15:10 Speaker 2

You can.

00:15:14 Speaker 2

Deals on on flights and.

00:15:15 Speaker 3

Because we didn’t have nine to five jobs, I guess we were flexible in a way where we’re like, you know what if someone booked it then that means time for us to find some place and go. And I remember I would put it on, but back then I was not very familiar with the app. So what happened was.

00:15:31 Speaker 3

I got the listing up and then I swear to you I guess I left it there. It would be like four months gone by and I was telling John, hey, I wonder what happened to you that are listing. I should check cuz I didn’t see any notifications. I guess I had it off. I went in. There’s like 10 different inquiries about my place that I never responded to. So they end up looking somewhere else.

00:15:51

That did not. Oh my God this.

00:15:52 Speaker 3

Thing actually worked. There are lots of people seeing our listing and our inquiry.

00:15:57 Speaker 3

And obviously my response rate tanked so low and I was rated terrible because.

00:16:03 Erwin

You’re not responsive.

00:16:04 Speaker 2

I think some people had even booked and then they’re not getting any check in info and they’re like following up with these Airbnb is like they have cancelled over and and rebooked them in other properties.

00:16:09 Erwin

Right, you.

00:16:10 Speaker 3

Have to cancel them.

00:16:14 Speaker 4

So we we start off as terrible hosts.

00:16:16 Speaker 4

Right. That was like that accent, like.

00:16:18 Speaker 3

Put this listing on.

00:16:19 Speaker 3

And back then, I guess the FBI didn’t have a lot of the same regulations. Now, if things are really easy.

00:16:25 Speaker 3

And anyways, I learned so I.

00:16:26 Speaker 3

Told John all this work.

00:16:27 Speaker 3

So when we’re ready to have our placement it out, we better be like you know on the ball. Like if we’re gonna turn it back on, we have to unlist our property.

00:16:35 Speaker 3

And when we’re ready to have someone to come in, then we turn it on. And then as soon as we turned it on, we had lots of inquiries and people were coming and we were able to accept a few bookings and then basically that’s how we experience Airbnb as a.

00:16:50 Speaker 3

Host for the.

00:16:51 Speaker 3

First time and we continue to do that every time we wanted to travel.

00:16:55 Speaker 3

And then Fast forward to COVID. So right in the beginning of COVID, we had a travel business. And then as COVID.

00:17:04 Speaker 3

Everything was cancelled. Basically. Yeah, we had.

00:17:05 Erwin

Right, you have to.

00:17:06 Speaker 2

Pivot well, imagine March and April of 2020, yeah.

00:17:07 Speaker 3

Zero business.

00:17:11 Erwin

Scary telling.

00:17:13 Speaker 2

Yeah, we we were dealing. We were the people that every angry, angry traveler, you know, that lost their flight or couldn’t book.

00:17:20 Speaker 2

Or cause nobody.

00:17:22 Speaker 2

Was was paying for insurance like, you know, cancellation insurance at that time either. So everybody was calling, our phones were going off the hooks with people just yelling at us because.

00:17:26 Speaker 3

Yeah, I remember.

00:17:31 Speaker 2

You know, where’s our money?

00:17:32 Speaker 2

And you know, we can’t get this flight and we don’t want to travel and you know.

00:17:36 Speaker 3

We don’t wanna get COVID and we had a huge like anniversary group and.

00:17:40 Speaker 3

A wedding group.

00:17:41 Speaker 3

It was like imagine spending tons of time working on these groups already.

00:17:46 Speaker 3

And as soon as.

00:17:47 Erwin

It’s no money’s gonna come in.

00:17:48 Speaker 3

Right, yeah, because the way it works in the travel industry is the money is with the supplier. So back then with with Sunwing. So some wing had it and they get future travel credit. But in terms of our work, we don’t get compensated until someone travel that’s a different industry anyway.

00:18:01 Speaker 2

We were. We were we.

00:18:02 Speaker 2

Were doing destination weddings, so this is not just a family of four, this is. This is.

00:18:08 Speaker 3

100.

00:18:09 Speaker 2

A group of 100 people.

00:18:12 Erwin

Yeah. OK. OK.

00:18:12 Speaker 3

There’s no wrong. You know there’s more.

00:18:14 Speaker 3

To bankruptcy or they’re selling off, but.

00:18:16 Speaker 3

They’re still around.

00:18:17 Speaker 3

And so I remember looking at John and say, well, you know what? I guess we have to figure, what else are we going to do? Right. The travel came to a halt. And I remember I was invited to a cottage up.

00:18:30 Speaker 3

In Blue Mountain.

00:18:32 Speaker 3

A friend of mine that got a new cottage and she’s like, oh, would you be interested in managing this? It’s a bit kind of like it’s.

00:18:39 Speaker 3

An hour. So it’s not too.

00:18:41 Speaker 3

Farber is not close either. And then at that gathering, she had a friend who was a wheelchair that was around as well, too, and the realtor and I met, and the realtor said, you know what?

00:18:53 Speaker 3

We have a bunch of properties to and one of them we want to do Airbnb, but we have no time for Airbnb. We’re so busy. Right? Would you be open to taking it on? I know you share cause they were asking us what we did in the past and we share. We had experience doing Airbnb and we’re like, sure, we actually never thought about it.

00:19:10 Speaker 3

But we’re like, OK, we’ve been able to manage ours. So let’s see how this would work. So we then took on that first property in port credit and that was quite the experience actually, right. We learned quite a bit. It’s one thing to manage your own property cuz you get a say in everything, but it’s another to manage someone else, making sure they get their bottom line.

00:19:30 Speaker 3

Trigger, but there’s limitations that you can.

00:19:32

Right. Well, the.

00:19:33 Speaker 3

Do. Yeah, of course, yeah.

00:19:33 Speaker 2

Learning curve too, right?

00:19:36 Speaker 3

And now you’re trying to figure.

00:19:37 Speaker 3

A team cause you don’t want to be the one doing.

00:19:39 Speaker 3

Everything cause you wanna be.

00:19:40 Speaker 3

Able to add on more properties.

00:19:42 Speaker 3

And then from that one property, things were done very well and I guess she started referring us to other clients and then those clients started referring us. And then before you know it, I think we had about 30 properties, wow listing within like a span of a year.

00:19:58 Speaker 3

And 1/2.

00:19:59 Speaker 3

You were just calling us. They’re like, you know what?

00:20:01 Erwin

Well, that’s explosive growth.

00:20:03 Speaker 3

Yeah, that’s crazy. So there’s a lot of up and down. We kind of took on a lot of different properties, but we also learned which properties.

00:20:11 Speaker 3

Work well which?

00:20:12 Speaker 3

Doesn’t work well. What we want to do as a company, and we did some rebranding. We started off with basically at first it’s just kind of like you know, self-employed. Then we’re like, oh, we should put this under an incorporation. We should run it as.

00:20:24 Speaker 3

A property management.

00:20:25 Speaker 2

Well, we learned we learned how to be interior designers, really bad ones. We learned how to be landscapers. We learned how to be handy men and women, and we kind of wore a lot of.

00:20:36 Speaker 2

Different hats in in.

00:20:37 Speaker 3

And and cleaners. So we learned how to clean properly as well.

00:20:37 Speaker 2

That yeah, right.

00:20:41 Speaker 3

Because there’s different aspect to cleaning and air BBB versus cleaning.

00:20:45 Speaker 3

Regular house.

00:20:47 Speaker 3

Because no matter, like even we hire on other people, I feel we need to kind of know it as well too. And and here we are. So we continue with the business and it’s been interesting.

00:20:57 Erwin

I imagine you should pile it on the kilometers on your cars as.

00:21:00 Erwin

Well, yeah, yeah, yeah, yeah.

00:21:02 Speaker 2

Well, that time when we started, we were living downtown and you know, initially we started driving back and forth to Muskoka Blue Mountain. We were cleaning properties up there.

00:21:12 Speaker 2

We would just take the kids with us and we would just, you know, we’d hang out there for a few nights and and clean and then.

00:21:18 Speaker 2

From Mississauga, when?

00:21:19 Speaker 3

Yeah, a lot of.

00:21:19 Speaker 2

We we started in.

00:21:20 Speaker 2

Mississauga we go back and forth all the time.

00:21:22 Speaker 2

To Mississauga, there a lot. Everybody’s in Mississauga, a lot of.

00:21:24 Speaker 3

Oh yeah, and Toronto downtown too. So the interesting thing was, before we managed the port credit, we weren’t sure like how it would be in Mississauga until we start managing that, we realized that we got a lot of inquiries of people that are just moving around. They just sold their house. It’s not even travelers because you think they’re being.

00:21:24 Erwin

Demand in Mississauga, yeah.

00:21:45 Speaker 3

Then usually for people who travel into the city exactly.

00:21:47 Erwin

Yeah, I’m still on vacation. Yeah.

00:21:50 Speaker 3

But no, these are people where, like my house got burned and, you know, unfortunately, I need a place or I just sold my house and we’re not gonna move into our new house until another two months.

00:21:53 Erwin

Ohh great.

00:22:00 Erwin

Right.

00:22:01 Erwin

Which is your classic midterm rental? Yeah, a new.

00:22:03 Speaker 3

Profile. Yeah. Or they’re fixing their house and they can be in their house or we had people who were. Yeah, we were working.

00:22:03 Speaker 2

Yeah, once. Yeah.

00:22:09 Speaker 2

Contractors who, you know they’re they’re been brought in from a, you know, another city.

00:22:14 Speaker 2

And they’re there for a month or two months, setting up the new gym or school or building building.

00:22:22 Speaker 3

Building because they have exactly. I remember we had one guest who were such great guests and they stay. They’re they’re a company from Germany and their technician has to be flown in from Germany in Canada. They don’t have the same engineers. And so they have to. So it’s interesting.

00:22:36 Speaker 2

Top notch yes.

00:22:41 Erwin

Yeah. Interesting. So you you mentioned you learned quickly what you wanted to manage and what you did.

00:22:46 Erwin

What’s the property?

00:22:47 Erwin

You don’t want to manage and why?

00:22:49 Speaker 3

Yeah. So behold, our experience, there are properties and I say properties, but it comes as a package, it’s also the home owner or the investor, right? So there are properties where it’s kind of like the owner just bought it as is and just don’t want to have long term renters and but they’re not ready.

00:23:09 Erwin

So I have no idea why, but OK continue.

00:23:11 Speaker 4

Right. And don’t.

00:23:13 Speaker 3

Want to have to deal with?

00:23:14 Speaker 3

That all these aspects of being in the hospitality business, because everybody is still hospitality. It’s not just about investing. Yeah. And so they would just throw the house out there and say, hey, you get it fully booked and.

00:23:28 Speaker 3

We found it’s not the case. There’s things you have to do to upgrade the.

00:23:32 Speaker 3

House for a certain experience, for certain.

00:23:34 Speaker 3

Look right and there’s so many other houses that are empty, so why should a guest choose your house versus someone else? And so for us, we know that we have to look for the right type of client with the right mindset. They want to be good hosts. They want to invest into the experience for their guests.

00:23:50 Erwin

Right, right.

00:23:52

And their.

00:23:54 Speaker 3

No, it’s not like.

00:23:54

You know.

00:23:55 Speaker 4

That, yeah, maybe back in the days.

00:23:57 Speaker 4

When it was new and.

00:23:58 Speaker 3

You throw whatever property on Airbnb and.

00:24:01 Erwin

There still need to.

00:24:01 Speaker 4

You just get.

00:24:01 Erwin

Be furniture and.

00:24:02 Erwin

They’re not like you didn’t destroy anything.

00:24:05 Erwin

It has to be. It’s better or an.

00:24:07 Erwin

Air mattress or something? Yeah.

00:24:07 Speaker 2

At least I sailed. Oh yeah.

00:24:08 Speaker 4

Yeah, at least something. But now get.

00:24:10 Speaker 4

Some more picky.

00:24:11 Speaker 3

They want the mattress to feel a certain way. It’s no longer. I just.

00:24:14 Speaker 4

Have a bed. Ohh your.

00:24:16 Speaker 3

Mattress doesn’t feel good.

00:24:18 Speaker 3

OK, you know.

00:24:19 Speaker 3

Those are the.

00:24:19

Things that.

00:24:20 Erwin

I want a coffee maker. I want coffee. I want a wine opener, alright.

00:24:24 Speaker 2

Ohh, you gotta drink coffee.

00:24:25 Speaker 2

Machine while we want Keurig want we want pod.

00:24:27 Speaker 4

Yeah, exactly.

00:24:29 Erwin

Or whatever. No. People go to accident. You really.

00:24:30 Speaker 2

Off they thought they go. Yeah, we get everything.

00:24:31

Get that kind.

00:24:31 Erwin

Of feedback. Yeah, yeah.

00:24:34 Speaker 3

Yeah, for sure. And we get people to tell you and you know we appreciate the feedback, but it doesn’t mean you have to follow all the feedback. It has to make sense either, but they’re.

00:24:43 Erwin

I can’t believe someone.

00:24:44 Erwin

Go to the extent to say I.

00:24:44 Erwin

Need a Courier like? Well, they would.

00:24:46 Speaker 3

Prefer that or they said, you know, so you’re.

00:24:47 Speaker 2

Yeah, because that’s what they have at home or.

00:24:49 Speaker 2

Or you know, that’s what they’re used to.

00:24:51 Speaker 2

Like I don’t know how to use a.

00:24:52 Speaker 2

Filter you know like.

00:24:54 Speaker 2

It’s it’s.

00:24:55 Speaker 2

You get some interesting.

00:24:57 Erwin

Because I don’t.

00:24:58 Erwin

Know how to use a filter, right? OK, yeah.

00:25:00 Speaker 4

Yeah. Also, it’s the guests, right?

00:25:02 Speaker 3

So the more you can accommodate to all the range of guests, yeah, without going too crazy, then you know, the more.

00:25:09 Speaker 3

Chance you have.

00:25:10 Speaker 2

Right. Yeah. But we we learned that. I mean, for me at least.

00:25:13 Speaker 2

In in my.

00:25:14 Speaker 2

I don’t like working with. I would prefer not to work with an owner or an investor who likes mixed-use.

00:25:21 Speaker 2

So for example, they want long term tenants upstairs and then it’s a duplex and then they you know they want Airbnb, the basement or or vice versa a lot of times I’ve seen that when you’re trying to mix the two it they don’t tend to blend very well long.

00:25:36 Erwin

We have challenges.

00:25:37 Speaker 2

Well, the long term tenant is not used to and they don’t like that there’s always.

00:25:41 Speaker 2

People coming in and out and then a lot of times, if people are coming in and out, if they’re there for the weekend, they’re there to enjoy, you know, noise tends to be a problem.

00:25:49 Erwin

Yeah, yeah.

00:25:51 Speaker 2

And yeah.

00:25:52 Speaker 2

So I think that parking garbage, you know, a lot of those things become.

00:25:56 Erwin

Challenges because even when I have my own, but it’s my apartment. When I rented it in my home.

00:25:56 Speaker 3

And they’re not.

00:26:00 Erwin

I would deliver it, rent it to a single.

00:26:01 Erwin

Person. Mm-hmm. Yeah.

00:26:03 Erwin

Because then they’re not talking to somebody all the time. Yeah. Because you went to a couple or a family. Just even a couple. They’re gonna talk. Yeah. And once in a while, they gonna argue. Yeah. And then you hear it all. Yeah. Versus rent to an.

00:26:13 Erwin

Individual I’ll take.

00:26:14 Erwin

Less rent. You have less noise. Yeah. Now imagine your you have Airbnb folks.

00:26:19 Speaker 4

Yeah, like they.

00:26:20 Erwin

My family, like we’re all talking this.

00:26:22 Erwin

Four of us.

00:26:23 Erwin

Yeah, I’m sure would be disturbing to the long.

00:26:25 Erwin

Term tenants.

00:26:25 Speaker 3

And it’s different if you’re the homeowner.

00:26:27 Speaker 3

That you live up.

00:26:28 Speaker 3

There or you live in the basement.

00:26:29 Erwin

I still wouldn’t like that.

00:26:29 Speaker 3

Because you wouldn’t, but.

00:26:31 Speaker 4

There’s a lot.

00:26:31 Speaker 3

Of people who are willing to let that go because they needed the money or, you know, it helps to have that in. But because you’re the homeowner, it’s fine. But for someone else who’s renting your house long term and they’re staying there.

00:26:44 Speaker 3

They don’t care. At the end of the day they pay their.

00:26:46 Speaker 3

Rent they want.

00:26:47 Speaker 3

Their business exactly. They want their quietness.

00:26:47 Erwin

Also doing. Yeah. Yeah and.

00:26:50 Erwin

Often it’s great, I.

00:26:51 Erwin

Have five friends who that Airbnb pays their mortgage the basement.

00:26:54 Erwin

Pays for their.

00:26:54 Erwin

Mortgage, which would be a lot of money these.

00:26:56 Erwin

Days, yeah.

00:26:58 Erwin

Yeah, windy day. But these days especially.

00:27:01 Speaker 3

So because John mentioned that.

00:27:04 Speaker 3

Tend to not like where they mix it because we would get calls from both like we’re not.

00:27:08 Speaker 3

The manager for the.

00:27:08 Speaker 3

Long term rentals.

00:27:09 Speaker 3

But we get calls from the long term tenants.

00:27:12 Erwin

Saying you’re getting complaints from a non client well.

00:27:14 Speaker 2

What tends to happen is these long term tenants because we’re managing the short.

00:27:19 Speaker 2

Term, we end up managing the long term tenant.

00:27:21 Speaker 2

As well, but.

00:27:22 Speaker 2

We don’t get paid for managing the long term.

00:27:24 Speaker 2

Tenant, you know, so then you start to deal with and then the long term tenant becomes your sort of eyes.

00:27:28 Speaker 2

And ears, which is it comes in handy sometimes, but it also tends to.

00:27:29

Which is nice.

00:27:32 Speaker 2

Be like you know, they comes and complain to.

00:27:34 Speaker 3

You about everything.

00:27:35 Speaker 3

Oh, I don’t like that that new group that.

00:27:37 Speaker 3

Just came in this and that, and so we are.

00:27:39 Speaker 3

Yeah, managing everybody or.

00:27:41 Speaker 2

Because we’re so hands on the long term, 10 will be like, hey, listen, you know, I haven’t been able.

00:27:45 Speaker 2

To get in touch with such and such owner.

00:27:47 Speaker 2

Sir, can you guys, do you have anybody can you fix that? You know the toilet or can you you know can you call somebody to fix this and that?

00:27:54

Yeah, right. And.

00:27:55 Speaker 3

I think we’re just nice and we’re we’ve always been the type who’s like, you know, since we’re around anyways. Well, well.

00:28:01 Speaker 2

Well, we want to, we want.

00:28:02 Speaker 2

To keep the peace too, you know it.

00:28:04 Speaker 2

Helps our business.

00:28:06 Speaker 2

If you have a long term.

00:28:07 Speaker 2

And that that’s friendly to the, you know the.

00:28:10 Speaker 2

Short term guests.

00:28:11 Erwin

So let’s start with the say someone brings you a property. Well, how often do they bring you a vacant property versus a property that’s already furnished?

00:28:19 Speaker 3

A lot of the client come to us because I would say they either just bought a house and they just decided not to rent it out long term and so it’s not furnished.

00:28:29 Speaker 2

Right.

00:28:32 Erwin

Right.

00:28:32 Speaker 3

But they know they would have to furnish it, so we advise them we give them a checklist what to do.

00:28:38 Erwin

And so there’s homework upfront and investment, of course, yeah.

00:28:38 Speaker 4

I like that, of course.

00:28:41 Speaker 3

There’s homework and investment.

00:28:43 Speaker 3

The ones who already have fully furnished and everything I feel they’ve already done their homework and so usually most of our clients, they haven’t furnished anything. They just come to us with an idea like they have a space or a property or they’re actually thinking of buying a property and they wanted our advice.

00:28:57 Speaker 2

Right. Yeah and.

00:28:58 Speaker 2

Typically outside of the, you know the cottage vacation rentals. You won’t see anything in the in the city that’s.

00:29:04 Speaker 2

Furnished expecting to convert from long term to short term. So if somebody is renting a like if they own a property and and and it’s an investment.

00:29:12 Speaker 2

They’re not going to be prepared to do short term. It’s usually a blank canvas that we have to.

00:29:17 Erwin

Start with and then. So what’s the? What’s the capital outlay like if I if I bring you a vacant house? Well, how much should I expect to have done best in order to get it ready?

00:29:25 Erwin

Sure, it’s not easy either it’s not.

00:29:27 Erwin

Like this? Just like go on Amazon, click, click and deliver me TV to couch.

00:29:29 Speaker 3

Yeah, no.

00:29:32 Erwin

And bed and all that.

00:29:33 Speaker 3

Because we furnish a full house like on.

00:29:36 Speaker 3

Our own so.

00:29:36 Speaker 2

Five bedroom.

00:29:37 Speaker 3

Five bedroom. And so we kind of have a ballpark budget and because we also have looked into so many different type of furniture from so many different store, so.

00:29:46 Speaker 3

Do have a budget sheet that we give our client. We said look like if you’re looking to buy just all IKEA, this is the.

00:29:53 Speaker 3

So you can look between and. Usually it depends how many bedrooms you have, right? And you multiply it by the beds, the side tables and so for us I have seen where you can furnish A2 to 3 bedroom, place about 10 grand. I would say yeah. But if you want quality you can go up to 20 grand.

00:30:00 Erwin

That’s just the.

00:30:08 Erwin

Oh that’s it, eh?

00:30:13 Speaker 3

So pretty great. Yeah, right.

00:30:15 Speaker 3

So it depends, but I know.

00:30:16 Speaker 3

For us, for a.

00:30:17 Speaker 3

Five bedroom house. It was almost. Yeah. About 3030 Grand, Right, so.

00:30:19 Speaker 2

It’s about 30.

00:30:23 Erwin

So at what point did it can can you take over the proper?

00:30:26 Erwin

Like I’ve ordered all the IKEA go assemble it. I’ll see you next week.

00:30:32 Speaker 3

Most of the time.

00:30:33 Erwin

Like you know, I mean like it’s all.

00:30:34 Speaker 2

It’s all packaging we’ve done.

00:30:36 Speaker 2

It before where we’ve, you know, we’ve come in with the two of us and we’ll, you know, we’ll hire one or two other people and we’ll assemble furniture and things like that. But now we kind of realize that unless the owner is willing to pay another.

00:30:50 Speaker 2

5 grand for our time. Yeah, you know, let’s say I’m just the ballpark figure, but.

00:30:55 Erwin

That you know, that’s something that they would have to range on their own very, very yeah. Cause they can buy because IKEA will they believe they offer that as an.

00:30:58 Speaker 4

And a lot of them.

00:31:02 Speaker 3

Yeah, but I find a lot of a lot of our clients. You know, they’re very aware of their budget and they want to keep it low. So.

00:31:10 Speaker 4

They do a.

00:31:11 Speaker 3

Lot of it themselves. So what they do is they have to assemble the furniture, they put everything. And so normally what we do is we do an initial site inspection, so we come.

00:31:12 Erwin

Oh God.

00:31:20 Speaker 3

And we visit.

00:31:21 Speaker 3

The property and we give them idea.

00:31:23 Speaker 3

This then we learned from the past because we used to have to come back four or five times. I had a property where they said it’s ready when we come back. It’s not ready because they’re expectation. What ready is is not the.

00:31:34 Speaker 3

Same as ours.

00:31:35 Speaker 3

Based on our.

00:31:35 Speaker 3

Experience. So now we have a full checklist. We said you have to follow the checklist. Once it’s fully 98% complete.

00:31:43 Speaker 3

Sure, we’ll come. And if there’s any little we don’t need everything to be complete because the main important thing is we just need like the things that you can’t see, for example, like all the bats, the couch, the table.

00:31:54 Speaker 3

Because for pictures very important so that we send in a professional photographer, they take the photo. We can then create it and put it on Airbnb or whichever other sites being used. And so we can actually list the property a month to two months before it’s fully finished too. Like if it takes some of that long.

00:32:14 Speaker 3

Because it takes some time for people to start looking.

00:32:17 Speaker 3

On you know, Airbnb to start booking. And by throughout that period of time they can continue to get it ready. They don’t have to have it 100% ready, right? Just the main thing we actually have listed houses where I don’t know if this is a good practice, but we’ve done it before where we said they just bought over.

00:32:20

OK.

00:32:35 Speaker 3

Our house and.

00:32:36 Speaker 2

We’ll talk to the seller.

00:32:38 Speaker 4

We talked to the seller.

00:32:39 Speaker 3

And they give us the photo of.

00:32:40 Speaker 2

Use stock photos.

00:32:40 Speaker 4

How the house used to look.

00:32:42 Speaker 3

And we put it.

00:32:42 Erwin

So the client doesn’t own the house yet.

00:32:46 Speaker 2

You know.

00:32:47 Speaker 2

They it’s like.

00:32:47 Speaker 4

They’re gonna close in a.

00:32:48 Erwin

Couple yeah, yeah.

00:32:50 Speaker 3

Yeah, but you’re right.

00:32:51 Speaker 3

So I’m not sure how legitimate.

00:32:53 Speaker 2

The lines been you know, it’s been signed and everything, but.

00:32:53 Speaker 3

It is.

00:32:55 Erwin

We we do the same for long term rentals like.

00:32:58 Speaker 4

If they did, let’s say if they.

00:32:59 Speaker 4

Took it over today.

00:33:00 Speaker 3

Even it’s not like they’re going to.

00:33:02 Speaker 3

Have all the furniture in by next week they might, right? But we said do you have any photos? But we would have to spend time really like explicitly, right?

00:33:05

Right.

00:33:12 Speaker 3

On the description this is not how the furniture will look.

00:33:16 Speaker 3

House the frame.

00:33:18 Speaker 3

Once you know the House will be available, let’s say two months from now, it will be fully new furniture and we will update the photo for you and we will show you how it looks like. We’ve done that with one of our property and we flipped like the House looks completely different than how the House was when we bought it and we got.

00:33:38 Speaker 3

Our first two months.

00:33:39 Speaker 4

Fully booked.

00:33:40 Speaker 2

Doing great.

00:33:40 Speaker 3

Yeah, and they’re they’re ages, though, as the time come, they’re like, can you show me photos of how?

00:33:45 Speaker 3

This how it.

00:33:45 Speaker 3

Actually will look and we send it because we’re confident it will look just as nice if not better. But if you don’t plan, that’s why we’re like, we’re hesitant. Like if.

00:33:46 Erwin

OK.

00:33:54 Speaker 3

You don’t.

00:33:54 Speaker 3

And to furnitures as similar are just as Nice and I have to really spell it out. I don’t want the guests to.

00:34:01 Speaker 3

Be booking something.

00:34:02 Speaker 3

And they’re not getting what they pay for.

00:34:04 Erwin

Yeah. And another conversation we had when we weren’t recording was you’re you’re mentioning how people would disclose on something. They bought pre construction. Yeah. And now they’re they’re asking you to take it over. Is that common?

00:34:16 Speaker 3

We had a few, yeah.

00:34:16 Speaker 2

The last 12 months has been quite a few of investors who they’re just stuck. They can’t assign, you know, reassign the the title. They’re not able to sell their property. And so they’re looking for any.

00:34:29 Erwin

They play a.

00:34:29 Erwin

Lot. That’s probably gone down, I’m guessing.

00:34:30 Speaker 3

Yeah, yeah, I mean, because we don’t know all the terms now, we don’t know if they’re supposed to do that, cause usually I think with a lot of preconstruction, don’t they have to stay and live in that house for at least one year.

00:34:31 Speaker 2

So locked in and.

00:34:43 Speaker 3

Before they can rent a house.

00:34:44 Erwin

I’m not a lawyer.

00:34:46 Speaker 4

So I told him I’m not a lawyer either either. Yeah, so I can list it for you. But you have to figure if that’s something.

00:34:48 Erwin

Yeah, there’s SSD implications, yes, yeah.

00:34:54

You’re allowed.

00:34:55 Erwin

To get there are interesting implications, yeah.

00:34:57 Speaker 2

There, there are certain regions where we manage certain properties that it’s you know it’s on them. It’s we can do all the everything you ask us.

00:35:06 Speaker 2

To do.

00:35:06 Erwin

It’s on the, it’s on you shins.

00:35:07 Speaker 2

But if if something if there are implications.

00:35:10 Speaker 2

That’s, you know, we.

00:35:11 Speaker 2

That’s where we have.

00:35:12 Speaker 2

To bow out.

00:35:12 Speaker 3

Yeah, we advice everyone to look at.

00:35:16 Speaker 3

Legality side of things, right? Does it allow you to have a permit? Do you require a permit? And what is yeah.

00:35:22 Erwin

Alright, but you know that site already? You know if there’s one for.

00:35:23 Speaker 4

Yeah, yeah.

00:35:24 Erwin

You know you need a permit. Yeah, yeah.

00:35:25 Speaker 3

Exactly. And usually there’s townhouses or condos that they have to ask for permission, even in the city that allows you to get a permit.

00:35:34 Speaker 3

But if that townhouse association doesn’t like, for example, in Mississauga, we had a property where they got a permit from the city, but the townhouse contact them and say you’re not allowed to rent anything out less than.

00:35:48 Speaker 3

Six months even.

00:35:49 Speaker 3

Though the city approved.

00:35:51 Speaker 3

Yeah, exactly. Exactly. Yes.

00:35:51 Erwin

Because the Donald Trump’s yeah, yeah.

00:35:54 Erwin

His condos have like rules on, like, no.

00:35:56 Erwin

Children, for example. No pets. Yeah, yeah.

00:35:59 Erwin

My dad’s condo.

00:36:00

No children.

00:36:00 Erwin

Was nice today.

00:36:02 Speaker 3

Wow. Ohh seniors, then seniors condo. You mean retirement? Condo. Wow.

00:36:03 Speaker 2

Have a family friend or adults?

00:36:07 Erwin

It’s an adults only condo.

00:36:09 Erwin

No, no child’s allowed to live there.

00:36:11 Erwin

Wow. Yeah. Is that rare? Maybe it is rare, I’ve heard.

00:36:14 Speaker 3

It seems fair.

00:36:15 Speaker 4

To me it seems fair.

00:36:16 Speaker 2

That before no children. Yeah, it doesn’t surprise me.

00:36:20 Speaker 3

Yeah, there’s also lots of different.

00:36:21 Speaker 4

Like like like.

00:36:21 Erwin

Rules in Mexico, there’s.

00:36:22 Erwin

There’s lots of resorts are absolutely.

00:36:23 Speaker 2

Ohh yeah.

00:36:24 Erwin

Can understand they.

00:36:26 Erwin

Don’t want, yeah.

00:36:27 Speaker 3

Yeah, I can understand the need for.

00:36:28 Erwin

That anyone who’s heard a baby crying on an airplane understands the need for, yeah, people. Some people want their space. It’s it’s even. It’s in legislation like RTA, like quiet enjoyment of your property. Yeah.

00:36:34

Yeah, for sure.

00:36:40 Speaker 4

So we hope.

00:36:41 Speaker 3

You we answer the questions about pre construction.

00:36:44 Erwin

Because what? What caught my attention was.

00:36:47 Erwin

How many of them are there? Not a question for you, but my first immediate, my immediate thought is it could get start getting saturated in terms of the availability of that number of Airbnbs. Like for example, when I did my first Airbnb in Hamilton Mountain.

00:36:54 Speaker 3

Ohh yeah.

00:36:59 Erwin

There was like I had, like maybe 4 direct competitors for that entire neighborhood. Wow. And that was years ago. I don’t remember the year now I think like 2018 ISH 2018 I think was and now there’s tons. Yeah, right. For example, one of my clients she used to dominate the ARBO. She had two of the five top properties on VRBO in terms of performance in Hamilton.

00:37:02

Mm-hmm. Mm-hmm.

00:37:19 Erwin

So she was doing midterm rentals before anybody else. This is she had one house that was hilarious. She had one house that was like, not touched.

00:37:25 Erwin

Since the 80s.

00:37:27 Erwin

Right and.

00:37:27 Speaker 2

But people love that.

00:37:29 Erwin

Movies and TV studios rented it for that reason.

00:37:31 Erwin

Yes. Yeah. They wanted to shoot it. They had seen from the 80s. Yeah, because the house was basically frozen in time. Oh, that’s awesome. Yeah. Hilarious. And she got tons of money for it. Yeah. Anyways, my point being is that she, she told me too the last few years.

00:37:31

Ohh yeah.

00:37:34 Speaker 4

That’s great.

00:37:37 Speaker 3

Yeah, that’s right. That’s crazy.

00:37:43 Erwin

Have been never been so hard.

00:37:45 Erwin

To keep it full right? That’s kind of partly why I have. Why do you have you here? And part of the point of the show is that.

00:37:51 Erwin

Share the realities.

00:37:52 Erwin

Of real estate investing? That’s right. Like so, for example, if my client who dominates normally and she hustles to be in contact with like, insurance companies, local major employers to make sure that if they need her place.

00:38:05 Erwin

Elbow and she’s telling me she’s having hustle. My point is, though, is that this isn’t easy money, no stuffs, not just falling on people.

00:38:12 Erwin

‘S laps no.

00:38:13

Right. Well, my.

00:38:13 Speaker 2

My knee jerk reaction to a lot of these investors who are trying to, you know, they they don’t have any other option to to flip their house or they’re by pre construction is I tend to.

00:38:25 Speaker 2

To try to discourage them from.

00:38:28 Speaker 2

Doing Airbnb because the first thing is you.

00:38:31 Speaker 2

Notice is that.

00:38:32 Speaker 2

If they’re just doing it for a short period of time because they’re just trying to, you know, by the time that one year, for example, that they need to put in or or it’s supposed to be owner occupied, they’re going to try to do the things like very.

00:38:45 Erwin

Cheap. That’s not your client.

00:38:47 Speaker 2

That’s not who we want to work with because we’re not. We’re not looking to.

00:38:50 Speaker 2

Do business for the next just 12 months like.

00:38:51 Erwin

OK.

00:38:52 Speaker 2

It’s the full time.

00:38:52 Speaker 2

Business for us.

00:38:54 Erwin

Well, people, people plan for short term trendy spend 1020 thousand on furniture, right. Exactly. Yeah, exactly.

00:38:54 Speaker 2

And then.

00:39:00 Speaker 2

Exactly. And then to to put in that that you know that financial investment of twenty $30,000, are you really prepared to do that for only a year and then you you have all this furniture now?

00:39:12 Speaker 2

You need to, you know, to offload. So I I tried to discourage them at first because if.

00:39:16 Speaker 2

That’s not something that they really want to do then.

00:39:18 Speaker 2

And that’s technically not really the the client we want to work with.

00:39:20 Erwin

Yeah, alright, I I got lucky with mine with Irving because when I when I sold it, I didn’t want.

00:39:25 Erwin

The furniture, right?

00:39:27 Erwin

So I just said they wanted to. Yeah, they wanted it cause a doctor was moving in from out of town. Yeah. And his mother was buying him the house. Wow. Yeah. And they wanted all the furniture because it looked great. Yeah. So they walked into a fully furnished house. I’m not suggesting that’s a good exit for.

00:39:34 Speaker 3

So you’ll find.

00:39:34 Speaker 4

The brain.

00:39:42 Speaker 3

Anyone. No, because you’re selective.

00:39:43 Erwin

Yeah. Lucky. Yeah, I got lucky. Yeah.

00:39:45 Speaker 3

It’s among.

00:39:46 Speaker 3

Smaller pool of people. A lot of people.

00:39:48 Speaker 3

Want it empty?

00:39:49 Speaker 3

Yeah, you can just put in.

00:39:49

So they have their.

00:39:50

Own stuff.

00:39:51 Erwin

Exactly the client say to me looking for a home principal residence.

00:39:55 Erwin

It’s like I don’t like this house. Like, why? It’s gorgeous. Everything you want.

00:39:58 Erwin

Fits your budget. It’s beautiful.

00:40:00 Erwin

It’s like my dining room table won’t fit. Wow.

00:40:04 Erwin

OK, you see the big oversized dinner dining room table? Yeah.

00:40:10 Speaker 2

Yeah. And so it’s like.

00:40:12 Erwin

In hindsight, that house was like 8-9 hundred grand.

00:40:15 Erwin

She waited three years and then the pandemic happened. Now that house is like 1.4 so.

00:40:20 Erwin

So that dining.

00:40:21 Erwin

Room table was a $500,000 decision.

00:40:24 Speaker 3

But that’s how we make these personal decisions that you know.

00:40:29 Erwin

It is what it is, you know.

00:40:31 Erwin

I make my decisions large with the spreadsheet. You know, people make decisions with their dining room table.

00:40:36 Erwin

Not at their dining room.

00:40:37 Erwin

Table about their dining room table, yeah.

00:40:42 Erwin

So there’s so many questions to ask, how do different pricing of of of an Airbnb?

00:40:47 Speaker 3

Great question. So I mean there is different ways that you can go about it and you can spend a lot of time doing it or you can just quickly spend a couple hours. But the first thing is you want to to do it properly, which we tested.

00:41:02 Speaker 3

And we also took a course.

00:41:04 Speaker 3

On this request you to have an Excel sheet where you actually have.

00:41:08 Speaker 3

Unbiasedly rate your property against some of the top ones that you see in the neighborhood, so there’s a whole process you actually have to do some market research on there. You have to find the local competitors to yours.

00:41:20 Speaker 3

And we say local, it has to be exactly. For example, if your 3 bedroom you narrow down, what are some of the other three bedroom in the?

00:41:26 Speaker 3

Area and then you kind of rate them on how they’re designed, how their photo?

00:41:31 Speaker 3

Right. And then after that you kind of see the average. So there is a formula that we do, but if we’re just going to do this quick, what I would do is once again go on Airbnb. So I would look for a property that’s closed.

00:41:44 Speaker 3

In the region where.

00:41:45 Speaker 3

Our property will be.

00:41:47 Speaker 3

And I’ll look to see, OK, other three bedrooms. What are they charging for this time of year for various times of year? And then?

00:41:55 Speaker 3

If I notice.

00:41:57 Speaker 3

Also, if they’re charging really high, but their calendar is empty, so I have to take that into consideration and then another property is really low, but it’s fully booked. So what we normally do do is we take an average of that and we just kind of like play that out. I guess we put that pricing initially and then we monitor.

00:42:18 Speaker 3

So we monitor for the first week we see what’s the demand like. Is there a lot of inquiries and we have to constantly adjust the price. So that is I.

00:42:26 Speaker 4

Guess the quick way.

00:42:27 Speaker 3

Of setting up the price for me, do you?

00:42:30 Speaker 3

Have other ways that you do.

00:42:31 Speaker 2

Well, it’s based on a lot of it is based on supply and demand too. So depending on on how quickly things.

00:42:37 Speaker 2

Will get booked if it.

00:42:38 Speaker 2

Books quickly. Then we’ll raise the price a little bit.

00:42:42 Speaker 2

And then if?

00:42:43 Speaker 2

It’s slow. Then we’ll we’ll lower the price. So it’s always it’s hard to determine. There’s never one price. Yeah, just there’s a lot of factors that play into and we can.

00:42:52 Speaker 2

Go even as.

00:42:53 Speaker 2

Far as studying the hotels if they’re.

00:42:55 Speaker 2

Able to like a two-bedroom unit for example.

00:42:58 Erwin

Wherever you consider your competition, yeah.

00:43:00 Speaker 3

Exactly. Exactly. And so pricing is a great question because that is one of the biggest thing that you know when it comes to getting your place really full and you know increase your occupancy rate is really how flexible and how quick you can adjust your pricing.

00:43:15 Speaker 3

Basically, just because you’re place lower sometimes doesn’t mean it’s good, because if your price is lower and you get booked really quickly, there are people who will book at a higher price if the supply is really low. So you kind of missed out on those people. And when everything is booked then they have to.

00:43:33 Speaker 3

Basically, pick another property which might be a little higher. So I find like if you kind of have faith that you’re probably is nice and it’s the way that it should be where you want a certain type of clients and you’re willing to not have to get a fully booked like six months out. I guess it depends on how you are.

00:43:52 Speaker 4

As I guess as an investor.

00:43:53 Speaker 3

The host some people are in a rush to get everything booked so they will cut down. They slash down prices, right? But based on what we learned through different, I guess pricing so.

00:44:03 Speaker 3

Where is that? There’s a strategy that you don’t need to get book right away, but you want to get booked for the right price, so your revenue will be higher, so someone can have full occupancy, but the revenue will be lower than someone who’s book, let’s say at 80%, but at.

00:44:17 Speaker 3

A higher revenue.

00:44:19 Speaker 2

And ego start to play factors there’s some.

00:44:22 Speaker 2

Clients that will rent.

00:44:24 Speaker 2

You know, let’s just say we’ll throw a price of.

00:44:26 Speaker 2

$1000 a night.

00:44:28 Speaker 2

Let’s say it’s just an average Airbnb.

00:44:31 Speaker 2

People will book that because it’s at $1000 per night and they can say I’m renting an Airbnb at $1000 a night, but you can also rent that.

00:44:40 Speaker 2

Property for two.

00:44:41 Speaker 2

$100 a night. But then, now you’re attracting a different clientele. But this clientele will will, you know, they sort of value.

00:44:50 Speaker 2

Money different than somebody who’s willing to pay.

00:44:52 Speaker 2

Higher. Yeah. So, you know, there’s a lot.

00:44:54 Speaker 2

Of different factors that come.

00:44:56 Speaker 2

You know, yeah.

00:44:57 Speaker 3

It’s interesting because for the same problem we’ve seen where we increase the price and we get like gas that comes in and they’re amazing guests. And then the same you slash it off 50% and you get guests. So you figure they’re happy to be able to book a property that’s normally double in price, but they come in and they give.

00:45:13 Speaker 3

You the most problem.

00:45:14 Speaker 3

Because they’re normally the type who can afford.

00:45:17 Speaker 3

The other so see so.

00:45:21 Erwin

Because I that.

00:45:22 Erwin

That I always remind, like novice investors, I I call it.

00:45:25 Erwin

Return on grief.

00:45:26 Erwin

Like I need to be compensated for grief.

00:45:28 Erwin

Yeah, right. So if you’re a pain in my ****, the price.

00:45:31 Erwin

Needs to be higher. Yeah, right. Yeah.

00:45:33 Speaker 3

Yeah. Which we don’t mind, right? That’s why if you set the price at a certain level, you’re gonna get certain type of people, and if they?

00:45:40 Speaker 3

Demand a lot of.

00:45:41 Speaker 3

You that’s OK because you set the price to expect those demands. But the moment you start slashing.

00:45:44 Erwin

Right, right.

00:45:46 Erwin

They’re being compensated for it.

00:45:47 Speaker 3

Yeah, exactly. The moment you’re getting slashed, all these prices, they still want the same, I guess to treatment and they’re asking for a.

00:45:57 Speaker 3

Lot, now you’re just.

00:45:59 Speaker 3

The price is so low now I have to do all this too.

00:46:01 Speaker 2

Well, I mentioned it’s much like being a realtor where you know you have a client that comes in and their budget is, you know, X amount and then you have another client that comes in that their budget is twice that amount. The person whose budget if, if you’re like, right in the middle and you have the option of selling to somebody who.

00:46:20 Speaker 2

Has twice the budget. It’s a lot easier for them to make decisions versus somebody who’s.

00:46:25 Speaker 2

At the higher end.

00:46:25 Speaker 2

Of their budget. Then they start to nitpick quite a bit.

00:46:27 Speaker 2

Right.

00:46:28 Erwin

Yeah, no different than like a. Like someone who’s selling who doesn’t have much equity or their.

00:46:32 Erwin

Negative equity, right?

00:46:33 Erwin

That’s right. Decision making is very.

00:46:34 Erwin

Different. Yeah, yeah, yeah.

00:46:35

Right.

00:46:36 Erwin

It sounds like you have some some portfolio is suburban.

00:46:41 Erwin

And some is like traditional recreation. Cottage. Yeah, right. So let’s talk to the cottage market. The strictly recreational use properties. How has demand changed since since COVID mersus today, which is September 2023?

00:46:57 Erwin

The things fluctuated at.

00:46:58 Speaker 3

All. Yes. Well, we have a property in a couple of properties in Niagara and I think, yeah, in Crystal Beach, which is just the beach town, right, and so.

00:47:09 Erwin

Yeah, really quiet during the week.

00:47:11 Erwin

Yeah, and it’s, it’s.

00:47:12 Speaker 3

The winter months as well, right?

00:47:14 Erwin

Yeah, but come summer weekend car.

00:47:16 Speaker 3

There has been.

00:47:17 Speaker 3

A huge slowdown in since.

00:47:20 Speaker 3

I guess the peak of COVID I think during the peak of COVID, a lot of people.

00:47:24 Speaker 3

Traveling within Ontario within Canada, there’s nowhere else to go, so this was very well. It was good for a lot of people, not just us, but a lot of other people that own vacation rentals.

00:47:26 Erwin

Yeah, we’re stuck.

00:47:27 Speaker 2

Within driving distance, yeah.

00:47:36 Speaker 3

But I think the last.

00:47:37 Speaker 3

Year and going into this year, we have seen quite there’s not a lot of bookings and for the ones that do get booking, I feel like the pricing you have to really slash down prices compared to two years ago, right? So you’re kind of getting.

00:47:52 Speaker 3

Killed at both ends. Your voices are low, and then you’re booking. But if you don’t, everyone else around you, the prices.

00:47:53

And wife.

00:47:59 Speaker 3

Are low, so.

00:48:00 Speaker 3

If you keep it high and it’s hard, so we have seen a slowdown.

00:48:04 Erwin

Right. Yeah, I ask because I see all these people courses promoted for like college rentals or midterm rental from talking to people on the on the ground.

00:48:12 Erwin

Like yourselves it to me it didn’t sound. It didn’t seem to be a sound sound decision, but getting into it.

00:48:20 Erwin

As like as a pivot makes more sense. Yeah, like I have problems. I’m vacant. I don’t want long term tenants. I understand why.

00:48:27 Erwin

You want to.

00:48:27 Erwin

Pivot. Yes, I don’t think I’d want to go out there and.

00:48:30 Erwin

Buy cottage and jump into this at this time.

00:48:32 Speaker 2

Unless you can, unless you can afford to.

00:48:36 Speaker 2

Sit on the property without having tenants. I would strongly recommend against getting into recreational properties like for yeah, yeah.

00:48:38 Erwin

Right.

00:48:43 Erwin

Like acquiring a property for these trades because we’re what? What’s the entry point for a price point? What’s the entry price for for one of these?

00:48:51 Speaker 3

Well, it depends, but.

00:48:52 Erwin

3.7.

00:48:53 Speaker 4

Yeah, I mean.

00:48:55 Speaker 3

At Crystal Beach, you can still get in at I guess you.

00:48:59 Speaker 3

Million. Yeah, but the problem is those like, half a million properties don’t get a lot of crazy. It’s the one by.

00:49:05 Speaker 3

The water and.

00:49:06 Speaker 3

They’re over a million, right? Yeah. Now, if you’re going up to Muskoka or, you know, other regions you’re talking about.

00:49:12 Speaker 3

Past 1,000,000 for sure.

00:49:14 Erwin

Yeah, yeah, I seem to learn I.

00:49:14 Speaker 3

Like you know, 1-2 million.

00:49:16 Erwin

See lots of stuff. 2 million or.

00:49:18 Speaker 3

Yeah, I mean, we have had friends who bought, you know, cottage, but they’re well to do and they just wanna enjoy. So then they’re gonna buy because they have the money too. That’s fine. But if you’re a client, just so that you can make money off Air BI, don’t feel like it would be a good time right now to do that because the rates are so high.

00:49:37 Speaker 3

Right. And cause you used.

00:49:39 Speaker 2

To be able to like like in Crystal Beach where it was close to us. So we we get a lot of we have a lot of conversations with investors there.

00:49:47 Speaker 2

If you had bought 4.

00:49:50 Speaker 2

Five years ago, you can afford to sit on it for the whole entire year and just make enough rental income, right? You know from the summer.

00:49:59 Erwin

Well, if you.

00:50:00 Erwin

If you were really kind of perfect, you bought during the crash of the pandemic or.

00:50:02 Speaker 2

If you bought during.

00:50:03 Speaker 2

The crash. Yeah, a large percentage.

00:50:05 Erwin

Of that community is American owned.

00:50:06 Erwin

Yes. So they couldn’t even come, so they sold.

00:50:10 Speaker 3

A lot of the properties they had to sell it because they weren’t planning on.

00:50:13 Speaker 3

Coming back anyway, right? Everyone was scared.

00:50:16 Erwin

Yeah, drink it over the.

00:50:16 Erwin

Border. Yeah, and I.

00:50:17 Speaker 2

Think they created a?

00:50:18 Speaker 2

New you know.

00:50:20 Speaker 2

What is that? It’s a tax for out of.

00:50:24 Erwin

Yeah, vacant home tax and yeah, foreign buyer tax, yeah.

00:50:28 Speaker 2

Foreign buyer taxes and things like that. So it makes it very in Crystal Beach, it’s very expensive.

00:50:35 Speaker 3

I mean, if you’ve always.

00:50:36 Speaker 3

A cottage and the price have gone down compared to the peak of let’s say COVID, and this is what you really want then? Yes, but not as an investment strategy.

00:50:46 Speaker 3

To be able.

00:50:47 Speaker 3

To rent it out and make it.

00:50:49 Speaker 3

Comfortable. No, it doesn’t. Yeah.

00:50:49 Erwin

Quit your job.

00:50:52 Erwin

Enjoy your college and live for free and.

00:50:54 Erwin

No, they’re crushing my dreams seriously.

00:50:57

It’s a lot of.

00:50:57

Work too. We just put it.

00:50:58

Even if you live.

00:50:59 Erwin

Together their course so we can.

00:51:00 Erwin

Promise people you can quit.

00:51:01 Erwin

Your job and live.

00:51:02 Speaker 2

In your country, but even even then, like even if you live in the city and you’re commuting an hour, like, yeah, prices too, a lot of.

00:51:10 Speaker 2

Those things.

00:51:11 Speaker 2

Unless you’re.

00:51:11 Speaker 3

You know we we we do.

00:51:12 Erwin

Driving life from the money, I can afford a.

00:51:14 Speaker 3

Helicopter. You know, we have friends where we told them to get into the air B, but they bought their cottage long ago and they were thinking of moving to another property and.

00:51:23 Speaker 3

They weren’t sure so.

00:51:25 Speaker 3

You know, they tried it and it worked for them. They were able to rent every saying like three years ago. They made a lot.

00:51:30 Speaker 3

Of money. But it’s a lot of work too.

00:51:33 Speaker 3

For them and now see and now they’re looking. So now they just got a long term tenant, even though the money is good. But at the end of the day, after they pay everything and all the work they put in.

00:51:34 Erwin

No, no, I don’t like a.

00:51:35 Erwin

Lot of work.

00:51:44 Speaker 3

In it’s not as easy as it used to be, right? Yeah.

00:51:47 Erwin

Yeah, yeah.

00:51:49 Erwin

You tell me your experience, but my college.

00:51:51 Erwin

Friends like they all complain about the amount of maintenance there.

00:51:54 Erwin

Is. Yeah, I can live with the maintenance.

00:51:55 Erwin

In my own home I live in.

00:51:57 Speaker 3

Yeah, yeah.

00:51:58 Erwin

I can’t imagine having.

00:51:59 Erwin

A second property to take care.

00:52:00 Speaker 3

Yeah, doesn’t.

00:52:01 Erwin

Of and then also I’m hearing like like my good friend with college is it’s challenging to find tradespeople.

00:52:06 Speaker 3

Yeah, for sure.

00:52:07 Speaker 2

It’s tough finding any any.

00:52:08 Speaker 4

Help I remember. Yeah, I.

00:52:09 Speaker 2

Dinners, tradespeople.

00:52:10 Speaker 3

Remember, we were managing a cottage and there was issue with the septic tank and you know the guests are there on the weekends. So you want to get.

00:52:17 Speaker 3

It done there.

00:52:18 Speaker 3

But no one’s available until let’s.

00:52:20 Speaker 3

Say a day after Monday.

00:52:21 Erwin

The city don’t don’t know how to take care.

00:52:22 Erwin

Of a septic tank.

00:52:24 Erwin

I am on the septic tank so I understand like there’s many things that can’t go in there.

00:52:28 Speaker 3

Yeah, exactly.

00:52:29 Speaker 2

And even even you have, you have.

00:52:31 Speaker 2

Cleaners that you know they don’t wanna work on the weekends, for example. They only wanna clean Monday to Friday. Yeah, and turnover days. Sunday. Usually in mess. Yeah. It’s like we have a fiber one we.

00:52:42 Erwin

Have the whole community, we have a.

00:52:44 Erwin

Time our window to clean everything.

00:52:47 Speaker 4

Yeah. And a lot of.

00:52:48 Speaker 3

These colleges are in smaller communities, so it’s not like you know, you’re able to find your cleaners. Your handyman like how you would in the City of Toronto. There’s so many, right? Yeah.

00:52:56 Erwin

Right, right. Yeah. Because you can probably if your.

00:53:00 Erwin

In days, you can probably find it cleaner within the same building. Yeah. Yeah. On the on the Facebook group for the building. Oh, yeah, they don’t know cleaner than five people. Yeah. And they’re in the same damn building. It’s so easy. Yeah. But and yeah, people forget, like, cottage country houses are like acres apart. So, yeah.

00:53:16 Erwin

We don’t have the same density. It’s not as easy, so this isn’t sound as rosy as definitely not.

00:53:23 Erwin

So what do you guys do it what do you?

00:53:25 Erwin

Guys do well.

00:53:27 Erwin

Because you have your own properties that you make that you rented a.

00:53:29 Erwin

Vacation as well.

00:53:31 Erwin

Yeah, because how you started hasn’t, like, hasn’t changed a whole lot. You still you still rent out your own properties for vacation purposes as well.

00:53:38 Speaker 3

Yeah, we you know.

00:53:39 Speaker 3

What the reason why we per se still do it for?

00:53:43 Speaker 3

That’s the one we have in Christ.

00:53:44 Speaker 3

Beach is for us. Unfortunately, we still don’t want to deal with long term renters in that in that space, right? Just the type of tenants that you would attract.

00:53:50 Erwin

I don’t know why.

00:53:56 Speaker 3