Pitching & Building Tiny Homes on Dragon’s Den With Victoria Cluney

Summer fun, failed home inspection, accepted offer in San Antonio, Texas, my friend Victoria is on Dragon’s Den for her Tiny Home village venture!! All this and more on this week’s Truth About Real Estate investing!!

We are back from my friend’s cottage we rented along with friends and their kids. It cracks me up how all my friends growing up had family cottages that were more like shakes compared to modern day cottages valued at well over a million dollars these days.

We rented from a friend for a couple thousand for the week which is great money but as a business or AirBNB? Not for me as our friends are hands on owner operators: husband is the handyman including having to unplug the septic system of feminine hygiene napkins in the middle of the winter that were accidentally flushed causing a back up to the wife being the point of contact for the renters.

It’s a wonderful business for those who enjoy being in hospitality, just not for Cherry and I who have very active businesses, young family, and prefer our investments to be as passive as possible.

Speaking of investments, my accepted offer in Kansas City, Missouri. The deal died as the renovation budget came back too high, killing my numbers, specifically capitalization rate: net operating income divided by the investment value. On to the next which came while I was at the cottage: an off market, detached 2005 build house in San Antonio, Texas, 2000 square feet, 4 bedroom, 2.5 bathroom for $265,000 plus $35,000 renovation and $2,300 rent per month. Cap rate? 5.1% even after those Texas property taxes and it still beats the pants off of anything I can find in Canada in the context of landlord friendly, historic levels of investment and high paying creation of manufacturing jobs in the State of Texas.

My partner in SHARE (iwin.sharesfr.com) put the deal together for me, held my hand for legal structure creation, ordered the home inspection, property manager inspection and quoting for the renovation. I just review everything from the comfort of the cottage. We close in a few weeks and provide more details on a future episode if you and my 17 listeners are interested!

Fun useless fact of the day about Texas: if you removed Texas from America, it would be the 8th largest economy in the world. Bigger than Russia, Canada, Australia, Italy, etc… A $2 trillion dollar economy and growing with a population of 30 million. Compare that to Canada also with a $2 trillion collar economy that’s stagnating with 39 million population.

I have about 100 more reasons to invest in Texas from my research, much of it you can pick up for free https://www.truthaboutrealestateinvesting.ca/. I have reports and a free newsletter, just click on the link on the right hand side, type in your name and email and you’re good to go along with receiving invites to our free and inexpensive educational events.

Another fun useless fact of the day: it’s public knowledge the American economy is exponentially increase their lead on Canada’s from here forward, why aren’t more Canadian real estate professionals promoting investing in the USA. My team at iWIN Real Estate is still really busy helping local investors almost entirely on the sell side. I make way more money selling real estate in Canada than the USA but I won’t shut up about investing in the USA. Food for thought. And if you agree with my philosophy please do share this podcast with your friends and family. The writing is on the wall how hard it is to be a long term residential landlord in Canada. BC just announced it’s now four months notice to evict a tenant if you’re moving in. The trend is not our friend here…

Pitching & Building Tiny Homes on Dragon’s Den With Victoria Cluney

Real estate development for it’s lack of long term tenants makes more sense which is a great segway for this week’s guest Victoria Cluney fresh off recording a show on Dragon’s Den to pitch her Tiny Home community and manufacturing of tiny houses!! Victoria is under a hush agreement about what happens on her episode but will share her experience auditioning, getting called back and pitching to the real life Dragons for the show.

Victoria is a returning guest of this show who’s on a great journey from small landlord of long-term rentals to short-term cottage “bunkies” to AirBnb’ing a motel to building a tiny home community, manufacturing tiny homes and being a part of the solution to solving this affordability crisis we’re having in Canada.

Victoria is also co-hosting the RE Resilience Summit (https://realestateresilience.ca/) Saturday and Sunday September 28 & 29. Her co-hosts include Meghan Hubner and Elizabeth Kelly. Elizabeth Kelly as you know is a regular and friend of the show, she’s one of the few good ones in our industry so if you’re new or old to real estate investing, you know the RE Resilience Summit will have something for everyone.

To follow Victoria:

Instagram: https://www.instagram.com/victoriacluney/?hl=en

WE BILD Meetup: https://www.meetup.com/webild/?_xtd=gqFyqTMzNzkwNjIyMaFwpmlwaG9uZQ%253D%253D&from=ref

Tiny Home building & community: https://www.tayridge.ca/

Please enjoy the show!!

To Listen:

** Transcript Auto-Generated**

On iTunes: https://itunes.apple.com/ca/podcast/truth-about-real-estate-investing…/id1100488294

On Spotify: https://open.spotify.com/show/6Z8yd37AQfQI5DK0J0Xwzz

Audible:https://www.audible.ca/podcast/The-Truth-About-Real-Estate-Investing-for-Canadians/B08JJS91WR

Youtube: https://youtu.be/S8JGDlNMA0g

HELP US OUT!

BEFORE YOU GO…

Before you go, if you’re interested in what kind of properties I am looking at in the landlord friendly states of the USA please go to iwin.sharesfr.com for what I consider the best investment for most Canadians, most of the time.

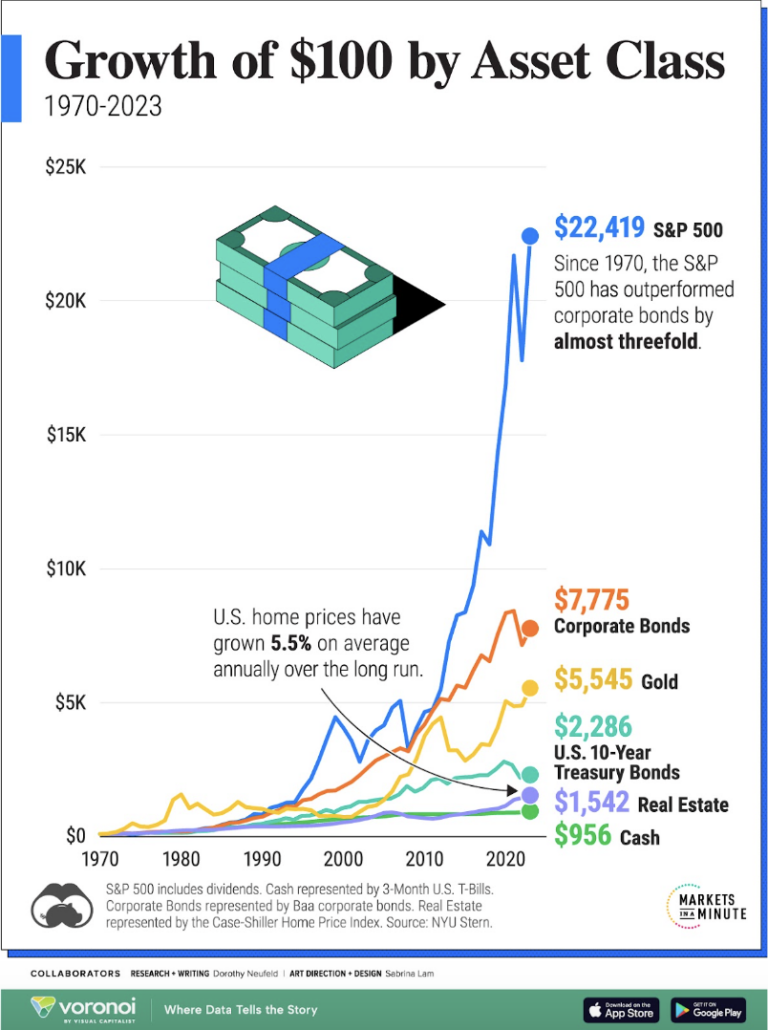

I’ve been investing in Ontario since 2005 and while it’s been a great, great run. I started out buying properties in the 100,000s and now it’s $800,000 to $1,000,000. How much higher can it go? I don’t know

To me, the remaining potential for appreciation does not match the risk hence I’m advising my clients to look to where one can find rental properties that are affordable range of $150,000 to $350,000 US$, with rents that range from $1,400 to 2,600/month plus utilities. As many Canadians recognize, these numbers will be positive cash flow and are night and day compared to anything locally. Plus the landlord has all of the rights, no rent control, and income is US dollars which are better than Canadian dollars.

If you don’t believe me, US dollars are better than Canadian dollars, go ask 100 non-Canadians which currency they prefer to be paid in.

So to regain control of your retirement planning. Go to iwin.sharesfr.com and check out what great cash flow properties are available in the USA.

The best part is, my US investments will be much more passive compared to by local investments as I’m hiring an asset manager called SHARE to hand hold me through the entire process. As their client and shareholder, Share will source me quality income properties, help me with legal structure and taxes, they manage the property manager and insurance provider while passing down to me preferred rates so I save both time and money.

Share will even tell me when to strategically refinance or sell. SHARE can even support investors all over the country for proper diversification hence my plan is to own in Tennessee, Georgia, and Texas. Share is like my joint venture partner but I only have to pay them fees while I keep 100% ownership and control.

If your goal in investing is to increase cash flow, I don’t know of a better strategy for most Canadians most of the time. One last time that’s iwin.sharesfr.com to see what boring, cash flowing real estate investing can look like on your path towards financial peace.

This is how I’m going to make real estate investing great again for my family and hope you choose the same. Till next time!

Sponsored by:

This episode is brought to you by me! We don’t have sponsors for this show. I only share with you services owned by my wife Cherry and me. Real estate investing is a staple in my life and allowed me to build wealth and, more importantly, achieve financial peace about the future, knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you, too, are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next event.

Till next time, just do it because I believe in you.

Erwin

W: erwinszeto.com

FB: https://www.facebook.com/erwin.szeto

IG: https://www.instagram.com/erwinszeto/