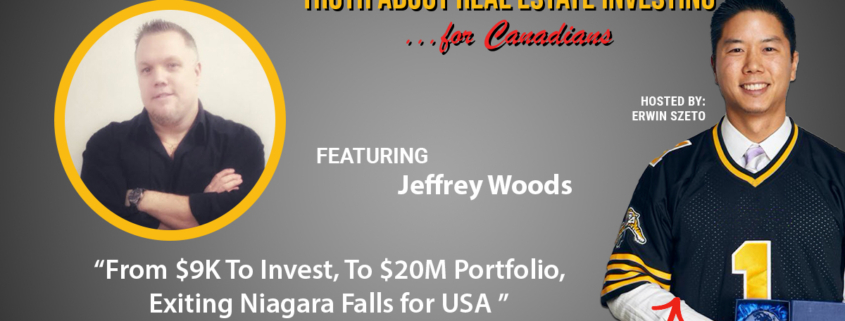

From $9K To Invest, To $20M Portfolio, Exiting Niagara Falls for USA With Jeffrey Woods

I’m back from Texas and Costa Rica only to hear about a massive bankruptcy protection filing and today’s guest co-authored “The Ultimate Wealth Strategy – Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate” back in 2014 along with great investors Quentin D’Souza, Andrew Brennan and our guest today, Jeffrey Woods. Jeff started with only $69,000 to build a sizable portfolio of multi-family, mixed-use, and commercial properties. Jeff has since transitioned out of Canada to live in the Dominican Republic and starting up investing in the USA. Jeff and I are old friends and like many of the older generation investors, he’s seen a lot and done quite well for himself so there is a lot to takeaway from this episode

But first, I am back from Texas after looking around Austin and San Antonio to get to know the areas I’m targeting for investment and honestly, the trip went better than I expected. I met some awesome people, I check in on the Tesla Gigafactory before security told us to turnaround, LOL. I stopped on the roadside to take in the size and scale of Samsung’s $17 billion dollar investment into a microchip manufacturing plant, making chips for 5G wireless technology, Ai and super computing purposes, something that is in short supply. This manufacturing plant will be home to 2,000 great paying manufacturing jobs which will create pressure on local rents and prices and I intend to get in front of all that wonderful economic fundamentals.

From Texas, I flew directly to Costa Rica to meet up with Cherry, my dad and the kids. Cherry had been invited to speak at a Costa Rica investing work shop so I tagged along to mooch off work trip, be with the kids and big bonus, spend time with my dad. My dad and I hadn’t been on vacation together for I don’t know how long. Dad usually travels to southern Europe as he’s a big wife buff vs Cherry and I vacation in kid friendly, winter escape destination like caribbean cruises or local ski trips.

Costa Rica is wonderful, don’t get me wrong but for me, I can only be there for short periods of time. It’s great for rest, relaxation, fun, food but I like to work and it’s busy at work with three of my own properties going up for sale and everything to do with investing in the US.

I’m on a mission to generate more cash flow with my real estate portfolio. The goal is $100,000 cash flow from rental income. Good old fashioned rents exceeding expenses, leaving me cash at the end of each month in my bank account.

With affordability, rates, expenses, inflation so high here in Ontario, I see little choice but to diversity to the USA. I wanted to be a part of the solution here at home to provide supply but every level of our government has made me feel unwelcome so I’ll go where I’m wanted instead.

Positive cash flow is what gets one freedom and de-risks a business or investment. Unfortunately, this new wave of investors, influencers, fake gurus went all high leverage with aggressive, complicated investment models.

In reading about the latest apartment building BRRR, flipping business to seek creditor protection, I see many things consistent with previously failed investment businesses I’ve studied back in the financial crisis of 2007-2008 and I’m seeing A LOT MORE of it now.

I was very close to the Paramount Equity debacle and still am. I know fully well how the best intentions completely destroyed that family run business: all the executives declared bankruptcy. The owner’s family had two sons in laws, his own son and wife working full time jobs in the business only to lose everything and now Mark is on the run from the law. Even with all the track record, skill, and experience and investments can still fall apart.

Is it any wonder why my investment strategy is so boring and under my direct control? I also have to heavy and conscience and lazy hence I DO NOT ACCEPT investment capital or partners. I’d much rather show others how I invest so they may replicate my successes, keep all the returns to themselves.

A client of mine was reference checking her litigation lawyer with me and I told her, I only know of her litigation lawyer from my own lawyer and in my experience, there has been little need for litigation because back in the financial crisis of 2007-2008, investor school REIN and Rock Star are much more conservative. We invested for positive cash flow which one could get with a single family house. Others bought apartment buildings in Ontario and Alberta but for cash flow so they could survive. Thank goodness the Alberta investors could survive as they have been in economic winter till just recently.

Note, I was members of both Rock Star Real Estate and REIN and still am at Rock Star. Tom Karadza, co-founder and co-owner of Rock Star is coming on the pod next week.

Anyways, this new wave education groups focus heavily on the BRRRR and private funds. Only in the last few years have I seen so many investors lend their money so indiscriminately. And no different when a car company comes out with a brand new model, I’m not buying it till 3-4 years after after all the bugs are worked out. I couldn’t imagine investing in a novice investment partner. Go prove yourself first or use tried and tested strategies that survived a correction.

I totally understand fake it till you make it but don’t borrow more than you can’t pay back. Especially at the beginning when you’re new. Everyone has to start somewhere but I would never invest with a beginner.

I’m old so I’ll say, back in my day, private borrowing was a lot of work for not a lot of dollars. Everything was more affordable 10-15 years ago, using one’s own HELOC was easier and cheaper than private mortgages.

Fast forward today there are all these coaches and gurus promoting 100% loan to value, no money down investments in the most expensive real estate market we’ve ever seen where it’s tough to cash flow even with large cash down payments. Sadly, these investors paid tens of thousands for training and I know from scrolling through their social media and the same real estate education companies keep coming up.

This new generation of investors in Ontario, with affordability being so bad have to rely on heavy renovations (yes, I consider a basement suite conversion a major renovation), then refinancing as their source of cash flow which has not worked out as the market has turned. Investors are having trouble paying their bills. A word of caution to all the service providers out there with investor clients: get paid upfront.

For the new investor and for anyone and everyone’s next investment property, I believe one needs to look at landlord friendly USA. My next investment will be on a property ranging between $100,000 to $350,000 that rents for $1,000 to 2,200 plus utilities. A rent yield of 8-10% or gold old REIN’s Cash Flow Zone metric to screen for properties.

If you’re interested in learning more about investing in the USA, I’ll be hosting a free virtual tour of US income properties: why I chose the locations, what the properties look like and the numbers and the positive cash flow. We already have 200 Canadians registered, this is a wonderful opportunity to start learning more about what I consider the best investment for most Canadians, most of the time. That is if you want an investment property that’s 10X easier than something local in Ontario or BC that actually cash flows positive.

Saturday morning, February 10th, link to register: https://www.eventbrite.ca/e/797034109477?aff=oddtdtcreator

Speaking of REIN and Cash Flow Zone, President and CEO of REIN Patrick Francey will be interviewed for this show next week so stay tuned! It is at REIN where I met today’s guest Jeffrey Woods.

From $9K To Invest, To $20M Portfolio, Exiting Niagara Falls for USA With Jeffrey Woods

Real Estate Journey: Woods started with a $69,000 property, gradually moving to multi-family properties, mixed-use, and commercial buildings.

Market Shifts: Discussion on the changing real estate market dynamics, particularly in Ontario, Canada, and his strategies in response to these changes.

Personal Strategy and Lifestyle: Woods talks about his transition to investing in the Dominican Republic and the U.S., focusing on lifestyle alongside investment returns. He stresses the importance of being in markets that are favorable to investors.

Investment Philosophy: Woods emphasizes the value of education in real estate, joint ventures, and creative investment strategies, including his plans to explore single-family homes and creative financing in the U.S.

Health and Work-Life Balance: He touches upon the significance of maintaining a healthy work-life balance and not letting the pursuit of wealth overshadow personal well-being and relationships.

Challenges and Learning: Woods shares lessons learned from managing properties, the difficulties faced, and how these experiences shaped his approach to real estate investing.

To Listen:

** Transcript Auto-Generated**

Erwin 0:00

I’m back from Texas in Costa Rica, only to hear about a massive bankruptcy protection filing. And today’s guest co authored the ultimate loss strategy, your complete guide to buying fixing and refinancing and renting real estate back from 2014 along with his great co authors Quint in great investors, Quinn D’Souza, Andrew Brennan in today’s today’s guests, Jeffrey woods just started with only 69,000 He actually only had like five to $9,000 to invest that six 9000 was the price of a property in Niagara region to run and build a sizable portfolio of multifamily mixed use and commercial properties valued in the $20 million range and 150 units. Jeff has since transitioned out of Canada to live in Dominican Republic and starting up investing in the USA. Jeff and I are old friends and like many of the older generation investors, he’s seen a lot. He’s done quite well for himself. And he’s here to share his takeaways. So there’s a lot to take away from this episode. Hopefully you’re taking notes. Welcome to the Real Estate Investing show for Canadians. Yes, for those who are watching on YouTube, I am indeed wearing my Texas hat. In my Keep Austin weird coffee mug. Again, I’m back in Texas, after looking around Austin in San Antonio to get to know the areas I’m targeting for investment and honestly, the trip went way better than expected. I met some awesome awesome people have checked it on the Tesla Gigafactory before security told us to turn around. I stopped on the roadside to take taking the size and scale of Samsung’s $17 billion investment into a microchip manufacturing plant. They are making chips for 5g wireless technology AI in supercomputing purposes. Something that for my research is in short supply. Apparently, open AI is even looking to raise around 10 billion to so they can start building their own chips as well for for AI purposes. So point is there appears to be a shortage. So this manufacturing plant will will be home to some around 2000 Great paying manufacturing jobs, which will create great net great, it will create upward pressure on local rents and prices. And I intend to get in front of all that lovely AI stuff. And all those wonderful economic fundamentals. Yeah, so I’m looking around some properties around there. From Texas, I flew directly to Costa Rica to meet up with cherry my dad and the kids. Cherry had been invited to speak at an event in Costa Rica on specific to investing a workshop. So I tagged along to mooch off the her work trip with kids and a big bonus to spend time with my dad. But I hadn’t I hadn’t been on vacation together for I don’t even know how long. He’s never been on vacation with us with the kids. So it’s been over 10 years. Dad usually travels to Southern Europe, as he’s a big wine buff versus cherry and I choose more winter escapes and kid friendly. So like cruises, and in winter, we do local ski trips. Neither is of interest to my dad. He says cruises are for old people. So it’s funny that someone who’s old is saying that what we do is for old people. Anyways, Costa Rica is wonderful. Don’t get me wrong. For myself personally, I can only be there for short periods of time. It’s great for rest and relaxation, fun food. But I do like to work and it’s busy at work with three my own properties going up for sale, things are taking longer than expected to get things to for sale. And that is the challenge when you have older properties. And you have all these student tenants that make coordination a lot more difficult. Because I was a little bit ambitious in my timeline, but it’s happening, it will happen. Hopefully they’ll go live the Thursday that you’re listening to the show. Hopefully those get sold because I want to be in the USA for my own investments and to help my clients and community be there as well. I’m on a mission to generate more cash flow my real estate portfolio. My goal is to generate $100,000 US dollars in cash flow from rental income. Good old fashioned rents exceeding expenses leaving me cash at the end of each month in my bank account deposited to my bank account with a 40 Will the elevated rates interest rates expenses inflation is so high here in Ontario and bc I see very little choice but to diversify to the USA. Also my research is showing that the Canadian dollar will devalue in relation to the US dollar through over the long term. I wanted to be part of the solution here at home to provide rental supply but every level of government has made me feel unwelcome. So I will go where unwanted instead. Positive Cash Flow is what gets one freedom and devious at business or investment. Unfortunately, this new wave of investors influencers fake gurus, like all high leverage with aggressive complicated investment models. I’m reading about the latest apartment, Burr business flipping business in DRC. creditor protection, I’ll have a link in the show notes. I don’t, I’m not going to name names because I believe in innocent till proven guilty. But I see many things consistent with this business with previously failed investment businesses. I’ve had guests on the show, who share about who had invested in those businesses, you know, those other investors. And I see a lot of the same commonalities. And appreciate that I’ve been studying field businesses investment business since the financial crisis of 2007, and eight, and I’m seeing a lot more of it. Now. Back then there weren’t not as many investment clubs. Really the two dominant were rain in rock star real estate, both preached much more conservative investing, then there’s new air, newer era, investment companies that opened up in like the last five years or so. So no, I was very close to permanent equity debacle. And I still am. And so as I have friends and clients that are that have money with them, that they’ve since gone bankrupt. I know I know fully well how the best tensions completely destroyed that family run business. All the executives declare bankruptcy. The owners, the owners, family had to send in laws and his own son working in the business full time along with his wife are working full time in the business, only see those jobs go away. And only to lose everything. My family has lost everything. And now the owner, the owner, Mark is on the run from the law. So even with track record skill and experience, investments can still fall apart. Is it any wonder why my own investments, I call them boring, I try to give more and under my direct control. I do have property managers and stuff. But otherwise, I’m still I’m still my wife and I are the only owners we can do whatever we want with the property, we can fire people, we can hire people, we can sell the property wherever we want, I am a control also have a heavy in. I also have a heavy conscience. And I’m lazy. Hence I do not accept investment capital, or partners. And actually had a good friend of mine. It was quite the compliment. He asked if I was taking on money to invest in the States. I’d much rather show same thing I told him, I said I tried to show you in my in others how I invest. So you may replicate my successes. And keep all those returns to yourself. You’ll get rich a lot faster that way by keeping the profits to yourself. A client of mine was reference checking her litigation lawyer with me and I told her I only know of her litigation lawyer through my own lawyer because we have the same lawyer because in my experience, there has been very little need for litigation. Even back in the financial crisis 2000 6000 7008 Again, I was back. Like, my community was different. I know there’s been a lot there’s lots of devastation then but I wasn’t I was among more sophisticated investors or at least those trying to be sophisticated. And that was that was Rockstar and rain back then. And again, both of those schools teach way more conservative investing. We invested for positive cash flow back that back in the day, because one could still get positive cash flow with a single family house and get at least breakeven I Burlington on downtown Ontario properties were breaking even at single family. Many others bought apartment buildings in Ontario or Alberta. And they did so with cash flow so they could survive a thank goodness all those up bird ambassadors could survive because rents declined because they don’t have rent control and they’ve been in economic winter till just recently. point is though. Unfortunately, they went for over a decade without making any money. But at least they could survive because of it because again, the rent could cover their expenses. So note I was a member of both Rockstar real estate. I’ve been since 2010. As a member of rain for a decade between 22,008 and 2018 and I still am at Rockstar. The Tom Craddock, co founder, co founder and co owner of Rockstar has actually coming on the podcast next week. This new wave of education groups focus heavily on burr investing, which is funny because our guest actually wrote a book on burr investing back in 2014. That’s buy renovate, rent, refinance, repeat, and but new but much newer that only came around last five years or so is private, private money and hard money. I don’t know why people got away from that term. These are hard money loans. Only. So again, only in the past year, have I seen so many investors? Some my clients not through me, not through my recommendation. Have I seen so many investors taking on hard money loans so indiscriminately? And no different when a car company comes out with a brand new model of a car?

I’m not buying it until like until like three or four years later, because I want to see all the bugs worked out before I’d ever take on a new model car. I couldn’t imagine investing in a novice investment partner. Like seriously go prove yourself first with your own money, or use conservative tried and tested strategies that have survived a correction before. For Ontario for BC, we even had a correction since 2008. And Alberta, you’ve had many corrections since then. So you’ve had lots of chances to test out your investment theories. I totally understand fake it till you make it. But don’t borrow more than you can pay back, especially at the beginning, when you’re new. Everyone has to start somewhere. But again, I would never invest with a beginner. I’m old, so I can say it back in my day, Pirate boring was a lot of work for not a lot of dollars. Everything was more affordable back 10 and 15 years ago. Hence using one’s one owns HELOC was easier and cheaper than private mortgages, which honestly was just pushing buttons and I would get a check in the mail. Anyways, fast forward today, there are all these coaches and gurus promoting 100% loan to value investments, no money down, don’t use any of your own capital. And we’re in the most expensive real estate market we’ve ever seen. When it’s already tough, it was already tough before the pandemic to cash flow with even large sums of down large cash down payments. Sadly, these investors paid 10s of 1000s of for training. And I know because I simply scroll through their social media. Some people are some some people’s accounts have gone away. But for those who keep their accounts open, simple scroll through their social media, and they know exactly what’s real estate, educate testing companies they belong to, they’ve spent a lot of money out 3060 $70,000 $100,000 And then ongoing coaching. If they do that as well, in the same real estate education companies keep coming up. It’s incredibly sad. And that works out to a terrible ROI return on investment. When you invest your time and money and you end up losing this generation of investors in Ontario with affordability being so bad Have you have had to rely on heavy renovations. And yes, I consider a basement suite conversion a heavy renovation retail price on one of those in my market is 160,000. And then they refinance. And that’s their source of cash flow. And unfortunately, that’s not working out in this market. Investors are having trouble paying their bills in a word of caution to all the service providers out there with investor clients get paid up front for the new investor. So for anyone who’s new listening to the show, or anyone who’s considering their next investment property, I believe one needs to look at landlord friendly USA, which generally means the southern states, not California and I personally stay away from from climate risk, which excludes most of Florida and Houston, Texas. My investment will be on a property ranging between 100,000 to 350,000. American that rents for 1000 to 2200 per month plus utilities. That leaves me with a rent yield of between eight to 10% are good old rains, real estate management in the works cashflow zone metric to screen for properties. And it’s actually if you know what you’re looking where you’re looking. If you know where to look, it’s actually quite easy to find these properties. So anyways, if you’re interested in learning more about investing in the USA, I’ll be hosting a free virtual tour of US income properties. Unfortunate we’ll be doing this online because there’s no way we’re flying down to like Memphis, Tennessee, Atlanta, Georgia, Dallas, Texas. But we can we can handle all that in about 60 to 90 minutes. I’ll discuss why I chose these locations, where my research is telling me what the properties look like in the numbers in the positive cash flow. We already have 200 Canadians registered for this event. And this is a wonderful opportunity to start learning more about what I consider the best investment for most Canadians most of the time. That is if you want an investment property that’s 10x easier than something local in Ontario or BC that actually cash flows. Note this is direct investment as in whoever invest in these properties. They own them directly. This is not a security. I’m not looking to raise capital. I’m looking to put people in touch with good properties. Saturday morning February 10. Link to register is in the show notes. Now speaking of rain cash flow zone, the President and CEO of rain project Francie will be interviewed on for the show. Just next week, it is rain where I met today’s guests Jeffrey woods. So Jeffrey, again, I mentioned he started with his first property was $69,000. You needed around five $9,000 to get into that. And then gradually moving on to multifamily properties, mixed use properties and commercial buildings. And that portfolio tarp that peaked at around $20 million in value across 150 units, mostly in the Niagara region. We talked about shifts, we’re talking about market dynamics, particularly in Ontario and how his his whole just strategies have had to change in response to those changes. We talking about personal lifestyle and strategy. As I mentioned earlier, Jeff has moved to the Dominican Republic and is giving up his Canadian citizenship. He We’ll be looking to re start his investment, real estate investing in the USA. And also with a big focus on lifestyle in returns, he stresses the importance of being in markets where they are favorable to investors. Jeff emphasizes the value of education in real estate and joint ventures and creative investment strategies. And again, he talks a lot about health and work balance. If you know many investors, especially full time investors, especially Ontario, and BC, full time investors, you know, it’s been a stressful go. So I think this is wonderful. Listen for everyone, from someone who’s been there and done that. So please enjoy the show. If you’re interested in Jeff’s book, it’s a wonderful book, the ultimate wealth strategy. It is a bit dated as is 2014. But it’s a wonderful place to start. You can simply find it on Amazon, again, linked in the show notes. I have links to Jeffrey’s website. It’s Jeffrey woods.com. And I’ll have a link to his Facebook profile as well in the show notes, please near the show

I was keeping you busy these days

Speaker 1 16:10

here when it’s a pleasure to be here. And yeah, just enjoying island life on the north coast of Dominican Republic. So that consumes a lot of my time. Oh,

Erwin 16:22

I was consuming your time on the island. Thing, subdivisions or something? What are you doing?

Speaker 1 16:28

Well, a little bit, a little bit of real estate, of course, that’s in my blood, but just kind of getting back to nature and health and exploring different cultures and languages and, and sights and you know, everything that goes along with adventures of a new country.

Erwin 16:47

How long you’ve been there now a

Unknown Speaker 16:50

little over two years now.

Erwin 16:52

And how you been? How you how you like it?

Speaker 1 16:55

Yeah, I like it. I mean, there’s pros and cons to everything. So when it comes to the weather, you can’t beat it. You know, ocean front, lots of fresh fruits and vegetables and vitamin D and a much healthier lifestyle. But of course, you know, one of the downsides is I do still have that entrepreneurial drive. And sometimes things here can move a little bit slower than I would like. So. But overall, it’s been a positive experience for sure.

Erwin 17:27

You mentioned the it’s hard to get things done like Island, time, Island pace, and community to appreciate that as well, because I see lots of gurus and influencers are in Caribbean locations promoting builds and whatnot. But when when I opening news piece of news was in Nassau, Bahamas, for example, where China’s building casinos, like they had difficulty with the local labor, so they actually had to bring in a lot of their own labor, which the Bahamian government didn’t want. They want to employ their own people. But if you want something done, having laborers is not the fastest way to get something done.

Speaker 1 18:10

Yeah, and that’s certainly an ongoing issue here as well. Right. So we’ve got labor shortages. And then of course, bordering Haiti, a lot of the heavy lifting and construction is done by Haitian workers. And of course, the Dominican government would much rather see that work go towards the Dominican folks as well. So that’s an ongoing issue here with labor shortage and finding people that want to do the construction side of things, the heavy labor. Do

Erwin 18:41

you know, what’s the source of the labor shortage? Is there too much building going on or not enough people? Well, there,

Speaker 1 18:47

there’s that as well. So some of its political where they don’t want the Haitians here, taking Dominican jobs. But the other part, I think, too, is, since you know, the pandemic, there’s been a huge influx of Canadians, Americans and Europeans coming to the island. And so I think it was a matter of overselling, right, developers selling more than they could keep up with. And, of course, limited, limited labor and limited building supplies. Being on an island has caused even more setbacks and time delays in addition to the already extremely slow island life, right. So it just compounded that even more.

Erwin 19:35

Yeah, so you’re part of the problem, because you Yeah. For those who don’t know, Jeff, Jeff, you’ve always been Canadian. always lived in Canada before Dominican? Yes.

Speaker 1 19:45

Yeah. All right. Yeah. Born and raised in, in Ontario. So

Erwin 19:51

and then and then did you always live in Niagara? No,

Speaker 1 19:54

no. So I grew up in a small little town north of kitchen Her Waterloo Guelph area, so a small little farming community 1800 people and how I ended up in Niagara was I went to Niagara College to be a correctional officer. Oh, okay. Yeah, yeah. So that’s perfect for a landlord. Yeah. Yeah. So yeah, I went to school for that and quickly realized that there’s no way in hell I wanted to go work within the prison system. I had a passion for, you know, I wanted to help, specifically, young men improve their lives. But the prison system was a very negative toxic environment. And I just didn’t see myself going to work there every day. Right? Yes.

Erwin 20:42

Negativity in a prison? Probably. Yeah, it

Speaker 1 20:45

wasn’t. wasn’t where I wanted to spend my days. That’s for sure. So

Erwin 20:49

since they became a landlord, yeah, yeah, kind

Speaker 1 20:53

of in a roundabout way. I stumbled upon real estate and just cut the cut the bug and yeah, never looked back. I’ve been investing since 1998. So quite a while ago.

Erwin 21:07

So for listeners benefit who hasn’t been around that long? Like, what kind of price point and what were you buying back in 98.

Speaker 1 21:13

So my very first property was a beat up old bank power sale. Because, again, I was not very financially stable. So I ended up getting a job in the casino industry, when they opened up in Niagara. And I was able to save up enough money to get a down payment for my first property, which was $69,000. And it was, yeah, but compared to today’s prices, it’s a it’s a bargain, right? And

Erwin 21:47

it was a tower six 9000 How much do you put down, I

Speaker 1 21:51

had about nine, nine to $10,000 saved up right. And, and then I put a little bit kind of sweat equity into fixing it up. And what I ultimately did with that property was it was three bedrooms, one bath on the main floor, and then in the lower yet level unit, it was a raised bungalow. So I did three bedrooms, one bath, in the lower level as well. And then I just rented to college and university kids. So I lived in one room and I rented out the other five rooms. And that paid for all the expenses put and put cash in my pocket. And so that’s what really solidified and proved to me that okay, you can you can make a difference investing in real estate. Fantastic.

Erwin 22:40

Where was this property that you can draw? Always in the world? Okay. Yeah, yeah. Yeah. Cool. So feel sorry for listeners benefit. The world is very close to Brock University. Yeah.

Unknown Speaker 22:52

Yeah. And Niagara College as well.

Erwin 22:57

Well, I’m a little further

Speaker 1 23:00

renters. Brock in Niagara. Okay. Yeah, yeah, there’s a Niagara College campus that’s not too far from from the world. It’s actually considered in Niagara on the Lake. But it borders St. Catherine. So it’s right in that vicinity as well. Yeah.

Erwin 23:17

No, I don’t mean to mail them. All right. When nice, yeah. Yeah.

Speaker 1 23:21

Yeah. Yeah. So that’s Niagara College there as well. So and that’s not far from thrilled at all. The main campus is in welland, but you can get students from the Niagara campus as well.

Erwin 23:34

To remember to like renting a room for

Speaker 1 23:38

I want to say around 350 Wow, something like that. 350 some, something in that range. Wait,

Erwin 23:47

hang on, I will pick up a calculator because I’m like the worst Asian and math. So 350 times five bedrooms. You can 1750 a month and rent on a $69,000 property.

Speaker 1 23:59

Yeah, yeah. Oh, it was it was amazing, right. And so that’s why I thought I was a real estate genius. And of course, all my money from my income I could save because I didn’t need it to pay any of my expenses. And so what happened was, I again, I started to save up and I wanted to buy my next property. And that’s when that was the property that taught me a ton of lessons because I really had I got lucky with my first property right and that was living there and it was college kids and stuff. But my second property I bought a again a beat up duplex in downtown Niagara Falls. And that’s where I learned to vote things like the landlord tenant board, and fire code and proper zoning and you know, all these renovations and electrical and fire hazards and all this stuff that you know, I really didn’t pay much attention to. I just thought well you buy the property you rent it out, buy low, sell high I Right. And that property taught me a ton of valuable lessons.

Erwin 25:06

So it was a tough area. Yeah,

Speaker 1 25:08

it was downtown Niagara Falls was a tough, very bad tenant profile, very difficult to get, you know, tenants to rent there any decent tenants anyways. So it was my worst investment, but also my best because it really made me focus and learn and, you know, consider education, right. I, that taught me that I really had no clue what I was doing. And if I wanted to be successful, I better learn how to do it properly. Right,

Erwin 25:42

right, because my experience with students is generally way easier than than long term rental, especially when you’re talking about a rough area.

Speaker 1 25:51

Yeah, well, my second property so the only property I’ve ever focused on students was my very first one. And the reason why was just I was around Brock and Niagara, you know, fresh out of college, a lot of my friends were younger, they wanted rooms they wanted, it was easier for them to stay with me. And so I just kind of fell into student rentals. But I never set out like hey, I’m gonna buy this property and turn it into a student rental. And then of course, my second property was a duplex so I just wanted to build like long term multifamily investment properties was always my original goal. And so that’s what I did with every property thereafter.

Erwin 26:36

And then what were you buying what was your What was your focus your strategy? Yeah,

Speaker 1 26:41

so I started out with the small multifamily is like duplex triplex four Plex, and then over time, that evolved into small apartment buildings, and then it evolved into mixed use properties and even commercial buildings. So

Erwin 26:59

and then what do you feel about that market now? What do you feel about apartment buildings and mixed use buildings? It will start with these all Niagara region.

Speaker 1 27:07

All Yeah, all night. All Niagara, Niagara Falls, St. Catharines. Thrilled welland, Chippewa, but primarily all Niagara a little bit in Hamilton as well. So

Erwin 27:17

yeah, we had well over trying to play like a $20 million portfolio, then. Yeah,

Speaker 1 27:23

in around that price range about 150 units under ownership with joint venture partners.

Erwin 27:34

That’s that’s a lot of growth from from a $69,000. House. Yeah, 10. Grand to invest. Yeah, investors today, it’s so much harder to do anything. Exactly.

Speaker 1 27:48

And but the big thing that my big key takeaway with that was, because in the beginning, I thought that I was just going to work really hard and save up my money. And every time I had enough, I would buy another property. And it wasn’t until I stopped investing in real estate that my real estate portfolio exploded. And what I mean by that is, rather than working hard to save up money to buy my next deal, I took that money, and I invested in my education. So that’s when I started to, you know, join groups like rain, real estate, Investment Network, and coaching programs and different training opportunities. And then I learned how to raise capital and how to do joint venture partnerships and all of these other strategies where now I had unlimited potential buying power, because I didn’t, I didn’t need to work to save up the money. I didn’t need to qualify the deal. I could just position myself as the the authority in the space and partner with other people that had the money and the credit. And then that’s when our portfolio really started to scale quickly.

Erwin 28:58

And near the benefit of time, as well, like you’re investing in great times as well.

Unknown Speaker 29:02

Yeah, yeah. Yeah.

Erwin 29:06

And now what’s the portfolio doing now?

Speaker 1 29:09

So now I am liquidating. So obviously, as you’re well aware, things have changed. In in Canada and in Ontario, and over the past several years, I’ve slowly been either based on our own decisions or joint venture partners wanting to get out of the market, but ultimately want to exit the Ontario and Canada market completely. So we’ve been strategically selling off over the past several years, which again, has allowed me to redeploy some of that capital in Dominican Republic as more of a lifestyle purchase and going forward. You know, as I said, beautiful life very peaceful, relaxing. lots of benefits to being in the Caribbean. But as far as like entrepreneurial drive and growth and where to, you know, kind of rebuild the Empire again, I’m going to focus on the US going forward.

Erwin 30:17

Why focus on the US? Like you already have so many boots on grounds relationships in Niagara region, Ontario?

Speaker 1 30:24

Yeah. And that that was, I think, one of the contributing factors as to why I didn’t invest in the US a long time ago, right? Because I have friends that have been investing in the US for quite, quite some time. And I always felt like, well, I’ve got my team established, right? I’m comfortable, I’ve got everything in place in Ontario, why would I? Why would I go to the US and redo everything all over again. And it really comes down to investing, you know, we talk about location, location, location. And we think about, you know, what, what property, what neighborhood what city. But when you look at the bigger picture of how a government or political decisions or things like the landlord tenant board, how that can impact your portfolio, it can be detrimental and just swings in the market, right? I think real estate in Ontario is unaffordable. And when you compound that with, you know, a situation where the tenants have all the rights, you’ve got, you know, high interest, high mortgage, you know, short terms on your mortgage, you’ve got tenants that you can evict. When you do evict, you can’t collect on damages. In many cases, it just becomes a very difficult environment to be successful, almost to the point where one might feel that the the government is against entrepreneurship, right? Like they’re really trying to repel business owners and landlords and investors where if you go down to certain states within the US, they are pro entrepreneurship, and they’re open for business and they make they make it you know, financing is much easier abundance of deals. You know, just the landlord tenant board. Rights are more, more fair. And so that really makes you consider moving.

Erwin 32:38

And then in turn the American states I personally follow Sunbelt, mostly, but they actually have oversupply rentals, which is from new construction, which is wonderful for housing prices and affordability. Yeah, yeah. Yeah, we have we have rent control, but we don’t have housing.

Speaker 1 32:59

Right? Yeah. And there’s so many. Yeah, taxes, right? Even just things like creative strategies that are much, much easier to implement in the States than they are in Canada. So yeah, there’s there’s a ton of benefits, which is worthwhile rebuilding. So

Erwin 33:21

before we get too much into this US discussion, which we will get there, you mentioned your 150 units, how are they managed? Did you do that in house? Or did you third party?

Speaker 1 33:30

Yeah, in house. So ultimately, I used to self manage in the beginning, right, because again, I didn’t know then what I know now. So I thought that I was saving money. I was learning I self managed. But then it quickly got to the point where I was no no longer able to effectively do that. So we went to source, a professional management company as another alternative. And I couldn’t find a company in the area at that point in time that was willing to do the management the way I wanted. So the third alternative was, why not create our own management company, teach the manager to manage the properties the way we want, and then turn that into a revenue stream where because at that point in time, I was getting people asking me like, Hey, would you manage my property as well? So we turned that into an revenue stream where we were able to reduce cost for our own properties by having internal management as well as take on and manage other people’s properties as well. How

Erwin 34:39

was that experience of owning your own pm company?

Unknown Speaker 34:44

extremely frustrating, difficult.

Erwin 34:46

Oh, why sunshine, rainbows ultimate real estate.

Speaker 1 34:54

The thing about property management is it’s it’s a very Very tough position to be because you’re trying to make the owners happy and keep the tenants happy. And so it’s, you know, it should be called people management versus property. Dealing with properties is easy, right? It’s the people, right? It’s the tenants and handling their expectations versus the homeowners expectations. So, and like,

Erwin 35:25

especially cabinets, or a roof is like, that’s like a two day job like, boom, boom, done. And then yeah, it’s action. Versus your Yeah, almost married to the tenant. Yeah,

Speaker 1 35:35

yeah. Yeah. So. So it was extremely frustrating and difficult. And again, huge learning curve, because in the beginning, my intentions were good. I wanted to help people. And of course, the people that want your services are the ones that are struggling the most, they got, you know, difficult tenants that they’ve inherited, and they would drop that problem at our doorstep, and then we’d have to go and fix it. And certainly the, the challenge was not worth the, the the effort or the financial compensation either. So, again, over time, you’ll learn to refine and not take on properties that simply aren’t worth your time. So, so we were very

Erwin 36:23

challenging, because even if the property is good, like, if it’s a bad tenant, and they’re not leaving them, then that effectively, it’s bad deal.

Speaker 1 36:32

Yeah, it was challenging. And we were over time, we were very selective with the properties that we took on and mostly just stuck to managing our own properties in house. So you know, it wasn’t a business that we really pushed to Zscaler grower to become this large, you know, management company, it was more to facilitate our own properties.

Erwin 36:58

Is that a need? Not? Because exactly, it looked like it was a good idea as a revenue stream as a new business, potential income stream, but it sounds like he got really good clients.

Speaker 1 37:09

Yeah, yeah. And with with the management, we had our own in house maintenance and renovations as well, because one of the things we would do, you know, cash flow is okay. Over time, the more doors, the cash flow builds up, but it was always nice to get a big payday in there as well. So every now and again, we would flip properties. And so we’re able to have in house, general labor and contractors that work specifically for us that would work on two fronts, one, they would maintain and manage our rental portfolio. But also in between that we would flip properties here and there for a larger payday. And so it was really the renovation side of the management and maintenance was where most of the profit came from. But the general sorry, the general day to day management of tenants and evictions, and, you know, filing forms and all that stuff is not very, wasn’t very lucrative.

Erwin 38:13

So the property manager, like the person who is the day to day facing, was it, how was their experience was it was easy to hire for that with that they did last long and a positions.

Speaker 1 38:26

Yeah, so I was fairly fortunate in that regard. So we’ve had a couple internal managers over the years, one of which is my sister. So having a family, right, and I would teach her and train her and her skill set is very different than mine. So one of the things that I like to focus on because while I did own a property management company, I was never a property manager, right? Like, I couldn’t tell you the last time I’ve collected a rent checker or went to the tribunal, right, or filled out a form. So I created the company and I put people in that position, I would train them and teach them the way I wanted it done. And made sure to employ people that were better at that task than I was. And so she’s very good at dealing with people and resolving problems and, and all of that good stuff. And again, that freed up my time to where I could focus on acquiring more properties and working with the joint venture partners and raising capital and these types of things that I enjoy doing.

Erwin 39:34

Now let’s let’s, let’s move on to the reason for the pivot now. We’re recording this in November, this product released in January, we’re a little bit backlogged. The forecast right now is interest rates will be cut. There’s even a chance interest rates being cut in like March or you know, it’s basically it’s a foregone conclusion by like July that we’ve already will will already have one cut. Right so my theory is we’re real estate legal Just look where we are right now. Interest rates are about three times what they were back in 2021. But we’re at the same price now. Right? Same price at 20.1. But the interest rates like three times higher. So when interest rates go down, we can only assume where the where this markets going. So there is upside to owning a real estate portfolio in Ontario in Canada. So why why decision to exit? Like there’s still money to be made?

Speaker 1 40:27

Yeah, again, pros and cons everywhere, right. But I like there’s a gentleman named Anderson, or Andrew Henderson, Nomad, capitalist. And he’s got a term that he says, go where you’re treated best. Right? Yeah. And, and so I like that, and I look at it. And it’s not only go where you’re treated best, but invest where you’re treated best, right. And so I want to invest in a country and a neighborhood in a community, and a place where they appreciate me providing affordable homes, and they make my job easy, and they’re willing to lend to me, and they’re willing to create an environment that motivates me to want to improve that community. And I just don’t feel that in Ontario, you know, the political environment and everything that’s going on, you know, banking, and financing and taxes, and all of those things combined, right? Really makes you question if you want to just contribute to that now, can you make money there? Yeah. But could you make more money with a much stress, much more stress free lifestyle elsewhere? I believe you can. And so it’s, it’s not just about the money, but the ease of doing business and doing it in a geographical location that appreciates and rewards you for doing it, rather than disciplining you.

Erwin 42:01

So he lived a long time in Ontario, why the decision to leave to go to the Dominican. So

Speaker 1 42:08

it’s always been one of my goals. And this goes back from the early rain days, and I believably on. Yeah, Don used to call it his personal beliefs, right, his vision board. So one of the things that I always wanted to do was to have a tropical home, you know, you know, a warm, tropical destination. And so that was always part of my goal and vision. And I started to work towards that in 2018. But as the years progressed, and with, with the pandemic, and everything, it just made me move faster, right. So I moved up my timeline, I was always working towards having a place in in the Caribbean or down south, like considered Florida as well. So that was always part of the goal. And but the original goal was to spend, you know, my winters down south and my summers in Canada. But now, through time and learning and exploring different options, it’s probably more likely that I’ll spend the majority of my time in the US building my real estate portfolio. And I’ll split that with the Caribbean, but more the Caribbean is more of a lifestyle investment. And then I’ll just go back to Canada to visit family and friends when needed.

Erwin 43:35

Amazing. And then I’m sure there’s lots of listeners who are interested in not also doing similar, like living elsewhere for the winters or potentially like leaving the country entirely. What kind of, like, let’s use your own experience, like what kind of so say, say husband and wife they want to bedroom? Where you live, what should they budget for? And what can they expect?

Speaker 1 44:01

Well, you could build a two bedroom two and a half bath Villa down here for probably about I would budget 300,000. Us. That’s it. Yeah, private pool. You know, with a lot double car drive. Yeah. Brand new, vaulted ceilings. So how

Erwin 44:25

long would that take? You’re talking about brand new RV. Sorry. It’s a it’s new construction. And you’re building it. You’re saying? Yeah,

Speaker 1 44:30

yeah. So if like that’s the going prices, so at the development where I’m building, that’s an example of a build that would like a price. So 300 Yeah. 300,000 for two bedroom, two and a half bath with a private pool.

Erwin 44:48

And so sorry, you currently live in a condo and now you’re planning on moving into the house?

Speaker 1 44:53

Yes, correct. Yeah. When when my villa is built, so I have the land currently But my build schedule has been pushed back significantly because of what was the original issues? Well, I bought the land in October of 2001. And, and the villa is still not done. Now part of that is based on my decision, just because there’s, there’s so far behind. And it’s, it’s a construction zone. So I’m really not motivated to build in the middle of a construction zone. So I’m gonna wait until the end, like I have no rush as to, you know, it’s not like I have a wife and children that need to be in a specific spot. So for me, I’m comfortable where I am. So I’m going to wait until the developments further along, and I’m not living in the middle of a construction zone.

Erwin 45:48

That makes sense. Like, yeah, that’s like the last night, I don’t even know if it’s an option here normally, because you know, for anyone who’s bought new construction My family has before and then, you know, you move in the driveway is all gravel, your lawn is all dirt. There’s no fences, there’s no trees, it’s not much to look at. It’s just dust

Speaker 1 46:04

dust everywhere it’s tracking and you know, your screens are full of dust. And down here, the dirt is like, it’s like a red tinge to it. And it stains and tracks everywhere. So it’s yeah, I just figured I’d rather wait until the developments further along before I start. So I’m in no rush. Plus, I can take the capital that I had set aside for that and redeployed in the US.

Erwin 46:31

Alright, so what are you planning for the US?

Speaker 1 46:36

So I’m looking at, and again, I’m open to options. But right now I like as far as locations. I like North Carolina, Atlanta, Georgia, and also Tennessee. Those areas I think are landlord friendly, lots of opportunity, taxes, you know, these types of things that we mentioned before. So benefits to that. But the other reason I like is Because currently, I’ve got my business and family and friends in Ontario, specifically Niagara region. And then of course, I’m in Dominican Republic. So if you look at the middle point it it lands right there. Right, Georgia, North Carolina, Tennessee. That’s kind of the midway point. So it’s an easy, easy geographical location to build from and still allows me to get back to Canada or Dominican Republic with ease. Right.

Erwin 47:32

And Atlanta is perfect, because it is like one of the biggest airports in the world. Yeah, so it’s probably a little hard to get a flights.

Speaker 1 47:40

Yeah, Atlanta and Charlotte as well. Charlotte, North Carolina. They have Yeah, direct flights to Dr. All year long. Oh, nice. Yeah. So you can literally

Erwin 47:51

like you can literally connect you literally, you know, you literally go to Charlotte or Atlanta work. And just hop another flight opportunity your trip home.

Speaker 1 47:59

Yep, exactly. And I’m closer. It’s much easier for me to go from, say Charlotte to Puerto Plata than, you know, Toronto to Puerto Plata. Like, as far as time I’m closer, it’s easier. The airport’s here. You know, it’s it’s a small airport, you driving you show up a few minutes earlier. It’s much much simpler. Here, navigating here, then from Toronto, to Charlotte.

Erwin 48:29

So, what did you like about these locations?

Unknown Speaker 48:34

In the States,

Erwin 48:36

yeah, North Carolina, Atlanta, Tennessee. So geographically,

Speaker 1 48:39

the way it’s positioned based on where I am now, but also their landlord friendly states, low taxes, tons of employment. As we mentioned, they’ve got there’s two major airports International where you can get just about anywhere you want in the world. You got large fortune 500 companies in the area. You know, Charlotte’s the second largest banking hub in the entire country, next to New York, Tennessee, very low taxes like no state tax, very low property taxes. And the other thing I like too is if you’re in if you’re in western North Carolina, or eastern Tennessee, and you’re also right on the Georgian border, if you are focused in that area, you could be in all three states. Within hours, right. So it’s just, it’s positioned nicely. You’re not dealing with things like hurricanes in Florida or high insurance, you know that. Florida, Florida is a great state as well. We’d say I would pick investing in Florida versus Ontario, hands down. But But yeah, I just I like those areas. But again, I’m open to exploring.

Erwin 50:03

I encourage all all listeners investors, when they’re when they’re looking at investing is create a list of nose. So my nose are no rent control. Yeah, no LTV. But I also want no tornadoes, no hurricanes. It’s USA anywhere like Canada, USA that are enormous countries. You can still sit you can say no to certain areas, and there’s still tons available. Yeah. Right. I mean, people are fixated on areas that do that do have recurring natural disasters.

Speaker 1 50:39

Yeah, that is that is a really good point. Yeah, for sure. Yeah. Figuring out what you’re not willing to tolerate, and go from there.

Erwin 50:46

Yeah, yeah. I’m not willing to tolerate rent control anymore. Yeah, exactly. Because you need to, because I think people need to remember to flip that around. Because if there’s rent control than us, the landlord, we risk inflation, which we know is here and coming. And there’s more coming. Right. So why would I be willing to assume that risk that inflation continues and I have to bear that expense for my tenants? Yeah. And then in the same time, I’m being vilified but immediately government?

Speaker 1 51:15

Yeah, just solidifying you know, more reasons to, to go into the US, right. Just go. Go where you’re treated best invest where you’re treated best. Yeah, figure out what, what you want, like you said, and then make your decision from there.

Erwin 51:34

So we talked about location, where what kind of strategy we’ll be looking to do. We even talked about the book, for example, like you wrote the book on birds back in, back in almost 10 years ago. I think it is now.

Speaker 1 51:46

Yeah, quite a while ago, the ultimate wealth strategy.

Erwin 51:49

I’m actually bringing it up on Amazon, just so you can look at the date. Yeah. For anyone who wants to play, just just look up, look up Jeff woods and Amazon, you’ll find his book. Yes, the first one, ultimate wealth strategy, your complete guide to buying fixing refinancing and renting real estate? Yeah, yeah. The first results really easy to find. And the book we’re looking for the year Sorry, continue.

Speaker 1 52:15

So So what strategy am I going to implement in the US? So? Yeah, well, it would definitely work a lot better in in those states than it would currently in Ontario, unfortunately. But that’s the other reason I like the states is there’s so much opportunity. So at this point, I’m open to different options. But I think I’m going to focus on single family homes to begin with, to kind of build that foundation, build the team, you know, get more familiar with the banking and property management and areas and all of that good stuff. And then I’m going to explore different creative options, because I do one of the things that I like, is the creative side of investing, how can I put together a deal, you know, without using my own money, or without traditionally going to banks or guaranteeing, you know, high interest mortgages, right. And in the US, there’s an abundance of opportunity. And the other thing, the other thing I like, down there, too, is where you could essentially take Property Management right out of the equation, where you can acquire the property, and then turn around and sell that property, collecting a larger down payment, then then you acquired it for so you’re getting paid a large chunk up front, you’re creating a spread between what you owe and what the tenant pays you. And then also, you’re getting a markup on the back end, because you’re selling it for more than you acquired the property for. No, right. Is this a sandwich lease option? Yeah, yeah. And so these last

Erwin 53:58

time you heard that term, especially the listener was last time you heard that term, because you can’t get these really hard to get done in Ontario.

Speaker 1 54:05

Yeah, but where I first learned about that strategy was when Ron Legrand came to right. And so you’re gonna have guys like Ron Legrand have been investing forever. And they they do that strategy all day. Like, you know, I think last time I listened to him, he said he was doing two or three deals a week like that, where he would acquire the property position himself to make a spread downpayment, a spread in between during the whole pay period, as well as a big check on the back end. And then and then what you’re doing is you’re you don’t like he doesn’t deal with you know, dealing with the tenants or fixing the toilets or none of that it’s all a homeowner now. So yeah, yeah. essentially rent to own seller for Financing, you know, different strategies for different states and areas, I think certain states allow for different, similar strategy, but it’s termed differently. So again, that’s one that I’m going to explore as a possible option as well, with the

Erwin 55:17

sandwich the option strategy, for example, Do you does the property? What? What do you think the property’s gonna look like? Like, what are you anticipating the property? Is is, is it gonna have challenges already? Like, is it something a property that no, people can’t get traditional financing on? And that’s where the opportunity is?

Speaker 1 55:33

Yeah, so, again, I’m just learning this myself, but based on what I’ve thought a property with opportunity before. Yeah, but as far as like doing it in the States, and what they’re targeting, I think, and this is, again, where there’s an abundance of more opportunity is, you know, they’re looking for deals that they can buy creatively. So there’s a term in the States called buying the property subject to. So essentially, what you’re doing is you’re, you’re taking over the debt. So the, the mortgage, my understanding is the mortgage would stay in the current homeowners name, but you’re taking over that debt and that responsibility. So in many cases, you know, life happens, it could be death job, you know, for various reasons, these people are going to lose their property, they’re behind on taxes, you come in, you’re able to save their credit, get them out of that deal. And in many cases, these are great, you know, great properties and great neighborhoods in good condition. Maybe they need light cosmetics. And then you’re, you’re just selling them, right, you’re wrapping them and selling them marking up, of course, you’re negotiating price under, you know, fair market value, and then you’re marking it up a little bit and making a spread.

Erwin 56:59

It’s funny, because the sort of difference in culture between us and American real estate investors, what they call a major renovation, is like 50 60,000. Yeah, like, Dude, that’s like my first payment from our basement suite conversion.

Speaker 1 57:16

Exactly. Yes. Yeah, it’s again, it’s a different. It’s a whole different ballgame over there, right? Like everything is, is better in certain states, right?

Erwin 57:30

More affordable. So so for the listeners benefit, what kind of price range do you think you’re operating in both for acquisition price, and like ARV is after after repair values.

Speaker 1 57:42

So again, this is something I’m open to, but based on the research that I’ve done, you’re probably in the 250 to 400,000 price range. You know, acquiring obviously low, as low as possible, and then selling it for whatever the fair market value dictates after the repair.

Erwin 58:08

How excited are you?

Speaker 1 58:11

Yeah, I’m pretty excited. Right? So it’s, I like learning. I like exploring, you know, different countries and opportunities. And so, yeah, it’s exciting. It’s, it’s kind of rejuvenated, you know, a little bit of that desire and that entrepreneurial drive, because for many years, even pre COVID, I’m in Ontario, and I’m just thinking this, this isn’t, this isn’t looking good. And it’s just getting worse. Right. So I started to look in Dominican Republic in 2018. So I already had, you know, one foot out the door, and, and was thankful, based on what happened in 2020. That I had started that early. So when

Erwin 59:06

did when did you leave? When did you when did you? When did you make the When did you booked your flight? When did you fly to Dominican?

Speaker 1 59:13

Yeah, I didn’t come down here full time until 21. But I started traveling and vacationing vacationing in the Dr. In 2018. I started looking at acquiring property here. 2018 right, just kind of doing research and checking out different areas and different developments and that sort of thing. And then combining that with a holiday. Our property

Erwin 59:37

rights and financing different much different than buying something in Canada.

Speaker 1 59:41

Oh, yeah. Yeah, yeah. Yeah. Now they do have so we have a Scotia Bank here in kavaratti. Which does, you know, they’ll promote that they do offer financing but if you think financing in Canada is difficult, just try and get it here, right. So it’s Uh, extremely difficult to do anything down here, it’s pretty much an all cash market. Now some of the sellers will do seller financing, but the terms are horrible, right? Like, you know, they want a minimum 50% down high interest rates and very short, like, they’ll finance you for three years and then you got to pay the difference out. So your mortgage

Erwin 1:00:22

in three years? Yeah, yeah.

Speaker 1 1:00:26

On the road. Exactly. And it’s a it’s a short road, right. Whereas in the States, you can lock in for 30, even 40 years, right, you know, what your payments are for 40 years? Right. So just that in and of itself is a huge advantage. So yeah, just, as far as, you know, building a lucrative real estate investment portfolio, I don’t think there’s many places that can compete with the USA.

Erwin 1:00:53

I’ve heard that the Americans were looking at less than 30 year mortgages. So for listeners benefit, you know, I think most people know that we have, like, pretty common we have 235 10 year mortgages are pretty fixed mortgages are pretty common, versus the Americans. I don’t know, I don’t know how many don’t have a 30 year mortgage, it seems like everybody has a 30 year term mortgage.

Unknown Speaker 1:01:16

It’s great. Yeah. It’s really, really

Erwin 1:01:18

protects them from from housing crisis as though like, you know, yeah.

Speaker 1 1:01:22

So going back to the creative investment strategy. So a lot of these American investors, what they’re able to do is when they come in and take over a property subject to, they could acquire that property with, you know, whatever, they can negotiate with the seller, but in many cases, little, very little money down. And they can assume that mortgage that that seller has locked in at, you know, 2.8 3.5% versus going to a bank and taking out a new mortgage significantly higher. And so they can they can secure that property with a low interest rate locked in for 30 years. Right. I mean, that in and of itself is is amazing. Versus go, you know, for us going to a bank and qualifying a mortgage at a significantly higher amount right now, that in of itself is just one more opportunity that is available in the US.

Erwin 1:02:19

Are you considering like a farm buildings at all, or mixed use or commercial, like you’ve got here,

Speaker 1 1:02:25

I would, you know, never say never, never say never. But there is, you know, a little bit more complexity to apartment buildings. And for now, I’m just going to focus on the single family homes, and then the creative strategies that we mentioned before. And that’s going to be my focus for now. But who knows, in the future, maybe I’ll evolve and go bigger. But I like, you know, we talk about as investors, we talk about financial freedom. And certainly one aspect of it is making the money. But I find a lot of entrepreneurs and business owners, they’re so focused on the money that they give up their freedom, right? Like, they’re, they’re working all day, every day, and they build their business to revolve solely around them. And so for me, I want to earn a nice income, but I also want to be able to maintain my freedom, be able to travel, spend time in the Caribbean, family, friends, focus on health as well. Right, which again, many investors, they, they sacrifice these things as they’re building and growing. And so I think, you know, as you get a little older and wiser, your time with family and friends and important relationships and your health are, are vitally important to that overall financial freedom equation. Right? Because if you have, you know, millions of dollars, but you’re not healthy, or you’ve got unhealthy relationships, your marriage is falling apart no time with the children, then was it really worth it? So, so I like to leave

Erwin 1:04:09

a very expensive event. Yeah, exactly. What you own is not yours anymore.

Speaker 1 1:04:17

Yeah. Right. And then and, you know, you compound that with the stress, right of dealing with it all. And so sometimes you have to, you know, what’s what’s most important to you?

Erwin 1:04:29

I’ve heard divorce courts like 10,000 a week. Yeah, wants some negative cash

Speaker 1 1:04:35

flow. There you go. Yeah, well, that’ll do it. And then if you’ve got a portfolio with non paying tenants, because you’re stuck in Ontario, and then you can’t sell the property to get that appreciation you thought you were gonna get because nobody can get in to see the property because your tenants are being difficult. Right? So that’s, or they want, you know, the whole Cash for Keys that used to work. Now they want like, criminal amount To money just to just to move out of the property that you supposedly own. Right? It’s, it’s, it’s just increasingly more and more difficult to, to make a profit in Ontario. Not impossible, it can be done. But for me, it’s, yeah, go go. Why not go where you’re treated best?

Erwin 1:05:22

I really I literally had a client who’s exiting his properties way up north. It’s already for sale. Tenant hasn’t paid money to rents sorry, two months hasn’t paid rent in two months. And then they had the gall to ask what more we give me the leaves. Because they need vacant possession because the buyers from Yeah, and so yeah, well, they know, they already know.

Speaker 1 1:05:42

Yeah, they know they can take advantage of the landlord take advantage of the system. And, and they’re gonna get away with it. Right. So it’s, it’s sad. You have people that work really hard. They think they’re doing the right thing. They want to provide affordable housing. Great.

Erwin 1:05:58

People. Yeah. Want to be part of the solution? Yeah, yeah.

Speaker 1 1:06:01

Improve the community, you know, turn rundown homes into safe, affordable housing, these types of things. And then, and then what do you get in return? Right. So again, joking, we

Erwin 1:06:14

tell my clients and friends, no, it’s, you know, we thought we own the property by ourselves. But it’s almost as if the tenants an equity partner now.

Speaker 1 1:06:22

Oh, yeah. Yes, but true.

Erwin 1:06:28

They get some money on the exit, too. Jeff, you you’re dealing with health. So are you good. So I’ve preached a lot on this podcast about like boring investing. Because I find for the vast majority of folks, they still they still work their day job because it’s hard to reproduce. There’s a lot of listeners make six figure day jobs, it’s really hard to produce six figures in investing and also the HIPAA risk. And then the time it takes away it could potentially take away from your family and friends and stress and kids and all sorts of things. Most and I find most people cannot handle like a six figure loss. You know, I mean, so I started talking like, super boring, super boring. You know, phase two always can take on more, you can do more complicated as part of a phase two or phase three. Right? And it’s funny, because I get people asking me all the time, like, what do you do this? Once you do this? Like? I’m old? I spend more time with my kids and my wife. Yeah, no, I need to stay married because I enjoy being married to Cherry. So I’m trying to keep my keep my side hustles boring. Yeah, it’s funny that more people think like you have to work harder to make a good return. But you know what? Stabilized portfolios. The returns are nothing to scoff done. You know, I’ve had a boring I’ve had a boring portfolio forever. I’m making like 2025 30% Return on my equity. Right? Yeah.

Unknown Speaker 1:07:55

So yeah, keep your investments.

Speaker 1 1:07:58

Yeah, yeah, it’s, that’s great advice, right. Keep your investments boring. And then if you want excitement in your life, you know, take some of those profits and travel with your wife and children and do do the fun things that you enjoy. Right? Many people, you know, because I’m in different facets of real estate, and they go wow, you must really love real estate. And no, I, I really don’t love real estate. But I do enjoy is what it allows me to do. Right? The the profits, the returns that I was able to create over many years of investing has allowed me to live a life that I do enjoy, but the real estate is just bricks and sticks, right? It doesn’t matter.

Erwin 1:08:39

I think the way I put it is I tolerate my real estate. ever turn better be good for my grief. Now we’ve passed that point where the return is not worth my grief. Yeah. Yeah. So that’s kind of like where I’m at. Yeah,

Speaker 1 1:08:55

and I think you’re just gonna see more and more people go, you know, I keep going back to it. But Andrew Henderson said it best when he when he says go where you’re treated best, right? Like, if, if you’re not appreciated where you are, then unfortunately, you got to look for a better investment area. In

Erwin 1:09:15

my own local market, about nine out of 12 of our city councilors do not like landlords or businesses. Right? Like that somewhere you want to start a business. That said, that’s, you know, they’re socialists and Marxists. Alright, so do you really want to be a topless entrepreneur in these areas?

Speaker 1 1:09:35

So yeah, yeah. And it’s hard, right? Especially, you know, you’re born and raised, you’re familiar, you’ve got family, you’ve got memories, and it’s hard for people to to wrap their heads around starting over in a new country, right. So I do sympathize and understand people’s hesitancy but at the end of the day, I I think, you know, it’s, it’s worthwhile exploring that and, and considering, you know,

Erwin 1:10:07

so I wasn’t planning on saying this, but it’s like my friends who are like considering divorce because they’re like fighting, the couples are fighting, the couple are fighting and whatnot. So I tell them from my own experience, you know, life on the other side so much better. If y’all can’t repeat reconciliation, like, you know, everyone will be happier if you break right? You know, I mean that you remove that from your life. And like so many people come back and tell me that’s true. Afterwards, right? They made it they made a new great partner the kids are just doing great. They may even be getting become best friends with the with the with the new partners, kids and whatnot. I feel like I’m holding that’s on the other side for that for us as well. Divorce. My friend calls Ontario, I’m terrible. Divorce on and you even sold your home because my plans were my plan is to keep my home. But yeah, you You went hardcore. You’ve sold your home. And sorry. You don’t have to answer this. But is your plan to give up your your your

Speaker 1 1:11:11

citizenship? Yeah, no, no, I’ll keep my passport. Yeah, I’ll always be a Canadian citizen. But one of the things I am exploring is becoming a non tax resident

Erwin 1:11:24

of Canada. Yeah. Non tax resident was a term I was looking for. Yeah,

Speaker 1 1:11:28

but I’ll still have my passport. I’ll always be a Canadian citizen. Yeah.

Erwin 1:11:35

Cuz you’re pretty far along in that non tax resident already. Like you don’t? What do you? Do you still own a car or a house?

Speaker 1 1:11:43

Last time I went home, I sold my car. So I still have my investment properties, corporations, businesses in Canada, but most of my personal stuff is like I sold my personal car, my personal home, all of that sold already.

Erwin 1:12:00

And then And then what’s left? Are how is the goal to be a non tax resident?

Speaker 1 1:12:07

Yeah, yeah. Ultimately, that’s the goal. Yeah.

Erwin 1:12:11

And then what has to be done then? Like, do all your assets have to be sold then? Or like moved to the States or something?

Speaker 1 1:12:17

Yeah. Yeah. So you can’t have? And again, this is I haven’t done it yet. So based on what I know, thus far, as you can’t have any ties to Canada, so no, no personal property. I think bank accounts, even things like gym memberships, and credit cards, you can’t have anything like that if you want to be a non tax resident.

Erwin 1:12:43

That’s so crazy. Yeah.

Speaker 1 1:12:44

So you basically give up all all ties to Canada in that regard, other than your passport, right? But then you’re you’re now a non tax resident.

Erwin 1:12:54

That’s kind of annoying, though. When you come back and visit, you don’t even have your own bank account anymore. Yeah.

Speaker 1 1:13:01

But again, it’s, you know, fear of the unknown, but there’s lots of good banks, like, you know, outside of Canada. And, and it is a little bit of diversification, like having banks in multiple countries, having multiple passports, multiple residencies, you look at a lot of wealthy individuals, they all they don’t speak about it a lot. But they all have multiple passports, multiple residencies, multiple homes in different countries, right, just to have that. diversification and that freedom, where if one place turns out to become a disaster, they can they can move on easily, because they’re already set up there. Do

Erwin 1:13:43

you have stats and Dr. Or us are seeking one? I’m

Speaker 1 1:13:47

going to be seeking it. So residency, residency status in the ER, as well as exploring the I think the E two visa in the US.

Erwin 1:14:00

I haven’t gotten good answers on how to get an E two visa as your research going.

Speaker 1 1:14:06

Well, my understanding is that if you can either buy a business, buy a franchise or start a business, and the US government wants to see that you’re financially invested in that business. So there’s no set dollar amount, but everything I’ve watched suggests around $100,000 of investing into that business. And, and it has to be an active business. So yeah, so if you meet that criteria, then you can get a an E two visa, from my understanding. Now I haven’t gone through that process. So it’s just something that’s on my radar of something I’m wanting to do.

Erwin 1:14:49

Right. And for listeners benefit. Sorry, e to visa means that your you and your family will have to stay in the States. There’s usually I think 10 years since The popular term. Yes, you could stay that entire time. Yeah, no one’s right. You don’t get to vote obviously, which is fine. I don’t think I want to get involved in politics. Yeah,

Speaker 1 1:15:08

I don’t want to get involved in the politics either. I just want to utilize the the pro entrepreneur, environment, right to grow and scale and to rebuild. Rebuild the real estate empire. Right. So that’s

Erwin 1:15:25

why we’re building a real estate empire should be considered active. Right. So I think yeah, so this should be easy for you, I think, Well,

Speaker 1 1:15:33

again, this is just based on my understanding is if you’re just acquiring investment properties, the they don’t see that as active until you hit a certain threshold of properties, apparently. But I guess the workaround with that is if you form a property management company that then manages those acquisitions, and that becomes active, right, so you’ll

Erwin 1:15:59

need a pickup truck and a lawn mower at a minimum. Yeah, yeah.

Speaker 1 1:16:02