$2,800/Month Delivering Food & Stock Hacking With Anderson Carter-Griffith

Do you ever lay awake at night because your brain won’t turn off? I have that all the time.

My thoughts are somewhat productive as I often think about what needs to be done in work, investing, and family; add to that all the challenges we face, rising costs, pending recession, climate change and its impact on my properties.

View this post on Instagram

It’s a lot, so to give my brain something else to work on that’s light, I’ll listen to podcasts about the Toronto Blue Jays and the Raptors.

The only challenge is sleeping with Airpods, which isn’t the most comfortable but passable. Thank Goodness they’re wireless.

Also keeping me up is what to present at the Wealth Hacker Conference. My planned talks are around the changing world order, how to prepare and weather the storm, and how real estate plays a big part in my and Cherry’s investment plans to build our wealth AND hedge against inflation.

With rents continuing to set historical highs each month, interest rates up, affordability down, new supply down, and demand up…. It’s complicated…

BUT I’ll be doing my best to summarise all the research I do daily AND pull back the curtain to share what deals the smart money is doing.

Thankfully we have many leading Canadian experts in all areas of investing coming to speak on Nov 12th for a one-day, all-day event.

Are market declines in real estate, stocks, and crypto fun? No, but it’s happened before, and I know people personally who got rich during these times; hence we have experts in each area sharing what they’re investing in on the dip.

We have Mortgage wizard Dalia Barsoum of Streetwise Mortgages sharing an all-new presentation on the investor journey from a comprehensive financing perspective, including partnerships and private money.

Like Cherry and I, Dalia invests in whole life insurance, an often overlooked strategy; hence we have Canada’s leading expert Jayson Lowe, founder of Ascendant Financial, to present why and how this investment has positive returns, EVEN IN 2022, when everything else is down.

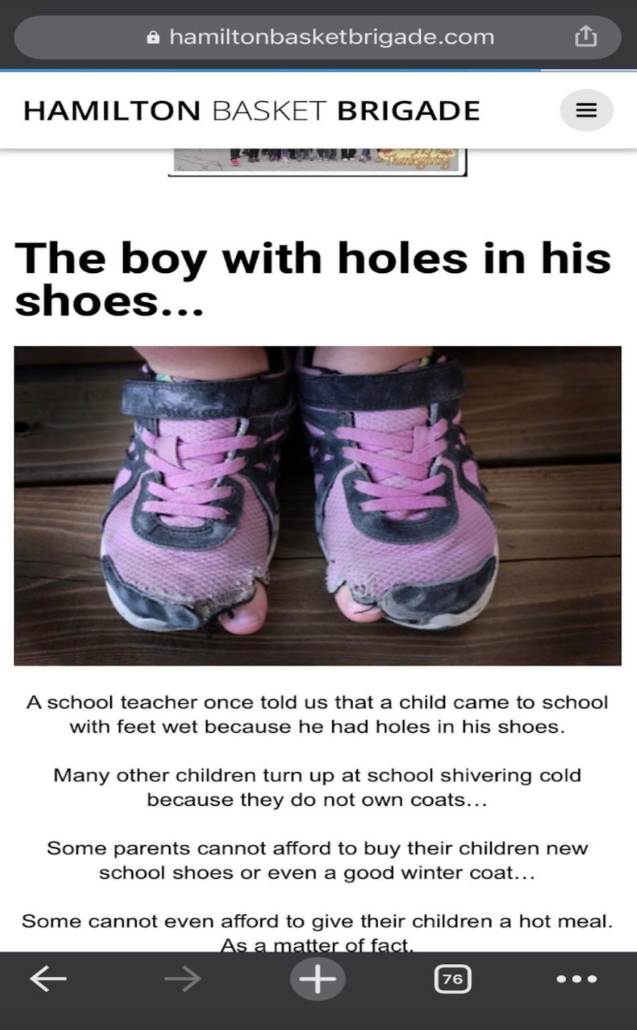

No child should be walking to school in running shoes with holes, exposing their toes to the cold, slush and snow. Cold, wet socks and frostbite are bad enough, but just think about how embarrassing it is for kids to show up to school in broken, dirty shoes.

Another bonus is a FREE ticket to Cherry Chan’s exclusive bookkeeping masterclass happening NEXT WEEK!

More reason to ACT NOW!

My discount code for you, my 17 listeners, is the five-letter word “truth”

Feel free to share it with friends and family, as everyone needs to prepare for this economic winter. Inflation is here to stay, so financial education is more important than ever.

CLICK HERE TO LOCK IN YOUR DISCOUNT AND BONUSES!

$2,800/Month Delivering Food & Stock Hacking With Anderson Carter-Griffith

On to this week’s show!!

One of the reasons we started Stock Hacker Academy was we knew real estate was inaccessible to many. With cash flow so squeezed on real estate, I know many are looking for better yield after their real estate portfolios had gone up so much in value.

At the end of the day, no matter the investor, we’re all searching for a return on our time, passive investments that cash flow and Anderson Carter-Griffith has found a side hustle and investment that works for him.

Anderson is an immigrant and a chef who was underemployed thanks to the pandemic. He’s since pivoted to investing in stocks, trading in options, and delivering food via Door Dash, an online food delivery app.

On this show, Anderson shares how he makes a couple of hundred dollars combined via his side hustles and invests in boring stocks for the long term.

Most importantly, thanks to Anderson’s newfound financial education, he has done a 180-degree turn, having previously prioritized buying luxury cars and accessories. He now prefers to invest for the benefit of compounding returns—something those who unknowingly were spinning their wheels in the rat race can understand.

If you know someone looking to make some extra money to cover rent increases or inflation, Anderson has found himself a solution in side hustles.

During the interview, we mention the stock and options brokerage we use. Here’s the referral link that helps to support this show.

Interactive brokers: https://ndcdyn.interactivebrokers.com/Universal/Application?employer=SHA8

Quick disclaimer, none of anything discussed should be considered advice; rather, Anderson and I are sharing our experiences for educational purposes. Please seek professional advice.

This episode is brought to you by me! We don’t have sponsors for this show. I only share with you services owned by my wife Cherry and me. Real estate investing is a staple in my life and allowed me to build wealth and, more importantly, achieve financial peace about the future, knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you, too, are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next FREE Online Training Class. We will be back in person once legally allowed to do so, but for now, we are 100% virtual.

No need for you to reinvent the wheel; we have our system down pat. Again that’s www.infinitywealth.ca/events and register for the FREE Online Training Class.

This episode is also brought to you by www.stockhackeracademy.ca, where everyday real estate investors learn the best practices in stock investing to earn cash flow in about 15-30 mins per day from their mobile phones. After real estate, Stock Hacking is the next best hustle, as you’ve heard from many past guests on this show. Among our students last year, 31 trades were shared with them. 30 were profitable for an over 96% success rate and 12% return on capital. I will be giving free demonstrations online, very similar to the one I gave my kid cousin, a full-time musician who just made a 50% return in 2021. Past, of course, does not predict the future, but if you’d like a free demonstration, go to www.stockhackeracademy.ca in the top right and click FREE Demo. At the demonstration, I’ll have special bonuses. We do not advertise publicly for all my favourite listeners, and I only have two more demos to give in the next few weeks.

Don’t delay www.stockhackeracademy.ca, what I consider the future of side hustles with real estate so unaffordable for many.

We’re hiring!

Just a friendly reminder that we are hiring more investment Realtors who want a full-time challenge to help our clients, regular everyday people, mostly from the GTA, invest in the top investment towns west of the GTA.

This is for driven folks who want to multiply their current incomes.

APPLY HERE: https://www.infinitywealth.ca/hiring

To Listen:

Audio Transcript

**Transcripts are auto-generated.

Erwin

Hello, everyone, welcome to the truth about real estate investing show. My name is Erwin Seto. And I have a question. You’re probably awake at night, because your brain won’t turn off. There’s a lot going on the world. And this happens to me all the time. My thoughts are somewhat productive, somewhat a little too fast and furious. As I often think about what needs to be done at work, what needs to be done on our portfolio, like maintenance issues or tenant requests, how low my rents are certain properties, family, of course, add to that all the challenges that we face, the rising costs, ending recession, climate change, and its impact on our property specifically, like maintenance and what damages it adds to the properties. And hence we need to make some decisions there. It’s a lot to tell take on so I need to get my brain something off to work on. That’s light. So I’ll listen to podcasts about typically about the Toronto Blue Jays and the Toronto Raptors. Yeah, they’re I know, they’re disappointing at times, but it’s late. It’s not depressing you they’re somewhat not depressing. The only challenge is sleeping with with your phone, air pods of the apple air pods, which isn’t the most comfortable thing to do, but it’s possible, but at least thank goodness our wireless. Also keeping up is what to present at the wealth hacker conference, I can be a bit of a perfectionist or other challenges. I’ve consumed a lot of information. I read the news regularly like every morning every night. I repeat stuff as well. It’s a good filter for fake news. My plan talk is around the changing world order. Because stuff is going on out there, how to prepare for it, how to weather the storm. Our real estate plays a big part in mine cherries investment plans, not just now but in the future, not only to build our wealth, but to you know, hedge against inflation, which was one of the main reasons I got in originally called people haven’t forgot about that. Rents are also continuing to set historic highs each month. Interest rates are up, affordability down, supplies down, demand is up. It’s complicated, but I’ll be doing my best to sum up all the research that I do on a daily basis. And I’ll pull back the curtain and share what deals the smart money is doing. Thankfully, we also have a lot of leading Canadian experts in all the areas investing coming to speak on November 12. For a one day all day event, as the market declines in real estate stocks crypto. No, it’s not fun. But understand this has happened before not for crypto. But for technology stocks. This has happened before. And I know people personally who got rich during these times. Hence we have experts in each area sharing what they’re investing in on this dip. We also have mortgage wizard Delia Barsoom of st Barths mortgages, sharing an all new presentation on the investor journey from a comprehensive financing perspective that will keep you out of trouble. Unlike a lot of people who got a little too bit too over leveraged in the last year or two. And she will also cover partnerships like joint venture partnerships, Capital Partners, whatnot, and of course private money. Dahlia like cherry and I invest in whole life insurance and often overlooked strategy. Hence we have the candidate leading expert and Jason Lowe, founder of ascendant financial to present why and how this investment has positive return, even in 2022 and everything else is down. Would you like to know about an investment that is always green? Crazy. As a bonus as a charitable bonus for every ticket sold. This week, we are donating a pair of winter boots to school kids in Hamilton as part of our basket brigade efforts. No child should be left to be walking to school and running shoes with holes in them, exposing their toes to the cold slush and snow, cold wet socks and Frostbite is bad enough. But just think about how embarrassing it is for kids to be showing up to school in broken dirty shoes. That’s something we like to allow happen, so we’re doing something about it. Also, we have a discount code for you my 17 listeners. It’s a five letter word, truth, Tru th feel free to share it with your friends and family as everyone needs to prepare for this economic winter. Get everyone on the same page, bring your spouse, bring your partner get them on the same page. There is trouble out there. Inflation is here to stay the globalisation is a thing. So expect inflation to be higher than ever going forward. So financial education is more important than ever, wealth hacker.ca with details and to purchase tickets onto this week’s show, one of the reasons we started stock hacker Academy was we knew real estate was inaccessible to many and with cash flow so squeezed in real estate with prices having gone up so much. Now interest rates have gone up so much. I know many are looking for a better yield on our cash looking for cash flow, because everyone would like more cash flow in their lives. Alright. Also, again, many of our clientele their real estate portfolios, even in this current market, their real estate portfolios have gone up significantly because they’ve been accumulating for like a five, three years. Right. So they’re looking for what to do with those with all that money they made in those properties. Also, I think everyone could do some diversification in their life. At the end of the day, no matter the investor. We Every investor I’ve spoken to, they want a return on their time. And they want passive investments that cash flow. Our guest today interesting courage, Griffith has found a side hustle and investment that works for him. Interesting as an immigrant and a chef who was underemployed thanks to the pandemic. He since pivoted to investing in stocks trading and options and delivers food via DoorDash, the online food delivery app. On the show, Anderson shares how much he makes how he makes a couple $100 combined each week via his side hustles and investments. He also trades young invest in boring stocks for long term so you want to pay attention to that. There’s something for everyone in this episode, especially for young people, especially for folks who find real estate and accessible. Most importantly, thanks to Anderson’s newfound financial education, he has done a complete 180 degree turn, having previously prioritised buying luxury cars, accessories, car accessories, you know, stuff that depreciates and now he prefers to invest for the benefit of compounding returns. So because Anderson didn’t know how to make money before and didn’t know how to invest, he was spinning his wheels in the rat race. So I think many of us can appreciate that. Many of us have probably been there before or know someone who’s still there. So if you know someone who’s trying to make extra money on the side to cover whatever increasing costs they have, thanks to inflation, maybe you want to share this episode with with them. Because again, Anderson has found some solutions in side hustles and investing. During this interview, we mentioned the stock and options brokerage that we use. It’s in the show notes. I have a referral link there. We don’t get any money for it. It’s just to for tracking purposes, and Interactive Brokers is promised to support our community better than just regular people. Quick disclaimer, none of anything’s good should be considered financial advice. But rather Anderson and I are simply sharing our experiences for educational purposes. Maybe little entertainment as well. Please seek professional advice. I give you Anderson. Anderson, how’re

Erwin

you doing?

Anderson

Very well. Thank you. Are you doing? As good as you?

Erwin

Perfect catching up? Probably

Anderson

better. Probably

Erwin

better wise. It can be it’s been a year since you had you on the show.

Anderson

Yeah, yeah. back last year, October.

Erwin

I can’t believe it. So what’s keeping you busy these days? I see your social media. So yeah, you’ve been having a good time I’ve

Anderson

been travelling. I’ve been working. I’ve been trading? Well. It’s three main things. If people are following me on social in our group door dashing.

Erwin

Okay, let’s get into it. So you answered my question already. When you’re it’s keeping you busy these days. So this is catch up the listener, you were here a year ago? You’ve awesome story you were recruited from sorry, which country was the Barbados? Barbados? And there’s one of the ones that they want to get wrong. Yeah, no problem. You were recruited at Barbados to come to Canada to work in hospitality. Specifically chef. Yes. Right. That’s hidden. And that’s when I found that that’s why you stayed was for because you met your wife? Yes. That whether environmental Sure looks nice. Oh, yeah,

Anderson

it does. It does. But yeah, definitely, definitely.

Erwin

And then actually remind, remind us how did we meet?

Anderson

We met because I follow your podcast the the truth about real estate investing? You’re one of the 17 listeners. Yes. One of the 17. And basically, you were talking about your stock hacker course. Yeah. So I listened to that, and I was very interested in it. Then I seek tell a bit more information. And then I took your course, stock akrami. And

Erwin

you thought it was a scam though?

Anderson

Yes, I did. I mean, for me, like I said on my last podcast for me certain things, when it doesn’t come hard used to be kind of weird for me. So like, I’m used to hard work. I’m used to working 14 1516 hours a day, you worked in hospitality as a show rep. And coming across your programme. And I was like, I just did the math of it. I was like, well, even if I could make $100 or $200 a week. That’s fantastic. That’s wonderful. Most real estate investors don’t make that. And I’m doing it from my phone. So that was my first introduction to you without you knowing. And yeah, and I just took your course and then from there, head down, studied it back to front, and got soaked into the markets and just kept learning.

Erwin

And just for the listeners benefit, because I understand somewhat what you do. Yes, you are much more active than then like what we taught?

Anderson

Yes, well, well, in the beginning, I was doing exactly what you guys teach, which is a beginner introduction to the stock market for people that don’t know, as well as the options market, which is specifically what we do. From there.

Erwin

It was also meant for someone who didn’t spend a lot of time correct Exactly.

Anderson

From there. When I found out that there was a way to make money other than working 15 hours a day. That’s where I started to get more engulfed and educate myself. Have on different strategies that you can use for options and equity trading and etc. And basically, it just built up my knowledge from there and your course was a base to introduce me to other styles of trading.

Erwin

There’s a lot to unpack here. Yes, for sure. So this show is about real estate, you know, interest in real estate,

Anderson

I do. But at the end of the day, it’s a higher barrier to entry for a lot of people. And with my journey, especially, my focus was on a certain niche, which is, I wanted to be able to expose people from Barbados, and also people that necessarily cannot get into real estate. But they’re able to maybe get into doing stocks, which is a way lower entry there, it’s less capital that they have to put forth. And as well, I was looking at it from a point of view and still look at it from a point of view where, especially in this economy now, if somebody can make an extra $100 or $200 a week, that’s $1,000, roughly a month that can help out for families in need, or families that are finding a bit tight right now on money. So

Erwin

I’m making us dollars, yes. Which is really,

Anderson

exactly. So I was like, you know,

Erwin

like the winning investment this year.

Anderson

So for me, that was my niche, I just wanted to involve more people or get more people involved on that end of it. Because everybody doesn’t understand real estate such as like yourself and your real estate group. But this and it’s very capital, intense, correct. And this skill to me, I believe anybody can do it with getting the right education. And it starts off as again, an extra dollar in your pocket at the end of the month. So that’s where it’s coming from further real estate end of it. That’s also very long term. And people want money. Now. You buy a house today. You can’t sell it tomorrow. However you buy a stock today, you can sell it next minute and make profit and pull it out and have it in your account.

Erwin

just clarify. That’s not what you’re doing, though.

Anderson

No, I’m not doing that. But I’m just so

Erwin

sorry. Before we get into that, when we taught in the courses, beginner, your education obviously evolved? Yes, for example. And we believe that here internally, it’s just that we’ll be teaching a beginner course, is you need to take what the market gives you x you need to go with the trend. Yes. And the trend has been only really one direction this year. Yes, it has. So just like the famous Netflix movie, The Big Short, yeah, you are shorting

Anderson

Yes, very much so very much. So I am a short, biassed trader.

Erwin

That’s just my style, because it’s the market is what the market is given?

Anderson

Yes, it’s what the market is given as well. And also, for me, it’s I don’t want to say easier, but the way I frame it is a stock goes up. But when it gets to a certain point, most people take what we call take profit. And that causes it to come back down. Therefore the move up is usually slower than the move back.

Erwin

stairs up. Yeah. Correct. Yeah. So yeah, so if you’re directionally bias Yep. Credit, you’ve thought you’ll make money faster

Anderson

than Yes, but I have no bias. I am a trader. So I just trade charts. Alright,

Erwin

I have a bias. I’m very pretty bearish on the stock market. Which is understandable, right until this trend reverses. But we’re in a trend right?

Anderson

Correct that and everybody has to know their tolerance and know their style. And I keep saying their tolerance and style because what you may trade I may not trade and what I trade, you may not trade. But at the end of the day, as long as you are comfortable with your risk and everything that you’re you’re you’re taking on for trading, then it’s your decision from there.

Erwin

So this is not advice. Yeah. No advice so folks can turn into the YouTube and they can see exactly. You’re literally wearing on your shirt.

Anderson

Yes, yes.

Erwin

You have to give me your contact for your swag definitely return. Yes. Is it drip? Like that sounds much better. Because drip means like fashion. Yes, swag does not mean I wear swag.

Anderson

There’s a smart businessman right there.

Erwin

Out of Zuckerberg money. For those who are listening, Mehta is on Anderson’s shirt. That’s why I make this comment. Okay, so where do we start? Okay, so I do want to touch on let’s talk about career stuffs. Yeah. Are you still doing the meal service for school kids?

Anderson

Yes, yes. But that’s been drastically reduced due to other commitments as well. And now that we are coming out of the pandemic, there’s more other business opportunities that are more beneficial for me as well. And also a step back from it, because I decided that this is what I want to do trade. Okay, I want to be a trader make more time for that correct. So I had to shift around my schedule a bit. But now literally, you cannot find me away from my desk, my trading desk that is between totally different now. Yes. Yes, big time. But I’m at my trading desk from around eight o’clock, just for eight o’clock. And you can’t see me leave there until around 1030 At night, no 8am until 1030, a long day. Two hours, two hours. And that’s where I find it funny where people think that this needs to take all day, it doesn’t need to take all day. And it doesn’t even need to take two hours. It’s just my trading style. Because I love the markets. And I choose to be visually sitting there every day. But I’ve got some positions on that I put on. When I say put on it. I mean by putting on I mean, executed done. I placed orders conditions in the market in the market exposure since three, three weeks ago. And I haven’t looked at them. Well, I don’t need to look at them. Right.

Erwin

So just trying to provide context. We had Tim Collins on two weeks ago. He doesn’t even look at his stuff. Because he’s on dividends stuff. Right? Okay. I didn’t even look at it. Yeah, for I think when he looks at is when when he comes in. Look, how has his portfolio performing? Yeah, I’m

Anderson

the same way on what I call my mid performing portfolio. Got it. Okay. So

Erwin

you’ve segmented your folio? Yes, I

Anderson

have. I have my my portfolio into three sections. So I have my short term, which is basically day trading. I have my midterm, which is couple of weeks anywhere between one week to a month. And then I have my long term, which is usually hold for a while. And that’s dividend ETS. Yeah, dividend ETF?

Erwin

sure which one? Well, I

Anderson

usually advise folks. I usually will do like stuff that basically has any tech in it, right? I do either dividend ETFs. Or I will actually do like dividend stock. Okay. So for example, my long term I hold like McDonald’s, I hold Walmart, I hold Exxon Mobil, that kind of stuff. That will when the price is right, and I made it, there’s a system that I have, which is I make money from the day trading, I take that profit. And from that profit, I put into dividends, or I’m not familiar if you know about something called IBC infinity bank in with Jason Lowe. Hey, yeah. So I have a couple of policies for him as well.

Erwin

Obviously, you’re buying life insurance. Plastic. Yeah. Interesting. Yes.

Anderson

So my trading funds my whole life policies.

Erwin

So you’re taking investment money to pay for your life insurance, that you own life?

Anderson

That’s pretty cool. Yeah. Oh, yes.

Erwin

We might the whiteboard this later. Yeah, sure. Definitely. Like this later.

Anderson

Like I said, for me, it’s I kind of like to approach things a bit different and think a little bit outside the box. And I was like, Okay, I’m sure people think

Erwin

you’re crazy. Yeah, some people do. So that’s fine. Play the majority your friends.

Anderson

They’re coming around, no, no, that they see the post on Facebook and they see certain things I’m doing and certain moves that I’m making. I know they’re there a bit. It has piqued their interest a bit when they’re like, for example, they go a year ago, this guy was completely crazy. Now they go, Well, he’s still doing what he’s doing a year ago. And he’s doing this with it. Right, which is like all Case in point a year ago. Again, nothing is guaranteed in the stock market at all. But as long as you I have a scene, and my saying is as long as you take your profits and bank it, you will be fine. The issue that that a lot of traders have is that an endorser and when I say in our circle in the trading world, we use a term called hold and hold. And a lot of traders do that. I don’t hold on hold, I set parameters. And I trade robotic. If I am entering a trade, and I say I don’t want to lose more than $1 or $5 wide if we’re doing spreads, and as long as it hits that I’m out of the trade, right where people go, Oh, we will come back. It’ll come back to me and you get destroyed that way. Right? You have rules Correct. I have params First, I have rules. And I follow them the same way as, again, for the listeners. There’s computers that do trading. They’re called our goals. They do not break their parameters at all. No, it’s a computer it’s a computer. So real exactly as as real similar. And if you’ve done research on algo trading, because I like I said, I’m into this algos performing over a long span of time, always make profit. Why is that? Because they remove the emotional stuff. Yeah,

Erwin

like fear, correct. We’re just kind of over right now. Fair or good? Yeah. Well fear right now fear right

Anderson

now, yes, because the market is going down. And then greed when the markets going up. But if you always have parameters set, that removes certain greed. And you’re just trading pretty much a chart. And, again, nothing is guaranteed, but over a long term. And it has been historically proven Understairs data points on the old day loan, that you will make a profit, it’s time in the market. Again, it’s not an It sounds weird. It’s time in the market, not timing, the market. Right? People try to time the market. So for example, I’ll give an example right now the market is in a bear market. And people are going to wait until the think that we’re getting out of a bear market. So you’re trying to time the bottom. Right. But where I’m coming from is regardless of time in the bottom, if you have time as in weeks, months, years, repetitive steps that you could do in a year, two years, five years, you should be profitable. As long as you set parameters.

Erwin

It’s time to mention it now. Because some people have parameters like before we’re recording. Yeah, there’s people we that we know. Yeah, we’re way down this year, of course,

Anderson

because they didn’t cut losses. Correct. They don’t cut losses, because their parameters just to hang on to it. Yeah, but actually, that’s not a parameter for them, though. That’s an emotion. I call it to get married to a stop. Don’t get married to stop

Erwin

right. Now. Don’t get married to have my house either. Right?

Anderson

Same thing. Exactly. If somebody came and offered you $500,000 More than you paid for your house, I can guarantee you’re going to go bye bye to the house. Correct. You’re not going to sit there and go I love this house. It’s on the lake. No, you’re gonna you’re the type of individual my investment properties around the lake. Right? Yeah, but but I’m just saying if but I’m just saying people will, will do that get offered way over the price that they bought it for. And they have an attachment to stuff. Me. I don’t know, maybe that’s just my personality. But I don’t like prime example. A bit funny. If I’m wearing a shirt right now, and you love this shirt. And you say, Anderson, I wanna give you 500 Oh, sweatshirt, this shirt has gone off the off my back at the end of the show. Because that $500 didn’t cost me $500. But I can take that money and go buy

Erwin

it again. And don’t take your investments personally. Correct?

Anderson

Exactly. I don’t I don’t. Because, like you said, there’s a lot of people hurting due to the stock market right now. And they they’re like, oh, stock market is crap. And and did it. But I don’t want to sound weird, but that’s your fault. Because you held them hooked. And you didn’t follow your guidelines. That’s all this is about?

Erwin

Or then after you get the guidelines?

Anderson

Or yeah, you know, or they just refuse to have guidelines. And first, which is crazy to me write

Erwin

everything down for greed as well. Yeah. Correct. And also everyone should consider the term as well. Because if you’re if you’re, for example, if you’re going to be one of those people that’s going to hold and hope yet, then you should have long term. Correct.

Anderson

All right. You can’t be in a hold and hope situation with thinking a short term outcome. It will never work. Never worked. And also, I mean, in my journey, like I like I said in my last book, it took me a while to get here, like get this mentality. Like I said on my last podcast, and don’t get me wrong, folks. When you start to trade, you have to be willing to lose money. You can’t win them all. You cannot win them all. Right now, house flipper can’t win them all. And the issue there is if you cannot stomach losing money, this is not the for you. Simple, but if you can stomach losing what I call planned losses over time again, or just due to straight math, it’s math. If I am trying to get five points, for example, and I am willing to risk two points to get five points every time I lose two points. It means I should be up three points. suspected. Yeah. Yeah, if my loss is going to be correct, I will always be up three points and three points repeated over and over and over. I will be up on My portfolio, that’s just a simple way of looking at things I like to simplify things. People like to come with this whole big brain stuff. I’m not big green, I’m just one of those individuals that I go to DoorDash, for example,

Erwin

just DoorDash, they don’t have it. The other ones you don’t like the

Anderson

other one, I was just DoorDash I just DoorDash because the other ones, the actual companies, they take more of a commission. Because Because we’re all freelancers. And how it works, just to quickly refresh the listener is, with DoorDash, you go pick up food deliveries, and you get paid. And then DoorDash gets paid a small commission from your pay to be on like, beyond their network is almost like a network fee. And they have the lowest fee. So I went with them. Right? And as long as you can figure out a system, and you do it over and over and over, you will be able to make money and you will be able to fund in my case, fund my trading account.

Erwin

How often are you working for DoorDash?

Anderson

I work every day, every day for five hours? Which hours? Usually do around four till nine in the evening dinner? Yeah, dinner dinnertime and ask before recording. Yeah, you don’t see any drop in? There’s no drop off is the recession. Yeah,

Erwin

today we’re clear

Anderson

correctly. So recession. But the funny thing is, is with with, with those delivery services, people tend to like not cooking. It’s kind of weird to me, but people tend not to like cook in. So they buy food delivery. And for me, it’s like they’re not in a recession because all they do is just buy cheaper stuff. So before we were going to like I said, somebody use that would use to be buying like steak and potatoes, for example. They will lower that down to chicken and potato or chicken and salad meal. Right. But it doesn’t affect me. Because my delivery free doesn’t change all your fees set. Well, it’s like distance. So regardless of what you ordered, okay, yeah, it is. It doesn’t matter what you order. My thing is based off of distance, and tip. Okay, so So I’ll give you a funny example. I did two deliveries side by side. So I’ll give a funny example. I did one delivery where I picked up 13 items. And for argument’s sake, let’s say that was $20. And then the delivery right after that, I picked up one item, and it was the same $20 That’s it a big item.

Erwin

It was a coffee. Yep, kidding me. How was it? $20. But they pay for the coffee?

Anderson

I don’t know. I don’t care. I don’t see their order. I don’t see the price they pay for the order. All I see is my delivery fee. And my tip. So with delivery free and tip. It was $20

Erwin

They smell like $100 Coffee. For me.

Anderson

It didn’t make a difference. For Lou. I can’t fathom why you would get a coffee delivered and pay me $20. But who am I to question and measure paid for? This? Yes. So the person ordered on the app, they ordered a coffee. And when I delivered it by the time the delivery fee plus they gave me a tip. It was $20 in my pocket.

Erwin

So they probably paid like $30 for a coffee. Correct?

Anderson

Exactly. Craziness. But for me, that’s great. $30 for coffee. But if you know certain brands of coffee, I don’t know if we can talk brands on here, but certain brands of coffee that they call six and seven and $8 not paying $30 For to think about it a family of four there’s $32 right to make my own coffee. You can I can they don’t. It’s crazy to me. We’re frugal. That’s why me and your frugal must be recession. It’s supposed to be a recession. I hear that all the time. But people don’t abide by what the government or whoever saying like they don’t care,

Erwin

or that is bad with their money. Yeah, it’s probably that correct, which is either

Anderson

bad with their money, or they just told himself, you know what, we just came out of pandemic, and now you put a recession. I don’t care. That’s a lot of people attitude. And they’re out and about, and they’re still going out and they’re still spending money. That’s them. It works for me. I’m, as far as I’m concerned. Keep doing it.

Erwin

Can you share how much you make in a week? And

Anderson

then we Yeah, so in a week on DoorDash I make consistently easily in a week, and we’re between my minimum is $500 to about $800 and that’s five hours a day.

Erwin

And then how do you split that up? What are your buckets for that you have a good vacation fund you have

Anderson

right so when I get well here’s here’s the breakdown of it. So when I get that money when I get DoorDash money, I put it into my trading account immediately. All of it okay, yeah, all of it. Then from my trading account is my pockets that I was talking about.

Erwin

Sorry, apologies. It’s still Interactive Brokers. Yes, sir. Interactive Brokers, Interactive Brokers. I’ll have a, we have our referral link in the show notes. I’ll put it there. We get nothing for it. We get nothing for it. Yeah. But

Anderson

great broker. I’m happy with them. They do what I need. Well, the thing

Erwin

is, we’re because we’re Canadian, we don’t have any options. And all the other ones were way more expensive.

Anderson

Yeah, well, we’ve got a few more options, but they’re not ideal to what we do

Erwin

expensive. Yeah, they want to expand. Yeah, they’re pretty Yeah. Then because we’ve got we’ve heard good things about all of them. Yeah, we’ve got

Anderson

more brokers that we could use, but for what we do Interactive Brokers

Erwin

is the best. I can’t imagine what your Commission’s would be if you were on a different broker.

Anderson

Well, I can I can tell it’s ridiculous. It’s ridiculous.

Erwin

But Interactive Brokers over 10 Grand i bet you Oh, yeah.

Anderson

easily, easily for no different service. Correct. All right. Yeah. That’s what I said. Like, like, we’ve chosen a very good broker and their platform is very well, in my opinion, easy to understand once you learn it. And then their Commission’s are great. Right.

Erwin

So isn’t the easiest learn for beginner? Because we yeah, we learned exactly what we taught how to use it for our purposes or right. It’s easy, because it can do like 100 different things. Yeah. But we only need it for like two things.

Anderson

Well, I use it for about three things. Yeah. So 3%

Erwin

Yes. So you only need to you only need to be taught 3% of the application because

Anderson

that’s exactly what I was saying back to my whole buckets I use my whole entire thing is Sir interactive broker. So even my my short term trading, which is day trading stuff, that’s Interactive Brokers, right, options made to the long haul, that’s Interactive Brokers, and long term straight stock dividend is also underwritten from brokers

Erwin

See, like boring things like the day trading, see like boring long term stuff. And you do the daily data? Yes, yeah.

Anderson

Correct. Correct place for all of it. Yeah, there is. And also, I

Erwin

want to say for the listeners benefit, you don’t have to do the day trading at all. All right. I do think you need a certain personality

Anderson

to do that. Yeah. It’s very high, intense, and, and very time consuming. And I will say right now, I do not recommend it for 95% of people.

Erwin

I do think anyone who wants to try should try it with paper, correct.

Anderson

Simulation and paper. And I’ve done that maybe

Erwin

you didn’t know you’re talented?

Anderson

Exactly. Well, to be honest, I paper traded what we call paper trading, which simulation trading. And I did that for over six months, right? Before I stepped foot in the arena of real money. And even when I did real money, I went in with what we call very small position size. So I was like, I’m in the stock market, and I’m gonna throw so much money at it. There’s baby steps to this. And there’s a learning curve, Stace, I just happen to ramp up my learning curve, because as I said, in my last podcast, as well, I’m that type of individual. I’m that type of individual that will when I latch on to something, I go full force. It was the same thing when I used to work hotels, and then people thought it was crazy. I worked at a morning job, did eight hours, and then literally begged and asked around for extra hours. And so my day was 16 hours and people oh my gosh, crazy. But for me, it’s always an end goal. It’s always I’m doing this to achieve this, right? People have asked, Oh boy, this guy goes out and does DoorDash every single day. Oh my god, I could never do that. He must be crazy. But I am collecting 805 $800 While you sit there and you complain that you don’t have any money. I have no money to invest. Correct. I have no tolerance where men are so sensitive. Yeah, I and I’m proud of it. Because I don’t I don’t like that people have this woe is me attitude or this. Oh, will feel sorry for me. I’ll feel sorry for you. Yes, but at the same time, you aren’t doing anything at all. To change your situation. It’s the same as also like back to your a bit of like the real estate side of stuff. If you want to buy a property and you do not have enough money. Usually what you guys try to do you try to do a joint venture, maybe not you per se but that’s how people do it. And they will go there on the seat, correct. And they’ll go there and they have to do the legwork. To find a joint venture partner. They have to do their pitch. That’s them putting in work, work to achieve something that is bigger at the end of it just for upfront legwork is the same. I just bring that back to what I do. Okay. I want to fund my training account. I don’t want to do it out of my day job money. I am free in the afternoons and I get that everybody is not free in the afternoons which is fine. But there’s ways to make money too. There’s work from home that bloomed and blossomed during the pandemic. Somebody could have picked up that if you’re Gotta type in. There’s people that want you to type up like legal letters and stuff like that. My wife does that. Right? And that’s her side job. That’s my point. Everyone should have a side hustle. Everybody should have one. As long as you are not bogged down with other stuff. I think everybody should have one. It’s very good. It’s a very good thing.

Erwin

I actually love your model, because your side hustle feeds into your your assets. Correct? Do you use your side hustle to pay for asset? Exactly?

Anderson

Again, people see certain stuff. And they don’t understand the background grind for it. So yes, I like like you said, I’ve got a vacation bucket. And I’ve got an invest in bucket. But all that comes with work on the back end to fund my account, to do trading to make profit to do these things.

Erwin

Right. So is it your trading profit that you’re travelling with? Yes. You’ve had some nice, yes. Yeah. Where would you travel the last four months?

Anderson

I’ve been going on it’s cheap. Yeah. Well, awesome. Yes, and no, because because here’s, here’s where I know, again, when you learn stuff, and you educate yourself, you can learn the system, what I call the system. Okay. So what it is, is there is travel points, with your credit cards, your signup, bonuses for those travel points. Those travel points can be used for airfare and hotels. And basically, it’s called Travel arbitrage. And what it is, is, you trade, you make a certain amount of money, in my case, you trade you make a certain amount of money, you apply for a card, you get the bonus, you use the card up to a certain amount of positions, certain like amount you have to hit so I’ll give dirty numbers. So if you get occurred, and the car says you need to spend $5,000, in three months to get 30,000 points, no, for me, I go $5,000, I can spend that in three months, that’s a normal number for average household electricity bill, food bill gas would run everything through that card. Here’s the discipline part again, and this goes back to anything, it’s discipline, you’re going to put it on your card, and you’re going to pay that card off, you’re going to put it on that card, and you’re gonna pay that car, use the card like a debit card, they don’t care, no balance, do not carry a balance people negative invalid got correct, everything is there, you just have to understand how the system works. And basically, long story short, you spend the $5,000, in three months, you get the $30,000 30,000 points, and you buy a regular plane ticket, and you upgrade for 20,000 points to a business class ticket for free. That’s how you do it. That’s how it’s done. That’s how you’re paying for all this stuff. You pay for some of it, you pay for some of it. Because then what happens is the longer game, that’s why so you have to understand how certain cards work. For example, I’ll pay for a business class ticket racket, and because you’re in that class, now you get triple or five times the points, which means that my next trip, I can buy a normal ticket, an upgrade, and still be in a business class or a premium class, if you understand that, and that’s how you

Erwin

travel. Yes, you want to be class are better. I do

Anderson

not know the economy and I have no shame in it. I will do normal economy. But if I can basically get into a business class, or first class for literally the same price as an economy to get all funded by trading. Everything goes hand in hand. All right. Your wife understands what you’re doing. Yeah, she she totally understands. She loves it. She loves it. Because I don’t leave her out. And that’s,

Erwin

I mean, every you’re travelling with her. Yeah. I don’t leave her out and leave her an economy when you’re in business class. Of course,

Anderson

never. I’ll be on the couch. And not only that, but um, she understands a trading because she she was working from home before. She’s now back at the office. But she’s working from home before. I my workstation is right next to her. I’m here and she’s there. And she would see me training. And she’s a very supportive woman, and curious as well. She trades as well. She doesn’t do it as aggressive as I do. But because she’s seen me doing it. She has gotten an interest in doing it. And, again, if you have a life partner or wife or whatever, that understands what you do, it’s even more fun. It’s more fun, because I would be sitting there at my TradeStation she’ll be sitting there at her computer. I’m making money. She’s making money. We’re what like a mini what we call prop floor where I’m calling stuff and if I’m for example, I’ll I’ll just and these are not stock Pics or anything. But if I’m trading Tesla, I’m focused on Tesla. She might be trading in video, same household, all the money still in the same household. But I have a wing woman, a wing woman going partner. Yeah, right. And that’s, that’s part of the fun of it too. And she understands the long term goal of it. And, and it’s not really to be honest with you, or, and it’s not anything special like don’t, if I make a million dollars, great if I don’t make a million dollars, great. My target. And my focus for stock Hacking has always been those three things, paid for my vacations, have a bit of money to pay for bills, and at the end of the day, have other extra to invest as well. And you have to be realistic with this. Again, this is not a magic pill, this is not a get rich, quick scheme. This is your hard earned money that you’re investing. It’s still invest at the end of the day. And it can be gone in literally it could be gone in a second. So I take it as actually just I call it my day job. And I sit at my trading desk. Do you take it that serious? Yes, I am at work. I am at work. This is not a game. Because I know that it took me 35 hours of doing DoorDash and I posted in our Facebook group people say I’ve done DoorDash all year round in snow, and sun and hot summers. So for me, if I’m out there doing that, why should I know take that capital and turn this into a game or a job?

Erwin

That you worked for extra hard earned money? Correct.

Anderson

So therefore, for me, I see it as a job. And I sit down and I when I trade between the hours of eight and 1030 ish. I am at work your professional. Yeah, I’m very disciplined and I go back to that old time. You have to be disciplined. This because people think that this is a casino. And like I said, this is not for everybody. If you have I mean, there’s people out there with gambling problem and stuff. This is not for you. I will never tell you to do this. If you if you have sad to say if you have an addiction to gambling and this is not for you. I couldn’t

Erwin

agree more. I said I’ve seen people do gambling this behaviour correct. It was absolutely wrong thing that correct. This is

Anderson

not for you. If you have that gambling mentality, and that gambling attitude. I will say this out loud and clear to everybody right now you will lose everything.

Erwin

Just like the casino. Correct. Your

Anderson

house will win. Yeah. So this is if you are that person, please take my advice. If you’re that person do not do this.

Erwin

The analogy I have in my head of the stock market. Yeah. Is I’ve been watching baseball lately. Yeah. So I think of the stock market as a professional pitcher. Yeah, and I’m the batter. Correct. And the pitcher is pretty much always like statistically, the pitcher almost always wins. Correct? Right? Correct. Like, you know, to be an all star you hit three 30% Yes, right. 300 Technically, but three times that attend you get a hit. You are an all star. Yeah. All right. In the world of, you know, gambling or stocks, you’re getting killed.

Anderson

So that’s how I think of it. That’s why I want people to have the mindset of the stock market is not there like making money for the stock market. There’s actually to prey on weak players to take your money to take your money. It’s there to take your money. And it’s purposely set up that way. It’s it’s literally like you said it’s online. Vegas. Right. And they have glorified this. They have glorified this where they turned it into a game when you

Erwin

like there’s certain games Yeah.

Anderson

Sorry. Yep, sorry. There we go. Game a fight. That’s where I’m looking for. It turned into a game where when you buy a stock on certain audio confetti flowing on your phone, and to me, that’s the wrong perception to be sending to people. But for me, gamifying it should not be and I’ve seen people got their shirts handed to them because of it.

Erwin

I feel like dollar cost averaging maybe you want gamify that? Yeah, absolutely longterm shirt. Yes. Grading behaviour.

Anderson

No trading behaviours should be gamified. Long term. Yeah. If you if you like you say if you want to gamify bitten, if a bite here and I’m holding in it. It’s got a dividend. I do that in my long term portfolio. I got cheese. Oh my gosh, do you see the price on Walmart? Do you see the price of war Nike or Nike just just had earnings yesterday to kill and got murdered and made money. But the long player advice folks, not advice. But again, that goes to my trading buckets. And you have to be educated to do the right you see under risk, correct frontline risks? Exactly. People need to understand the risks that I’m putting on here is minimal. I don’t want you guys to think that this guy is here, throwing the whole house gambling, no, very far from it. But what I’m doing is repeatable. I’m very specific steps that I do. repeating over and over and over over a long term.

Erwin

We’ll talk more about that offline. With the team. I’m sure they’d like to hear for sure. I forgot I was going, oh, I want to continue with the baseball analogy. So we’re in beta, I’ve been battered, so successful, usually when the pitcher makes a mistake, correct. For example, if you’re hanging curveball, yeah. And so the analogy I would apply for stock is stock market is sometimes there’s excessive fear. Yes. Right. You know, for example, one stock I keep watching is Bank of Nova Scotia. Okay. All right, then the CEO has transitioned out. And the stock has tanked. Yep. But now the dividend is over 6%. It’s still going down, I think there’s a good chance there’s a chance to make keep going down again, not advice, folks. But to me, this seems excessive. Yeah. It’s overdone. That’s overdone. And that can be a buying opportunity.

Anderson

But remember what I stated earlier, and we said it earlier, people get fearful. And it’s an elevator write down. Right. So when people see read on that screen, it induces a feeling of panic. And it induces a feeling of the your hair’s on fire. So I have to sell, right? Whereas with a long term strategy, again, dollar cost averaging and learning educating yourself on how to do this. You can sit on the sideline. Cash is a position that yeah, cash is a position people look, people seem to not remember that. Cash is a position. And anybody with cash in a bear market will succeed when it turns around, because what can they do? Like and ride the wave? And rather than

Erwin

is fierce? It’s actually funny. It’s actually on CNN as website this year. The fear greed index? Yeah. And it actually said a month ago, we were neutral. We’re almost we’re almost midpoint, like, almost 50%. midpoint. I can’t believe that was a month ago. Yeah.

Anderson

But yeah, let’s talk about inflation and a lot of that stuff. Recession, recession. And, you know, what the, the the Federal Reserve war in Ukraine and Russia and stuff going on in Europe, with their dollar and world events cause, like the stuff to happen, right? So a month ago, when people were saying we’re neutral and stuff like that, but you’re reading articles about this is not changing. We have to do an inflation. We hiked inflation rates by this much by 75 basis points. And I’m hearing nothing out of their mouth about we’re cooling anything. All they’re saying is we’re hiking, we’re hiking, we’re hiking, eventually, what do you think will happen? The fun has the right has to come to an end. It has to, and you have to get things you have to reel things back in and get things under control, where people have, I should say people were used to a lot of machinist in the stock market. Everybody thought that once you bought a just goes to the moon. A lot of people got in around back in the day, you know it Gamestop EMC those kinds of crazy times, people got in and thought that that’s the stock market. No, it isn’t. But again, so foolish, foolish, silly, very, very, very silly. And they don’t understand the mechanics of it. Right? And they don’t like you and I that will beat dive and look into what’s going on in the economy, what’s going on in the world, what’s going on with inflation, what’s going on with with mortgages or whatever. And we then pieced together a puzzle where we formulate a trade plan, which we execute over a long term. No kid on his phone, in his mom’s basement is doing that. But he’s gonna take his check from his job and go through it into the stocks and then wonder why he has no money.

Erwin

I don’t know anyone personally doing this.

Anderson

I’ve read articles. I don’t know anybody personally either, but I’ve read of articles. And it’s a bit sad that people just don’t understand and they’re just casinos. Yeah, it’s casino stuff. But as long as you know what you’re doing and again, you’re educated and you have the right mindset. This can be done. And this can be done easily.

Erwin

What’s your outlook for the markets? Or do you care? You’re gonna read the trend.

Anderson

I don’t care. The reason why I don’t care because I am I am a I’m a what you call, I’m a Chart Trader. So I just trade what’s in front of me. I don’t, I don’t have a crystal ball. And I don’t like to forecast too far out anyway. But I will say this over history. And over time, the market has done this over and over and over. And it has done what rebounded. So I have to take again, the data that is there. And the data is telling me that the market goes down, and it goes back up, and it goes down, and it goes back up. We’re just in a downward motion. I don’t know for how long, nobody knows for how long but I will say this, as long as you know that you have cash on the sideline, or you’re making moves where you are able to capitalise on a down move.

Erwin

And if you don’t need your money right away current market exactly how

Anderson

you can sit this out. And trust me sit in and out will reap some major major David, major money on the way back? Because right now start marks on sale. People don’t want to hear that. But for me, it’s not Marcus on sale. It’s gonna be hidden lower though. Yeah, but But I’m saying we will never thought or people will never think that we can be picking up certain stocks at this price. Yeah,

Erwin

like Nikes. Like in the 80s. Yeah. And it was 160. Yeah. Not that long ago.

Anderson

Correct. Right. And if I said

Erwin

no crack stock, let’s say AMC, Jr. Right? Correct. This is

Anderson

Nike quality company that’s been running for years. And that’s, that’s, that’s what we stress on in our programme as well. We stress on you’re buying quality, long track record stocks, you’re not buying the jump on the bandwagon what to do stocks, the carnival right stocks is what I call them,

Erwin

at the most recognised yet top two red, most recognisable brand in the world. Yeah, the Nike swoosh sure, do them

Anderson

the only other person rather than that is Apple or McDonald’s think, you know, but in our programme and what we’re taught, we’re taught to to buy quality socks, right. And that way, as long as something is quality, it may go down in value, because it is quality. People will recognise that at that price. It’s a deal. And it will go back up. And we our programme is usually a long as we trade long, long what we call long bias. And because there’s only so much

Erwin

time to teach, right, exactly,

Anderson

but right now,

Erwin

that’s that’s hard enough for a lot of people to figure out the long, a great, including spray. I totally agree before we cover shorts,

Anderson

I totally agree. It’s complicated. It’s very complicated. I tell people all the time, it’s one of those things where you have to be willing to take time out to learn this. This is not something you learn overnight. This is not even even if you take the education not going to take stock hacker Academy, digest it all in two nights. And go trade next week. That the course actually if you’re doing stock hacker Academy, correct. That’s what course should take you a couple months. And then you you actually need to refresh it.

Erwin

Yeah, you should be practising with paper. simulated trading. Yeah. If someone’s really new to this, like new to stock world new option world. Yeah, they should probably retake the course correct. Which is free to do. Because it looks at the recordings for 12 months. there’s any confusion they should they should understand what they’re doing for the rest of their money.

Anderson

Exactly. And people don’t understand that. When you invest in yourself, and you understand what it took to take that money and invest in yourself. That’s why I said, How can you take this for a game? Anybody doing this and anybody taking the role of education and stuff like that? You had to work for that money. You took time away from your family, you went to your job. Some people are in a job that they don’t like. So you went to a job that you didn’t like and you work for 40 hours times X amount of

Erwin

weeks, you’re driving the snow, correct? It’s dangerous. Exactly.

Anderson

And for me, it’s for anybody for that matter. If you’re investing in yourself and you’re investing in a course and you’re taking your hard earned money to do it. You need to take it serious. I am out there from me personally, I am out there in the snow, delivering food and it’s a risk. Every time I get in my car, it’s a risk. Right? And I’m doing it Because I am willing to say this risk is worth a bigger reward in the long run,

Erwin

as well as in the long run, but you’re doing extremely well. Can you? Can you share some numbers? how well you’re doing? Yeah.

Anderson

So I started out with a basic tart. Actually, I’ll put it this way. So I started out with $1. Target. And now I’ve transitioned into a percentage target. Okay, so high dollar target, was, when I very first started, I started out, I’ll give you a number. So I started out my account with $3,000. That’s the minimum that you need. You need $2,500 to trade.

Erwin

That’s a really smart number. Yeah, I like 3k. Because like, for most, that won’t be devastating, at all. Exactly. But let’s see if you can prove to yourself you can make money with 3k. Exactly before you do. 100k. Thank

Anderson

you. And you took the words right on my mouth. I start with 3k. American, Canadian, American, okay, so 3k American, because we owe for our platform, for the listeners sake for our platform, well, if you want to trade US stocks, and that’s where the move, what we call the movement is more action. Yeah, and the Canadian or Canadian election, when the volume, there’s Canadian stocks that pay very well, next dividend, and I keep those in my long term. But tax advantaged TFSA, you put it in that and everything else, but for what we do options trading, you either need movement in it, or it needs to go sideways, if you’re doing spreads. But basically, I started out with a $3,000 account. And my target was let me make $100 a week, on a $3,000 account, you can make $100 a week with a spread, if I really want to get technical, and this is in a perfect world, folks. But I’m just saying for numbers sake, if you took $3,000, and in a perfect world, you did spreads, you could generate around $1,000 on them. And it sounds crazy, doesn’t it. But I’m just saying that, that’s in a perfect scenario. That’s why I started with that. And the numbers wise, we are not in a perfect scenario, we do not know what’s going to happen the very next second stock market. So but I’m saying that on paper with spreads. And with the three key accounts on paper, you could make that money that just I’m just trying to show you the power of trading and what could be done in bulk. But on my end started with 3000, try to infer $100 a week, then I took my DoorDash money. And every week, I added to my account. And I just told him that you can make $500. So that’s nice round numbers $500 a week of DoorDash. Every week is $2,000 at $2,000. Plus, what I originally put in that puts me at What no $5,000 Then there was a plus exchange Yeah, around 5000. Give or take a bit. And even on that for about the first I want to say two, three months, my target was to make $100 a week with the movements in the market. Luckily for me, I took advantage of certain market moves and certain stocks, and I was making more than that. So then I decided, okay, let me change it to $200 a week. And that was about two, three, I want to say three months to be unsafe, so three months later. So if you do the math, again, this this, again is a process, right? And the easy way to put it is the more money you have in your account, the more trades you can take. So if I started with 3000, and every month, even if I am taking, again, controlled losses from taking control losses, but I’m putting a run $2,000 into the account from doing DoorDash. then by Month Number three, I should have around six or $8,000. Starting from the beginning, around that mark No. You can take bigger trades. You can do different styles of trading, or style we sell puts, but there’s a couple of different styles that I use to trade. I also do straight equity. I also do by trade

Erwin

equity for your

Anderson

district stock. street style like how we will buy a stock and hold. Same concept, buy the stock straight, sell it for profit just in a shorter window. And those stocks are stocks that are under $50. So for the listeners sake, when we talk about contracts, one contract is 100 shares, 100 shares, times $50 stock is $5,000. I just said that in three months, you have $5,000. So therefore, the three month mark, I can no trade equity, I don’t only have to trade options, right. So therefore, at the three month mark, you can now afford 100 shares, I can afford 100 shares of stock that cost me 5000, which cost me $5,000. Same move, and you make money for the listener again, that might not know, you make money when a stock goes up by buying it, or you make money when a stock goes down by selling it. Either way, the movement in that stock. For example, if it’s a 50 cent move, and you have 100 shares, that it’s $50. If it makes $1 Move, you have $100, switch to equity, trade, get a 50 cent move, or even a 25 cent move. And my target that I said used to be $100 a week, if I can get a 25 cent move in day, there’s five days in the week, and I have enough in my account, I can make my 100, actually more than $100 a week. And that’s how you know, like I said, this becomes no compounding. And this becomes how you grow your account. Once that part is done, and you start to add a few more strategies, then basically at the end of the day, you can grow an account from 3000. To where it is over 5x. In my case, he five extra account. Yes. How you feel about the amazing, completely amazing, and how long? You’re just under your because we were here. I opened the account on my last interview with you. But that was Yeah, but that’s from trading profits and working. Okay, let’s not forget to work in part. Let me be clear, folks, this is not only true, I know because people think only 25. This is coming from $3,000 trade. No, I never said that. This is from working and trading.

Erwin

So what are your new goals? Now? What are your goals? As a percentage now, percentage wise,

Anderson

I’m trying to make about anywhere between five to 10% a month. Right? It’s not always there, right? No, no, no, that’s my goal to make. They’re pushing for it or not pushing for it. You’re not pushing for it. Because because you don’t want to force traits don’t force it. That’s, again, this is a job. And this is structured. So I need to be clear. And I will say it again. If it’s not there. It’s not there yet.

Erwin

Right? It’s like you’re building a house correctly. If you’re ready to pour foundation,

Anderson

you don’t do it. Same thing. Exactly. Because the long term being being in the market long term is more important than forcing a trade and losing everything that I’ve built over time. Don’t lose money. Correct. Rule number one, don’t lose money. Or I will say or okay, there’s rule number one, don’t lose money. And then there’s rule number 1.5, which is if you lose money, lose less than you make. It’s simple math folks. Simple math. If I maintain the game, correct, if I make 100 I am not risking 100 I am going to risk 20. Because here’s the thing with stock market opportunities will arise over and over and over again. It’s circular. Yeah, opportunities will.

Erwin

Right. So sorry. Anderson has Have you seen the new version of Soccer Academy? We’re calling it internally we call it 3.0. No, I have not. Okay. I have not seen we’ll go have a look at it. I think for sure. Yeah. Cuz it’ll. Hopefully we’ll be happy with it. Yeah, it’ll be the best version we’ve ever put it under fold. That should be fun to see. Because we actually we haven’t actually offered stock anchor Academy, the beginner bundle for a couple months now. Right. Okay. And we’re not announcing until the conference. Gotcha. That’s well, first available, but I’d love to love you to have a look at it. Yeah, for sure. Let us know your feedback. I will. Definitely. I’ll take a look at it for sure. We’ve definitely tried to make it much more comprehensive. Yeah. And a lot more beginner friendly. Just from the feedback we’ve been getting for sure. And we spend a lot more time on the stock side just like basic stocks died before we even got into like options.

Anderson

Yeah, which which, which is very good, which is very good because it’s actually easier for somebody to understand stock trading well, when it gets in my in my head. It’s equities. But it’s easier for somebody to even visually, visually, it’s easier for somebody to see by I buy and sell, rather than going into an options chain. So yeah, that there’s a very, very positive move on your dice part that simplifies things even more for people to get into it. So yeah, that definitely will boost your your programme. Straight out the gate, I will tell you that will boost your programme, because it’s just easier, easier for people to understand.

Erwin

I’ve noticed that because like you like for your long term portfolio, for example. You don’t need the option stuff, right? You don’t need the stock stuff. Exactly. And then, while some other surprises that will amount to the condo, wow, lovely. But you know, our speakers, Derek Foster, yes, yes. So for a long term investor, but he’s just a long term kind of guy buy and hold kind of guy. And he’s positive on the year. Yeah. Yeah. And then saying,

Anderson

I can totally see that though. I can totally see that. Because they’re Foster is is a genius. This is his way of when I say genius, his way of looking at the markets and investing. He’s an investor not a traitor. Correct. That’s the word I use. Investing is Buffett style is very, very strategic and very, very calculated. And he’s very smart. And he’s done it for years. He’d been retired for how long?

Erwin

almost 20 years. That’s crazy. That’s crazy. That’s crazy. But what I want people to appreciate as well is that he is retired by all definitions retire. Yeah. As he doesn’t do any work. Well, doesn’t earn any wages anywhere else. Just off his portfolio eight. Yeah. Okay. Amazing. Because in the real estate context, often see people that Oh, I don’t I retired. Yeah, but the became full time real estate investors. Right, which is actually pretty busy. Yeah. You know, for many, it can be very stressful, especially these times. Yeah. Versus he’s got like, no stress. Present cash. Yeah. Right. His greatest worry is inflation is eating his money. Yeah. But that he can deploy that he can deploy that. And we both know many ways. Correct. Better to lose money. lose money to inflation.

Erwin

So losing money to inflation, not the word. Exactly. It just looks like it’s all relative. Yeah. And we’re joking around that. Like the only winning, there’s only I think there’s only really two winning investments this year. US dollars. And oil and oil is only a slight winner this year. Everything else lost money this year. Yeah. Across the board,

Anderson

everything went down. Everything went down, which is why being going willing to go to the short side. Correct. Is profitable as a trader. Yeah.

Erwin

And those have been almost all my best trades this year have been short side. And totally agree. I totally agree. anyone’s ever told me there have been going bullish and making money this year. I’m like, crazy. No.

Anderson

Unless they’re day trader, and they’re in and out. But outside of that, if you’re telling me you’re making money long, no.

Erwin

Crazy. If you’re a trader, there’s no reason to just play one side. Exactly.

Anderson

But if you do what we do, like you said, and you’re making money, you have to go short. So if anybody is saying that they’re going on making money, please show me, man. And I don’t think

Erwin

anybody and you made only little correct more money to be made on the short side for this year.

Anderson

Of course, this year has been a complete bear market, a complete the market. And as long as you know how to go short, money’s there. You know, that’s just how the stock market where money’s there. And that’s how I I mean, for me, that’s how I grew my account. And, and between that, like processes, nothing special work, put your money in the account, trade, don’t lose as much money as you profit. That’s all it is. The process is just rinsed and repeated events don’t repeated. And five vaccine for me means I started here. I started with three, I’m over 15. Now that is with working. And that is with trading.

Erwin

Like five year old thought five years, five years ago, Anderson with a believe you’re doing what you’re doing now. Five years ago, it’s a scam.

Anderson

I should say yes. And no. Because because I know there’s people out there making money in the stock market. I know there were I would see them on YouTube. But the difference is, is that I was like, What am I missing? Or what do they know that I don’t? That’s all it was. And then like I said, I met you and I understood, okay, if that’s what’s missing, which is understanding the stock market, educating yourself. It’s like any profession. This is what I again, I just don’t understand. You will go to school to be a doctor, lawyer, nurse, chef. You go to school for two years, but you don’t want to go take three months or four months to learn the stock market. It’s crazy to me totally crazy. Yeah. But yeah, it’s been a good ride, man. It’s for me. It’s been great. It’s fueled my vacations, it’s fueled. It’s put food on my table. It helped me to pay down debts as well. That’s another Important part two, I don’t think people, people don’t understand that what this can do for you is help you to do other stuff. paying down debt as well. Canadians are debt laden and debt laden

Erwin

like crazy. We’re falling just following the example of our government. Correct. But what your debt laden,

Anderson

and I’m saying that a solution to combat that on an individual person, person basis is horrible. Get a side hustle about learning to trade, humble, taking your side hustle money, or your trading profits, and you paid on that 19% credit card. Because technically, if you pay that done, you just made 90% on your year. Might we have thinking to be honest with you? Mature duck the last? Yeah, correct. But my way of thinking over the last year, I would say I’ve matured so much in understanding even how money flows, right? If anybody listened to my old podcasts, and they listen to this one now,

Erwin

what do you recommend? October 2030? Thinking about 2021? Yeah.

Anderson

And if you listen to that was more at the very, very beginning of my journey. And it was more about time. I’ll never forget, we were joking. Oh, you got rims on your car and edited? And yeah, that’s nice. This Anderson here

Erwin

today, different guy, this woman 12 months, bro, 11 months different guy.

Anderson

Because I understand the power of trading. I understand

Erwin

that you can make money with money. Yes. That to me that the gift

Anderson

was it was a foreign concept. Right. But when I when the light bulb went off, I was like, you can make money with money, instead of making money. And I’m not saying don’t buy nice things or whatever. But for me, I’m very picky with what I choose to buy. Now, you know, where before, if I meant for example, if I made this kind of money, back in the day, I’ll be upfront, if I made this kind of money. Three years ago, yeah. If I made this money two years ago, I’d have probably gone down payment on another car. I’ll be honest, I’ve been upfront and this is the truth about real estate. And this is a true full show me the only Aragon and don’t pay on that occur, guaranteed. I know I can make money. I know I can. And that’s a self belief to all the listeners out there, you have to believe in yourself as well. It takes believing in yourself. And it also takes you have enough conviction to know that you can do whatever you put your mind to. That’s the tip. If you guys are listening and nothing else on this whole entire podcast, please listen to this. You can do whatever you put your mind to. And once you have that dialled in, nobody, I don’t care who you are, nobody can stop you. No one. And once you learn how to, like you said to make money with money, there’s a lot of other stuff that you’ll be amazed that your eyes will get opened up. I picked it I start learning so much about and reading and even with the ABC and that to me is asked me about that a year ago.

Erwin

You’re the way Porter for Adam Dunn,

Anderson

you know, but it’s stuff like that using money to make money. The three buckets. I’ll simplify my day trade to fund my midterm, from my midterm to fund my long term account, three simple buckets. day trade, midterm, long term, the cycle keeps flowing.

Erwin

So now you see your path to financial freedom. Correct. All right. Very much. So did you have that two years ago?

Anderson

Yeah. I’ll put it this way. I did. Just not in the timeframe that I know I can do it now.

Erwin

How much did you shave off?

Anderson

Ah, so far, have took off about six years, six years, six years? Because I used to be way back like two three years ago. I used to be the pay the minimum on your credit card kind of guy. Mostly. Yeah. And carry a balance a couple years ago. I wasn’t educated for on that level. Right? When they say a couple of years ago, I’m talking maybe like four or five like couple of years ago. But I was of the buy it on credit card pay the minimum only and, and that’s it. Oh my and then when you get around to it, you you you pay down your your credit card whenever Damn. This is the truth about real estate. And this is the truth about me. Anybody has this is me sharing my story. And that mentality is now I shouldn’t say only changed in a year because because to be honest, that was years ago. But learning and the process from then to now. Night and day

Erwin

because your your your past If that was quite advanced, what you’re doing? Yeah, what you’re doing now is actually more commonly only seen than rich people. Yeah.

Anderson

Yeah. The behaviour of it. My behaviour? is that of a rich person.

Erwin

No, no, the how you’re acting with your money. Yeah,

Anderson