**Transcripts are auto-generated.

Erwin

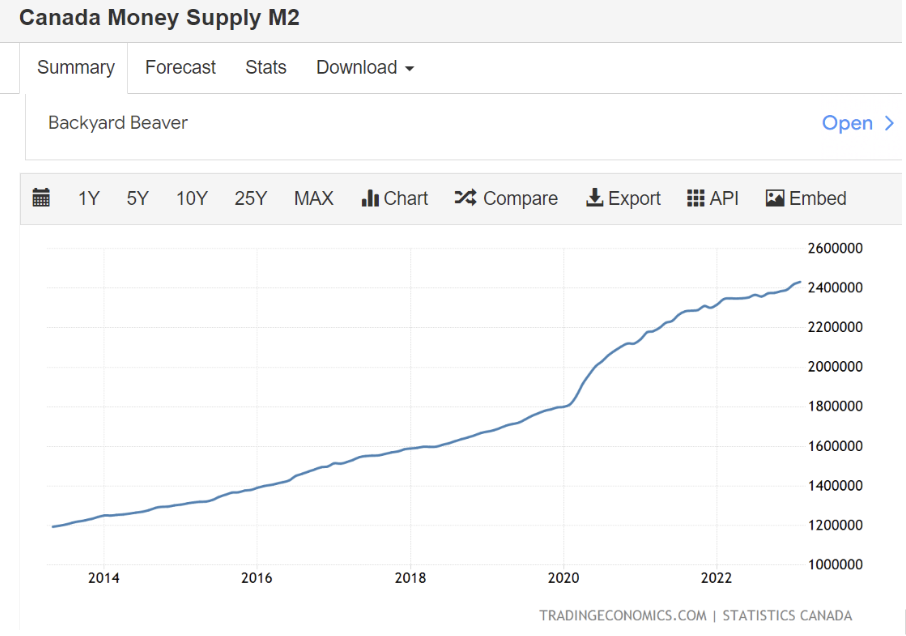

Real Estate is booming. You can win big, but you can also lose. There is risk with real estate investing. And that’s the reality no one’s showing about, learn about how everyday investors lose as well as win here on truth about real estate investing show since 2016, nearly 300 episodes all over an hour long. And before that I was blogging since 2010. Weekly, the market has done a very good job of taking care of us longtime real estate investors with over 10 years experience of actively burning, besting continuously improving, it’s honestly the truth is it’s only the recent high leverage get rich quick schemes that have caused investors to go bankrupt, including going bankrupt in 2021. Before the market even downturn, so their own investing Operations, Business Operations failed them, not the market, not interest rates, nothing like that. And the organisations that those coaches students belong to, they simply slap them under the rug. Fortunately, there are many good people out there and good investors out there who are willing to share what works and doesn’t work on this podcast. And also understand that we do have off record conversations as well, which really helps me filter out the noise as to which courses coaches strategies are good and which are not. And the whole point of the show is to highlight how to achieve predictable repeatable success in real estate investing versus the hype in shiny objects. Also keep you updated on current events relevant to Canadian real estate investors. For example, in the US, all eyes are on regional bank PacWest, whose stock has collapsed 75% Since March 75%, they’ve lost three quarters of their value since March, as there’s fear that this is the next bank that will fail. There’s a couple of other banks that are in similar situations. What do banks in the US and internationally have to do with us? Traditionally, bank turmoil leads to bailouts paid for using debt, government debt and cause falling interest rates. I’ve included a chart in the show notes of the show. So to explain what I wanted to highlight in the chart, if you look at 2020, so only three years ago, before the pandemic, the US federal debt payments, so interest expense related to their debt has increased 50% In just over three years. 50% from 600 billion to 900 billion currently doesn’t interest payments. Keep in mind, when governments have excessive debt, investors best defence is hard assets, my clients and I choose real estate income properties. And doing so we’ve made millions of real estate investing. When interest rates decline, we’ll see more fuel to the fire, more fuel added to the fire and the real estate markets and properties we already target where everything is already selling quickly. We are in a pretty heavy seller’s market already. The bond traders that predict so I use a tool called the CME group’s FedWatch tool. It aggregates and analyses what the bond traders are doing. And bond traders in are predicting rate cuts by the US Federal Reserve starting in September of point two 5% and subsequent point two 5% cuts each meeting after that, for a total of 2% and cuts by the end of 2024. Identically included a chart in the show notes as well. Again, this is what the bond market’s saying. These are my predictions. I use a piece of information like this to form my own opinions. For those on our email newsletter, the show notes and charts will appear in your email inbox. If you’re among the already 10,000 Plus Canadians who already subscribe. Sign up today to receive timely updates on our new podcast episode, episodes and you’ll be the first to know about upcoming events like Ireland free trainings and mastermind tours. But you do not want to miss the tours especially they sell out usually within just a few days. And those are really highly valuable. Our newsletter is the best way to stay connected with us to stay informed about all the exciting things we have in store. So don’t miss out, sign up now. Join our community of engaged and informed 17 listeners. And if you’re new to the show, or the show, we do have a few more than 17 listeners, we’re actually closer to 20,000 downloads per month. So if you’re interested in joining the community, www dot truth about real estate investing.ca And then you’ll start receiving our newsletter to be informed about real estate investing in the events that we have going on. www dot truth about real estate investing. Enter your name and email address on the right side in your skin. You’re good to go. As always, we will tell you how it is to be an investor of Canadian real estate. onto this week’s show. We have Matthew Lee in England, the owners of a full service real estate business called coalition properties. They happen to also host the largest meetup in Toronto and if you can believe it, them in their community successfully invest in Toronto, mostly small multifamily again so we’re not talking about condos we’re talking about small multi families you know duplex triplex four Plex five Plex is about and do understand they do require significant renovations. Significant renovations required Have you no capital to invest? Preferably cash. And so Matthew and link detail how they add apartments to existing buildings, including laneway suites. And they’ve been doing all this since 2012. If you invest in the right way since 2012, in downtown Toronto, you know, if you’ve avoided all those shiny things about other countries and provinces, including ones that are oil rich, if you compare an orange province versus downtown Toronto investing, well, yeah, there’s really no comparison. You’ll likely be very rich like these guys are and their clients who’ve collectively added over 100 billion to their net worth. Position offers advisory services, investment Realty Services, designing renovation, and property management services. Yeah. On top of that, these guys both have good sides, portfolios, wives, young kids, how they do it. I don’t know. Obviously, it’d be pretty boring. So let’s find out together. If you enjoyed this episode, volition is hosting a meet up on Wednesday, May 17. Doors are at 6pm I don’t think the meeting starts to like seven ish. It’s on the Danforth. So if you’re downtown, you know, you’re on the dance floor. I think that’s pretty easy. I’m not trying to lie, but I know enough. I know it’s pretty should be pretty accessible by subway. Link is in the show notes to register. And the keynote speaker is someone you do not want to miss link, again is in the show notes later on in your email newsletter. Then you’ll see it there. So please enjoy this. Oh, gentlemen, what’s keeping you busy these days?

Ming

Jeez. A lot. We’re actively trying to run this. Toronto investment. Realty business. That’s got me working 12 hour days, 14 hour days. 1414 hour days.

Erwin

Has a half that time, so I’m only like, especially since he lives out in the boonies. Actually, yeah,

Ming

I live out in Aurora. But he said I’m a country boondocking type person. So you drive into the city to work. Okay. I don’t go into often maybe like two or three times a week. Yeah. It’s a long time in the car.

Erwin

So it’s been a lot of times to see you guys in person. I think it was before the pandemic suicide last night in person. Yeah,

Ming

I mean, all our hair colours have changed. Since we last saw each other. I’m heavier, you’re used to look good, do

Erwin

I eat less? That’s all I can afford it. If he’s interested, he can afford to eat

Matthew

more bags under my eyes since we last saw each other too because of a couple of kids in tow now,

Erwin

story assures that before kids, I always get carded. As soon as the kid like I was 33 when I had my first kid. I’m a kid getting carded. So yeah, my kids a little bit older than yours. But yeah, so

Matthew

I’m still weapon bombs. Yeah. And that’s my own actually.

Erwin

Be glad you’re still young enough to wipe your own. Safe. Are we?

Ming

Two minutes into the podcast? Are we off the rails?

Erwin

We lost like, at least half of our 17 lives. But they should listen to this because you guys have been actually making money in Toronto.

Ming

Yeah, I mean, it is. And we’re starting to see Toronto proper,

Erwin

not GTA business. Nothing. No, we’re talking about, actually, what are your boundaries?

Ming

So streaming? Yeah, generally, we’re staying in Toronto proper. So that is like the original Toronto borough, not North York. Not, you know, Scarborough. We dabble in East York, like we do. We’re kind of in East York and the central of Toronto, but we won’t go out to like a telco this for investment purposes, right. But we are very centrally located. And that’s driven by the way that we approach things like we started, when we started the business. We were all investors and other places. We were doing like, admittance and SunBreeze. And, you know, you name it, whatever was flashing at the time, we were investing there.

Erwin

And then lots of flashy things. So there was lots of shiny, shiny objects,

Ming

and we were chasing all of them. Right. And, you know, we were looking at, like the returns, and also the tenant profiles. And I think it was through year, we started listening to a bit of Grant Cardone. And like, I remember thinking myself, how can I text this business? And then I’m like, do I want to Texas business. I was in Waterloo at the time and I was like, I had 20 Something doors and I was like, I don’t want more of these tenants. I can’t manage it, like it was already working so so much to try to manage that portfolio. So we started focusing more on Toronto, and that was more in our wheelhouse. 10 profiles, which is easier for us to manage. We started looking at what they wanted and developing a business model behind the tenant profiles that we wanted. And yeah, that’s how we landed in the city.

Matthew

So that’s generally how we volition as a real estate investment. advisory in realty business. We looked at things a little bit differently. Most people are chasing ROI, the chasing cash flow, the chasing returns and and what have you. And of course, ROI is a really important component to consider, but not in isolation. So it’s really funny in finance, there’s this concept of risk adjusted return on capital Roc. That concept for whatever reason doesn’t exist in real estate. So what volition aspires to do is actually bring a risk adjusted return on investment mindset to our investing as well as a headache, adjusted return or on investments.

Erwin

I jokingly call it return on grief and either a high number of

Matthew

headache, grief, it’s all the same thing. If you’re spending time energy headspace effort, dealing with tenants, LTV, whatever the lower might return, actually. And so what that’s all culminated in is the volition investment business model, which is heavily predicated, as you guys were talking about in and around the downtown core. In a nutshell, essentially, we have a business model that actually works in Toronto. It is a multifamily small multifamily business model, acquiring freehold houses multifamily in the residential neighbourhoods adjacent to the downtown core. So it’s yes, this is very much Toronto proper 416. And, you know, in these really, really cool funky neighbourhoods that are gentrifying, that are super hip and super attractive to this young tenant demographic, professional millennials, university educated two to five years of school making 60 80k Working at a big company in downtown Toronto. Yeah. So that business model does work. And we’re one of the few investment Realty teams that doesn’t make it work here in Toronto. Not here in Toronto, I guess here is Oakville now, but

Erwin

we are we’re in the CN tower right now, a nice view of the investment model has changed through time, right? Because when you guys started, I’m sure the property that you targeted in Toronto was different than what it is now. But can you start with what it was when you started? Yeah, it looks like what it costs.

Ming

I’m sure very much parallels your own investment journey. When you were doing like a duplex and you’re paying like, you know very little for it for us. I think it was probably starting at around like six 700,000 When we first started getting into these things, and a duplex with cash flow back that if you’re in the right neighbourhood. Now we have I mean, now kind of the minimum is a triplex but we have a lot of clients doing more advanced things. So let’s say buying it residential is for adding units exiting on commercial financing with CMHC CMHC. Yeah, CMHC financing, better rates, longer amortisation and

Erwin

that programme that everybody’s talking about the CMHC the MLS? Let’s Yeah, everybody’s talking about it. Yeah, we

Matthew

have. Yeah, we have a client right now he’s doing exactly exactly this taking small multi families or even single families to turn them into five plexes that can be four plus four Plex plus a laneway, for example, and then exiting on commercial CMHC financing memulai slots, and EMI select is getting 4.34 on the interest rate in a 50 year AM. Once you’re into those types of numbers, your cash flow goes through the roof. So this is why like you have to be a little more sophisticated. Yes, we help people find turnkey, too, but turnkey has a lot of competition has certain limitations. If you’re a little more sophisticated, and you know how to make Toronto work. Toronto can work for you.

Erwin

What are the how many doors you need to have for, for CMHC. This like programme,

Matthew

you need minimum five, five. And then part of it is you have to hit like 100 points, combination of energy efficiency improvements, as well as affordable

Erwin

housing. So if I was a brand new investor, and I wanted to do one of these, see, I had the financial capacity for this. And that meant because

Ming

that was my first question. You know,

Erwin

I’m a millennial. Yeah. Instead of 100. Grand. rubbed all my pennies together? Yeah. 100 grand? No, I’m kidding. Actually, no, it’s actually good question. What should to be successful ternal investor which they come to the table with in terms of resources?

Ming

Yes, it’s a good question. I mean, we get people coming from all sorts, everything from like, you know, C level executives down to you know, somebody fresh out of school. And, you know, one of the things I think we pride ourselves on is we’re not a traditional brokerage that you know, you want to go buy a condo, here’s a condo, we go through an advisory process, which Matt runs and sit down and kind of devise a plan, depending on where you’re starting and where you want to get to and how to actually get there. Real Estate’s involvement in that. So it’s a bit of a wishy washy answer it depends. What we’re trying to get people into is eventually Single Family Housing single family with multiplex right not to be investing in condos though that may, may be a step for them along the way. But I look back to like one of our staff she started off in a condo then went to live in a triplex refinance that triplex got into another triplex. So now she’s got to refinance. One of those got into Another house for sale, which is now turning into a duplex, bought another condo along the way, and that was in about five years. So that’s like, you know, we help people graduate through the properties that way, because otherwise there’s no other way to do it. It’s not like people are saving up hundreds and 1000s of dollars. It’s all about the equity, right? So as accurately grows within the property, getting that back out, so you can go acquire something else.

Erwin

Because we all come from the same, the same learning that it’s all about cash flow.

Matthew

Those days, rainy days, cash, remember, there’s the 10% rule. There’s

Ming

I remember so one of the stories that really sticks in my head one of my like life lessons was I found a property in Waterloo. And the typical cashflow Ford is looking at the time was like two 300 bucks and I found this place was was cashflow like five or 600 bucks. It’s like double the cash flow, right? And I was like, super proud of myself. I took it to my mentor. I was like, hey, like, look at this deal. I found I’ve beaten the market, I found more cash flow. And he turns me he’s like, great, what you’re gonna do with that you’re gonna buy me dinner. And I was actually like, really taken aback because I’m, like, really proud of myself found out. And he’s like, so what? You’ve got an extra 200 300 bucks. He’s like, is it in the right locations? He started just drilling me like, What was your time profile? What’s it going to look like in 10 years? What’s the transit going to be in the area? And I was like, Whoa,

Erwin

real estate spreadsheet? Yeah.

Matthew

And that’s, I think that is the good quote. You should trademark that. But as we’ve matured in our strategies in our thinking, it hasn’t matured past just cash flow. It’s funny. I’m looking at that book by Julie bribe. Cash Flow. Yeah. Is it is it really broad? You wrote that? Yeah. So like, I remember reading, reading that back in the day too. But really, it is more than just cash flow. It is really about equity. And it is really about understanding. So I get a lot of people come to me I run advisory so I got a lot of people to meet come to me and they asked, I asked him, What are your goals? And they come to me and they say, I want to 10 properties like you’re no no, I didn’t ask you how many properties you wanted. I see what your goals were. Here’s what we do at volition what we do during advisory is we want to understand where people are at their starting point. We want to understand where people want to go and then help them build a plan to get there. Which is a lot different than excuse my vulgar anus throwing shit against the wall and seeing what sticks I think that’s what how most cuz we’ve tried all that lots of shit and then we like play in our shit. You know, throw shit try to justify our shit. And by selling it

Erwin

divesting

Matthew

Yes, yeah, but we get we get a lot of people who who just say like I want 10 properties or I want maximum cash flow. I’m like no, no, no, no like it first of all,

Ming

for them Derman.

First of all, if you’re looking at Toronto, there are those concepts here. But, but generally speaking, it’s really understanding where people want to go because there is no one size fits all investment. Even even in Toronto, as much as we have this multifamily business model triplex for plexes, maybe laneways, catering to a specific tenant profile, and all the rest, there still is no one size fits all type of investment. And so it’s really about understanding what their goals are. And then once I understand what those goals are those life goals, I’m talking about what we used to call Belize back in the day, we can translate those into financial goals in support of those life goals. And once I translate those into financial goals, I can translate those financial goals into real estate goals, and I can help them build a real estate plan to get there. And so that’s all part of our advisory process. But one of the concepts I want to narrow in on is what you were just talking about, that we were discussing, actually, in the preamble beforehand. It’s around equity. And that’s not a concept that was taught to us back in our education days, where we don’t have the cash flow, we like all cash flow. And then it was it was okay 500 bucks per property. Okay, if I want $5,000 That means I need 10 of those properties. Like that literally was the formula back in the day, we teach something a little bit different now. And what we teach people is

Erwin

just part of their, it’s not like, it’s not like $500 $5,000 cash flow is bad thing. This is not realistic. It is like basically, without a tonne of cash

Matthew

in base in you know, which, you know, like you’ve done the concept of joint ventures because you’re gonna get tapped out and all that other stuff. But yes, absolutely. Like, we think of things a little bit differently now. And the way that we think about it is in terms of equity, and it’s really understanding the relationship between equity and cash flow. And that’s not something that we understood back in the day. So what I like to ask some clients now you advise your clients is okay. What does Albert Einstein have to do with real estate investing?

Ming

I have no idea. I don’t I haven’t gotten through one of his advisors session. For

Matthew

a long time, what does Okay, so what does Neinstein theory relativity has to do with real estate investing equals MC squared? What is the stand for energy? What does M stand for? mass mass? What does that equation actually telling us?

Erwin

To move mass to create energy,

Matthew

it’s saying that matter and energy are two forms of the same thing. And through this relationship equals MC squared, I can transform one into the other. Now, similarly, in real estate, if you understand the relationship between equity and cash flow, you can actually transform between the two. So if I built up a whole bunch of equity, that I can then translate that into cash flow. And so one of the ways that we do this is we have the volition multiplier effects for very sophisticated and seasoned investors do not give me anything new. But we show start off with media Toronto $1.5 million triplex making sudden $500 in rent, and basically cash flow neutral at 5% growth, which we think is fairly nominal for Toronto spend less interest for inflation the way it is, right. And you know, that’s, that’s actually less than the Canadian average over the past like 3040 years, right? 5%, we just model it 5% At 5% growth in four years, you built enough equity in that property to do a refinance equity takeout and go buy another like property. And both properties are worth about 1.8 at that point in time in four years. And then rinse, repeat, keep on doing that. Imagine you reach a certain point, you’re 12 and you’ve got money at these places. Great, right? Then what do you do when we say okay, maybe we wait how long we wait maybe six years, why six years, in six years 5% growth reach a magical number 50% loan to value 50% loan to value means that I can solve for those properties and have the mortgage the other four, and now I’m left with massive and life changing cash flow, not the couple 100 bucks here and there to take your Metro for dinner. Yeah, this is massive life changing cash flow to the tune of in the volition model will kind of explain all this, but to the tune of $500,000 plus cash flow per year. And then we’ve started the levelling up, you can pass that now we’re teaching clients. So I sold a few properties for the first time I’ve had now have, I had money for the first time in my life, every time I had money, I would always go into real estate. So I was always poor, all of us were

Erwin

poor. So I’m not even gonna look skinny.

Matthew

But what we do now is we actually take the net proceeds from our sales, instead of paying off the mortgages of the other half of the properties, we on boarded with private wealth the first time ever, and we discovered that, wow, private wealth has access to financial products that normal retail investors 20 have access to one of those things is structured notes. Structured notes offers a double digit return, fixed income return. And essentially we put we take those proceeds, putting them into notes that in this volition model, it would boost cash flow from about 500 grand to 900 grand a year. This is all a framework. This is not any one particular person’s plan. But to illustrate the concept of why equity is so important and focusing on not instant gratification. Now a couple $100 cash flow now it’s about the massive life changing cash flow later. And that’s where Toronto comes in. So Toronto offers a vehicle to allow this to all happen. Because really, it’s about just buying solid risk mitigated properties that are low headache, that allows time to do its thing. And then it’s time to do its thing, it can be the vehicle to help you reach those life goals.

Erwin

I actually know quite a few investors that bought in like small town Ontario that neither of us have, none of us could name. And then their regret greatest regret was I wish I bought near a bigger centre. Because even though they got cash flow, or 300 800 a month or whatever, they missed out on all the equity gains that we all got

Matthew

at the equity gains. It’s also the risk mitigation. When you’re buying in a small town, one of the biggest challenges is what’s going to happen to this town. So if you look at industry over time, and how our economy is changing, you trenching heavily into a lot of professional services, types of industries, and then it may not be the sawmills and auto manufacturing and stuff we used to do in the past, you know, moving toward the future. And this is why when we start looking at Toronto, there’s you know, the the Microsoft’s and the Amazon has wanted to come here and so on so forth, the Googles and what have you, and those knowledge workers, the professional, professional employee base, really, for us, it makes sense because they’re all coming to Toronto where their headquarters are there and that risk mitigation is therefore in place for Toronto. And it’s really funny because if you talk to a non sophisticated investor, they’ll look at a price tag of one Point 5 million and go, Oh, that’s too expensive. Therefore, it’s too risky. Actually, sorry, dude, that’s not how risk works. Actually, price is what you pay value is what you get. Yes, it’s an expensive price. But it doesn’t mean it’s risky. That’s not how risk works. So that’s part of the risk mitigation strategies that we employ at volition when we’re looking at these types of investments. I remember

Erwin

talking to novices and like they want to buy and like the crappiest part of Hamilton. And ask them why? Because it was cheap. Yeah. 60 grand for a house. Like, yeah, but your risk, your risk is way higher. Yeah, absolutely. Property Managers won’t go in that neighbourhood. The worst tenants because you’re next to the next right next to the steel mill. Right. So your vacancies gonna be high.

Matthew

A lot of our clients, so due to the fact that it’s Toronto, and the price tag, the barrier to entry is obviously higher. Generally, our client bases a higher socio economic demographic. So, you know, senior directors and VPs, and CCS execs and partners or senior partners at consulting firms, accounting firms or small business owners. And so a lot of these people understand the relationship between risk and reward. So we don’t have to explain it. I mean, probably less headaches, and they want less headache as well. And so you know, the the business model accounts for all of that, right?

Erwin

Can you share with the audience like how are they financing properties? Are they still using HELOC? So these guys are these guys are that rich, cash rich.

Ming

And it comes from a variety of sources. Usually, the majority of our investors are between kind of 35 to 45. So they’re not early career and they’re not early to investing in general. So they’re sometimes playing them from stock portfolios, a bunch of our clients have stock portfolios, and they may be boring against that stock portfolio, for example, with the bank,

leveraging it against the portfolio, not having to divest the portfolio, if you’re in

Ming

private wealth, you can do stuff like that. They’ll you know, some depending on what you’re invested in, you can get like 80% loan to value and you start to

Erwin

come up because it’s all it’s all real estate.

Ming

Yeah, like, you know, that that’s, some people are doing that some people have primary residences that they’re pulling money out of, some people do have a lot of cash. But most people are leveraging something, either real estate some other way that made money. There’s,

Matthew

there’s another one. So I work with a lot of clients who, again, are profiles, you know, 35 to 45, maybe 50. And they themselves are part of this kind of sandwich generation. We’re all most of us are part of the sandwich generation young kids ageing, parents, let’s focus on the parents for a little bit. So one of the questions I normally ask clients is who, like if you’re, if you’re not one of these people who have, you know, $350,000 you can’t find it by reaching down into your couch cushions and finding that that type of money, then, you know, your stock portfolio or whatever is not the place where you can come up with the capital available to invest one of the solutions, and it’s pretty funny to think about this, if you’re in your 40s that mom and dad but not bank, a mom and dad in the same way that a young 20 Something millennial would would ask that woman died 20 Something millennial and let’s go buy the first condo and yeah, but actually, one of the ways one of the things we’ve been thinking about is utilising a boomer parents primary residence, and the primary residence of that Boomer, call it in Toronto call it a $2 million house that’s paid off, right, just for ease is not, I think average probably closer to 1.5. But let’s just use 2 million for for shits and giggles. So imagine they bought this, you know, 4040 years ago for like 40 grand, right? That’s it’s funny.

Ming

I mean, parents like this, by the way.

Matthew

Anyone anyone willing to do. But boomer parents, there’s a really interesting financial product out there that might be of interest and boomer parents, who have a property that’s been paid off for a long, long time. Now it’s worth 2 million, let’s say there are there’s a product called a reverse mortgage out there. And the reverse mortgage has a really, really, really bad rap in the States but operates a little bit differently here in Canada. I won’t get into the differences, but I’m gonna talk about the merits of it and how this actually works. Are you familiar with it? Have you come across it just what

Erwin

I’ve read, like generally people are a bit on the elderly side. And they’re retired no other income?

Matthew

Yeah, that’s that’s a pretty typical example. So using it to supplement income imagine you know, you had an old Italian grandma who had a house in the annex, and now it’s worth like two and a half million dollars and she can’t even afford to pay on property taxes, you know, that stuff like that. So it’s it’s use very typically in examples like that. Drawing equity over the home in order to subsidise a lifestyle, maybe subsidise the pension, maybe to allow people a more comfortable retirement and maybe pay for care as They continue to age and advance on inheritance. Yeah, yes, exactly. But the way that we’re looking at it is through an investment ones. And so an opportunity like this could be very substantial. Actually, quite a few of our clients are employing opportunities like this. What it is, is a boomer parents home costs 14 million, say that their age is over 65. I forget all the exact LTVs. But if I recall correctly, I think 55 Age 55 and above, you qualify for like, I’m going to say like 30% LTV or something like that. And then 60 qualify for like 40%. And like 65 is like 50%. I might my LCDs are a little bit off. But the point being that’s pretty conservative. It’s very conservative. And when you the kicker is no mortgage qualification. If you’re if if a boomer parent wants to qualify for a mortgage and do an equity, takeout or HELOC, generally it’s very, very, very difficult for them because then they don’t have an income. Right. And so that ends up being really difficult to access the equity in their own home. You know, people will say, Oh, can’t eat equity, can eat equity can eat equity. But like that, yeah, exactly. My

Erwin

heart I bought was No, I can’t eat it, but equity paid for it.

Matthew

So I thought you said that you were eating like Kraft dinners and stuff.

Erwin

But it’s been coming up very often on the show, like real investors, people we all know from the community, and it’s coming up regularly, no one’s eating cashflow, because no one’s got it. Right, because like you’re the proxies for talking about it to do like a like to renovate a four Plex and build a garden suite. There’s money going out the door all the time, like who’s eating on the exit

Matthew

on the refi. Right, but the opportunity grandma’s house,

Erwin

the eating on the reef on the mortgage on the

Matthew

its equity, it’s still it’s still the equity that they’re drawing out. This is just a really well off of it. This is just a very sophisticated way to access that equity. So a few of the key points here you can get up to 60 50% loan to value with no mortgage qualification. So 50% loan to value no more qualification. Here’s the kicker, no more monthly mortgage payments, no monthly mortgage payments, all the interest is capitalised until passing. So think about the opportunity here. If grandma or I guess it’d be not grandma just mom for our kind of like Gen Zed type, not Gen Z Gen X type client base, their boomer parents or our boomer parents would could access a million dollars of equity out of their property no mortgage qualification no monthly mortgage payments yes the interest rates a tiny bit higher it’s like some some percents of like 6% or something like that but not all not overly not overly burdensome not too far off like the lender rates right? So can you imagine take a million dollar takeout if they were to hand that money? This is not bank a mom and dad in the traditional sense salute Hear me out. If they’re gonna take that money hand it to their Gen X kids, those Gen X kids maybe if they’re having problems problems come up with the down payment and or add or mortgage qualification for a $1.5 million triplex maybe they can still qualify for a $500,000 mortgage though not a not a $1.2 million mortgage. So that million dollar takeout becomes a massive downpayment towards that $1.5 million. triplex $500,000 mortgage, massive cash flow because the financing is so low. And if you work out the math, you know, call it $7,500 in rent and call it up maybe $1,000 of expenses. So you know, $6,500 left, call that mortgage payment, like I don’t know, three grand, something like that, right? You still have like 30 504 $4,000 a positive cash flow, that positive cash flow can be kicked back to the boomer parents to subsidise subsidise their lifestyle and their retirement, right. And so it can be a win win. structuring it like a win win is the key. So it’s not just the handout from bank bank of mom and dad to the Gen X, their adult children, structuring it like win win. And so the beauty of this is that, you know, all this is gonna go to the kids typically anyway, upon passing, the interest gets accrued, and then the reverse mortgage just has to be paid out upon passing. And really, it’s just going to be an asset handed down to the kids anyway, normally, you have an appreciating asset, the family home is going to depreciate, yes, you’re gonna have debt that’s going to continue to accrue but more importantly, I was able to acquire another great asset and have really great cash flow and helped my parents at the same time right and potentially house hack. You can house hack it you can live in the truck triplex you can generate additional rent, you can subsidise during the live cost of living there’s lots of great opportunity to hear the triplex

Erwin

now you can Airbnb the other suites I don’t even know I’m not a Toronto person.

Matthew

There’s some restrictions here. Airbnb but but generally, but generally speaking, house hacking is one of the ways that a lot of our clients are get onto the property ladder as an alternative to a condo. And we’ve we’ve shown that it is viable alternative to a condo, same down payments and closing, same carry costs. And then

Erwin

the cost of the grandma, grandpa, everyone in the globe mail just few months ago, I’ll find you that article as well. But it’s the cost to them is the same if they give it to you today versus they give it to you after they pass

Matthew

- One of the things if you talk to wealth planners and private wealth managers and stuff like that now, one of the things that’s starting to come up and I appreciate this too, because my wife works and she has a PhD in gerontology. And so she works in with ageing and care. And one of the things that’s starting to come up for these ageing parents is a living inheritance. So you mentioned you refer to that earlier, rather than just upon passing. Give it to them now, so that they can see them enjoy it and appreciate it now rather than later. And then in the context of real estate, real estate is going to be more affordable now than later as well.

Erwin

By sharing my story on the show, like my each of my kids have a house already about the metre how we train I bought the metre house before their turn one. But then like just don’t know more recently, I thought about it, I’ll probably get a pretty decent mortgage on it as well. So at least at the pay, like two grand a month or something instead of what it would be if they bought it would be like six 8000 Right. So they have some sort of pain, some some responsibility. Yeah, cuz like my mortgage is big in front of a friend of mine in Toronto has bought a house 2.8. So his mortgage is gonna be like, five digits. monthly payment. I mean, that’s crazy. So, you know, my point is that when I wind that down to like two gradients, yeah, you know, something more digestible, like something that you know, that’s always like a break them

Matthew

with a Bill Gates say, I want to leave my kids enough that they enough that they feel that they can. So they feel like they can do anything, but not so much that they feel that they can do nothing. You know what the amount was? 10 million. For him, that’s a drop in the bucket.

Erwin

Can you walk me through like a recent Toronto deal?

Ming

Sure. So right now, we did one just a couple of weeks ago, downtown near kind of DuPont and Dovercourt for those who are familiar with the city. Turnkey four Plex, very nicely renovated. We picked up for just under 2.5 million. That is and that was trading at a 5.2% cap.

Erwin

As is or you did as do work to it, turnkey? Did they advertise it as 5.2?

Ming

They did. And we did all our due diligence, and we took it at just under 5.2. When all sudden then.

Matthew

Oh 5.2. Okay, I’m getting the digits mixed up. The purchase price was 5.5.

Erwin

How often does that happen? Well, their account numbers accurate.

Ming

It doesn’t it’s not super often because it is not because the cap numbers aren’t accurate. It’s because true turnkey is not really turnkey, right. Most of the properties that we look at which are turnkey, are really like 70 to 80% Ready, and you still have maybe 40 5070 grand to put in to really get it maximised. Not a bad thing. Because sometimes that means a better deal for you. But yeah, if they do occur, we did one the month before that, which was actually an even higher cap, that house had more problems, though, like, bathroom needs to be fixed stuff like that. But they exist, I think we’ve seen a rise in trading caps, because of interest rates, right? Like houses aren’t going to trade if they’re in the low fours right now. Nobody’s gonna buy them, especially if your investment properties, right.

Matthew

So investment. residential investment, real estate was in around the four and a quarter 4% You didn’t like 3.7533 quarters. But then, you know, with with the change in the environment in the real estate market, we are seeing kind of high fours

Ming

are trying to get, you know, trying to buy these directly from developers now because we have clients lined up. We’re looking to buy if we can, if we can find something that’s in a five cap there, they will happy to buy it. So there any developers on the show want to hit us up. We’re always happy to talk.

Erwin

So these are small, tiny developers. Yeah, we’re

Ming

not looking for big stuff. It’s usually people looking like you know, four, four or five, six units Max.

Matthew

Usually, hopefully still with residential financing. Because that’s usually advantageous. But if you you know, we can make it work even on on commercial As we know how to get to, if it’s not legal, we know how to get to legal so that we can get it to see much commercial financing CMHC and then CMHC insured without the MLA select programme is about four and a quarter on interest rate and 40 gramme not a 50 around. So it’s, it’s still pretty good. It’s just not quite as good as the NY slap programme.

Erwin

So how much for this? fourplex? That’s right, you said two and a half? Yeah, just kind of down payment of some of the brain for that.

Ming

He put 20% down.

Erwin

That’s it? Yeah, so

Ming

maybe not a typical deal, then because you know, he’s doing well. So he can qualify under regular residential financing.

Erwin

Not like they’re not trying to live off this cash flow. No,

Ming

because even at even at that cap rate, cash flows, there’s very little cash flow there, right? It is minimal. It really is about acquiring a turnkey property. He’s a super busy guy. So he doesn’t have time to manage it, he wants something that is gonna be trouble free for his property management company, therefore trouble free for him. And to let it build

Erwin

equity over time, his property management service costs in Toronto,

Ming

we have a really good deal that we have with one of our partners, we’re paying 400, for

Matthew

monuments, but it’s actually flat rate. So typically, in smaller towns, eight to 10% of rents is pretty typical.

Erwin

Or it’s gone up a lot, though.

Matthew

So we’ve negotiated, we have a flat rate, actually. So think it’s like 325, for triplexes, and 395 390, and 40 bucks, for four classes, it ends up being like 5%, less than 5%, or less than 5%. In a lot of instances, wow.

Ming

They don’t take on any property though. That’s because we’re giving them volumes volume, we’re also giving them a certain type of tenant profile, because everybody who’s, you know, spending three grand on rent in the city is a certain type of professional and whatnot, they’re not trying to scrape them,

Matthew

but they so they, they follow the properties that they taught take on happened to be properties that we they follow. They’re very similar ideology in investment business model. So they want headache free, as well as much as possible. And so all the properties that have to be located in a certain area catering of a certain quality catering to a certain tenant profile, very rare. And so that’s why they’re able to keep their rates and that lowers because of the headache factor.

Erwin

Go back to this four Plex example. The inherited tenants, you kept them all?

Ming

Yeah, yeah. In this case, we did. Usually we don’t. Most the time you want to make it was because typically, it’s under, you know, they’re under market. But in this case, we did like we did some due diligence. And we decided to inherit all the tenants,

Erwin

the due diligence, due diligence, we able to do that during a conditional period or anything like that. Yeah.

Ming

So you know, this was about a month ago, before things started getting really crazy in Toronto. So we did have a conditioner period to do all these things. Yeah,

Erwin

the nice days, they went away fast, very fast.

Matthew

So a lot of a lot of clients now crying over spilt milk. We told them last year by you know who you are. We’re like, you know, everyone’s like, Oh, I don’t want to catch a falling knife. And like, the thing is, like, you and us, we know we studied like economic fundamentals, we understand. We understand that interest rates are just a market influencer. They’re not an economic fundamental. Most people don’t understand that though.

Ming

stocks.

Matthew

And so like I spent a good part of last year talking people off the ledge. Basically, everyone’s like freaking the hell out. They’re like, Okay, we got into this business model for a very specific reason. And the economic fundamentals are there and the long term prospects haven’t changed. So I forget to have it right. And so we talked we last year was a lot of talking people off the ledge, and then a lot of people were apprehensive even though the it was presenting a really incredible opportunity. We knew that this this was going to slam shut once there was stability back in the interest rate environment. And so not that we had a crystal ball but we said once once back Canada wants to back when, like, you know, which they say okay, things are gonna we’re gonna stabilise interest rates. What’s going to happen? This is where the most newspaper headlines got it wrong, not wrong, incomplete. They said, Oh, the higher payments are making people not want to buy. That’s only partially true. The other part that they neglected to mention is that buyers did not want to buy in an environment of uncertainty. They didn’t want to buy in an environment of uncertainty. So as soon as we got back to more stable environment from an industry perspective, that immediately got reflected in the real estate market. So the 40% less sales volumes and transactions last year, those buyers at the end of the day was still Toronto, those buyers didn’t disappear. They just moved to the sidelines. And as soon as they saw stability back in the market, they all jumped back in, not, let’s say all the 40%. But a crap tonne of those 40% of people are back in that market right now. Which is why we’re back to point two offers. In the last six to eight weeks, it’s been a hellish environment, operating

Erwin

and listings are way down.

Ming

This is one of the I guess, I don’t really want to call it an advantage. But when you’re dealing in, in properties that are kind of the two $3 million range. The majority of people are transacting on that stuff, right? Especially if it’s an investment property. So we do have a little bit more time we do have a little bit more grace, than if we’re fighting over like, I don’t know, like a $1.1 million investment property. There’s tonnes of people that are after those kinds of things. But when we’re we’re playing around the two and a half, three and a half. There’s time for negotiations for that way.

Erwin

That’s nice. Well, I’m

Matthew

well I mean, we have sometimes not all the time, but we have a $3.8 million I flex listing right now it’s a pocket listing. And, you know, awesome runs like a two and a half $1,000 of rents cash flows as is. Yeah, so anyway, the point being is that there still is stuff that the competition isn’t necessarily there for this type of product. So you can still find really good stuff

Erwin

just to highlight you’re allowed to solve real estate publicly because you’re licenced Realtors as well.

Matthew

Yes, we are licenced realtors.

Erwin

Breaking the law like some other people do.

Matthew

He’s had a realty so you should talk to him. Don’t talk to me. Yeah.

Erwin

So. Oh, can you uh, what were the rents on this? Two and a half million dollar four Plex?

Ming

I don’t remember them off top my head 12 and a half 1000 Matt matzo was really good with numbers off the top of my head. I’m terrible

Matthew

in names, and then he doesn’t he barely remembered.

Ming

Yeah, I’m glad it says your name everywhere in this room. Otherwise,

Matthew

his name is Mr. Hamilton. According to that licence plate. Yes. Expect to see that on the car. I see. See that is dented. So who did I think

Erwin

it’s actually just kind of get it off? Because it’s old. Yeah. Yeah, I don’t know what else it was. It was just like stuck on.

Matthew

He’s bad with faces. Now. He’s done with names and faces. So together we make a really bad one brain.

Erwin

Also, we have a green plate on the car on the new car. So Oh, yeah. That green plate, you know for each morning driving HOV. So I can reuse this. Like doesn’t that didn’t give me a job.

Matthew

People don’t recognise that Tesla already means Green

Erwin

Point. I don’t know. Yeah. volts. Think about that. Like, no, no, it’s not green licence plate, but

Ming

it’s a pretty recognisable electric car.

Erwin

Yeah, good point. I’m gonna stick it back on them. But yeah, here’s a little thing that they will play. So we don’t want to throw shade at any other people’s investments. But Matthew, before we were recording, we’re talking about investing in Alberta because it’s a hot topic, because I don’t know you mentioned before we’re recording you don’t spend much time on social media. But there’s a lot like this. It’s been in the news by BC in Ontario. People are leaving to go Alberta makes sense. I think Calgary is beautiful. Little too cold for my liking. My family’s all here too. So I won’t go anywhere personally, there are people flying to invest in but the you have experience. And the reason why I also pick on you as well as because I think it’s always wise to speak to someone who has nothing to sell you in Alberta. Right? Because literally I have Alberta bulls in the show. Right? And they’re not hiding anything. They have whatever to sell. It’s totally cool. Nothing wrong with selling stuff. We all sell real estate here. Yep. And we meet people a lot of money. Right. So it wasn’t a terrible thing that we advise them to purchase real estate that we earn commission off of. So what was your experience? Like, you know, Berta

Matthew

years ago, I think when I was younger and very enamoured by the shiny objects, you know, we all of us here and a lot of the people come on your show are going to be old part of the old rain guard. And so one thing that ranged the tote a lot of was cash flow, cash, cash flow. Back in my earlier days, I think Oh, Reagan used those put those Top 10 Top 10 towns right, and I haven’t seen one of those in a long time. But Edmondson, topped the list. There was top 10 Alberta towns, Ontario towns, BC towns and Canada. And Edmonton was at the top of the Alberta one and the candidate when I was like, oh, there we go. Let’s go target

Erwin

was number one, number two on both as well. In Alberta and Canada. Yeah.

Matthew

And, and so and, you know, a lot of rain top brass invested there. I’m like, Okay,

Erwin

well, just to give context for the listener, like we’re talking about, like 2008 doesn’t last for many years. Yeah. Many years, so I don’t think anyone needs to know the market that well to know like those markets were all decimated.

Matthew

Yeah, this is this is years ago. So you know, chasing the shiny objects. I went to a lot of different places and to invest and Edmonton was one of them. And you know, like you said, I want to throw shade in anyone else’s investments or anyone else’s business models. I’ll just speak from my own experience. I purchased it a block of four townhouses. So I basically went in and monopoly terms, I went straight for the, I guess, the red hotel. And so I bought for the block and for townhouses, a number of years later, I went to divest them, I do other personal considerations, and I wanted to bring back everything to Toronto and everything like that.

Erwin

Coming to us to do holding them five,

Matthew

five years, we were what year you

Erwin

got in, because I’m going to ask you how that can work compared to a local piece of real estate. I know this, this is the truth about real estate investing. Right?

Matthew

This is yeah, I’m trying to remember exactly when early 20 2010s like that back in those days,

Erwin

held. So that’s after the crash to as if I

was at it was actually after the real estate crash in 2008, when she wasn’t nine. So you still turned it right. And it didn’t work. You know, even from a timing standpoint, it was not that bad. Let me think that 2014 Way worse, if you if you’ve been way, way worse. I know a lot of other horror stories. I also know, the type of asset I was buying also gave me a little bit little more protection. I know a lot of people were buying really, really, really cheap condos for like 180 grand. And like, I know that people got decimated with not just the market, special assessments, and stuff like that. So anyway, let’s refactor and talk about what happened. So I got these blocker for townhouses, five years later went to sell them, sold them for the exact same price, I bought it for five years earlier. And it took me over a year to sell it. Couldn’t even find a frickin buyer.

Ming

And I couldn’t properly sell with an APS and

Matthew

I couldn’t even sell it. Normally, I had to offer an agreement for sale, I had to offer an agreement for sale as part of the as part of the offering in order to make it enticing enough for someone to come in and buy. So you know, if you’re a little more sophisticated, you were you know, if you know anything but agreement for sale, if your sales still essentially means I’m in the deal. I’m down on title, I’m down on mortgage, you’re still the official I’m still the official owner, the other person takes control of the property. And the person dictated to me the amount that they want to put down as a as a deposit. I couldn’t even access all my own equity. Because I only got the little pittance they offered me

Erwin

how much a couple grand

Matthew

like for the you know, a 20% down payment or 20% equity ahead. I think they came in less than less than 10%. So like half my equity was still locked up in this property and I wanted to get out couldn’t get out. But this is this is the realities of, you know, some markets that are very, very boom and bust. And so a

Erwin

small market we’re talking Calgary here, Edmonton, sorry, Edmonton. Yeah, a small market,

Matthew

not a small market. And you know, it’s just it wasn’t the same experience as I’d had here when I was here in Toronto. Anyway, who made money on this on that deal? pesky real estate agents on acquisition on the disposition agreement for sale real estate lawyers on the acquisition on the AFS and on the closing

Erwin

for legal fees to pay

an eye for legal fees yeah times this is all times for because I had four smaller properties

Erwin

right so I started some by all four so we came in and bought

Matthew

bought the block of four Wow Yeah, and then so yeah,

Erwin

so the so the lost money after all, because all the fees you have to pay how this played

Matthew

out was the logical conclusion actually was they couldn’t get financing at the conclusion of the AFS. So I stayed on mortgage because all I had to do was call up my lender and say, hey, I want to renew this for a year and then I was able to get a an extension fee. So that’s the only money I made in this whole deal because I actually only they only broke even after holding for five years, not through appreciation through mortgage pay down cashflow I managed to break even and then that small extension fee was the only thing I made an entire deal. But I ended up holding mortgages even longer and not accessing my equity for even longer right so

Erwin

while inflation did oh yeah, I

Matthew

lost money. If you if you look at on a real basis

Erwin

for listeners both inflation was higher than the Matthews returns. Yes. So in real terms, you lost money.

Matthew

I lost money. Yes. If I had just put it under my couch cushions alone. Yeah, I would have done better.

Erwin

While I was headed to this probably advisory centre, how to hide money? Coach? Yeah, different yourself. You don’t spend it. So I said I would ask, what would you bought instead in Toronto?

Matthew

What would I have bought? Or Or should I have bought?

Erwin

Did you have anything in Toronto for example? Yes, yeah,

actually, here’s the here’s the ironic thing. My very, very first investment property was in Toronto. And I didn’t know anything at the time. I was working corporate I you know, I graduated from engineering at Waterloo. And then after that, it worked for a bunch of tech companies on the business side. So here, I was working in Toronto, and I thought I was gonna do what everyone else is gonna do, which was buy condo, let’s move all my friends are doing so seemed logical. Okay, I guess I’m gonna buy a condo. And I was talking to a buddy of mine. He’s like, why you can buy a condo? Why don’t you do it? I’m doing like, what are you doing? Like, I bought a duplex. I’m like, What’s a duplex? And then he’s like, Oh, it’s two units in a house. I’m like, why would why the hell would I want a house? I remember growing up mowing the lawn, and you know, all the crap that comes along with us, right? Somebody who show shovelling snow and everything, all the problems associated with it. Why would I want a house?

Erwin

Because no one taught us hard assets in school? No.

Matthew

Here’s the other ironic thing. My parents actually invested in real estate when I was young. But I was born and raised in Belleville. And that’s where they invested. And they had a hell of a time. I know you’ve we’re widespread audience. So we’ll make sure to change. Right. So yeah, coming back, was gonna

Erwin

sort of actually help topic was belvo Back then, because I think it’s 50,000 to

Matthew

50,000. Now, it was, it was 37,000. Back then. If you kept the boundaries the same, it’s still 37,000. The reason it’s 50,000. Now is because they amalgamated with the surrounding communities is not a growing market, actually, from a population standpoint. But anyway, that aside, so when looking for a duplex, and because my friend told me it was good idea, and he’s like, Hey, I live in one side in one unit, I rent out the other and helps me cover my costs. I was like, Oh, that’s pretty interesting. All you do, all you did was allocate your capital in an intelligent way to bring down your living costs. I didn’t do that. Cool. So I went, I went shopping for a duplex and then I and then I accidentally bought a four Plex. And that was my very first investment property. I still own it to this day. And that has been still my best performing property. It’s a four Plex in the annex. And I lived there for many, many, many, many, many years. Gives me the need my girlfriend turned into a wife and then turned into one kid and turn to another kid living with two kids and 750 square feet is

Ming

that was delayed moving into his giant custom mansion. That’s why

Matthew

it’s not a custom mansion. It is a normal sized Toronto home.

Ming

It’s a nice place.

Matthew

Why didn’t you know, it was anyway, delayed gratification. I was part of it, too. But yeah, that was that was the first investment property that that I had bought. And so Toronto was the first market I actually I’ve ever entered.

Erwin

So this fourplex in the annex, there was there was something you had to do a lot of uplift to, or the market is take care of you. The

Matthew

so we purchased it. It was this was many years ago. So we purchased it for was listed 799 It was already renovated. Turned into Florida units. So I came in not knowing anything. There was an offer date, there was no offers. So I thought oh, let me you know, we’ll get this for under market or under the list price. So when like 768 rejected or offer 788 rejected or offer 800 or 79 ad list rejected or offer. And they listen, you just said we want a 10 so, lo and behold, I gave me time. And meanwhile I was kicking myself. I was swearing at my real estate agent. I was like what the hell? How can we good going over ask on there’s no other offers? Like what the heck, I’m overpaying for this thing, right? That $10,000 Now, as we all know, is a rounding error. Right? Like it’s less than a rounding error or

Erwin

someone would gladly pay you temperature $10,000 for this property, right.

Matthew

Yeah, probably. They would probably give you

Erwin

fair market value and 10 grand for your pain and suffering that property off your hands.

Matthew

Yeah, I think 10 grand would probably get the closet me less than the closet. The so yeah. I mean, I’ve refinanced this multiple times over the years and you know, market that is always much higher than that. And it’s requiring four flexes.

Erwin

What do you think roughly? The market value is? No.

Matthew

I’m not a real estate agent.

Ming

You should be getting in if you renovate it. So it’s it’s nicer. No, as is Come on, as is. Low twos.

So that should be that should be I refinanced. I refinanced it. I think it appraised that 2 million, like four years ago. So it’s worth more than that. And it needs a bit of work. Yeah, it’s a little it’s, it’s a wonder for a few. Yeah, so more or less, no, but like, the, the thing is, is looking at this upside potential, I can build a garden suite on it, no one knew what I know. Now, I knew nothing back then all I knew was, you know, I knew how to work, I worked in business. So I knew how to run like a business case and business model on it. I know how to run financials on it, but didn’t know anything else. Knowing what I know. Now, I can look at look at the zoning on it, for example, the density is 1.0, not 0.6 0.6. Typical in most residential areas, 1.0 gives me the ability to do a lot more with the property, I can add a lot more square footage as of right, I can I can go up, I can go back, I can build a laneway suite on this thing. So now with a more sophisticated lens, I can recognise all this upside potential. And this is the type of stuff that we try to do with our investors as well we look beyond just you know, there’s so many people who call themselves employees, you know, you must see this all the time, too. You know, you see you have all these people who call themselves investor realtors. And really they’re like, Okay, Mister client, here’s the income, here’s the expense, here’s cash flow. Wow, I’m an investor realtor now, and the reality is much different. There’s, you know, legal status and permitted use, there’s zoning, there’s, you know, building code. First. There’s, there’s 1001 things that go along with this. And so that’s, you know, realising that kind of upside potential or being able to recognise it as part of

Erwin

a part of our agenda fourplex, that the fires the fire safety standards is like, the most people have no idea. And then,

Matthew

you know, part of part of what we do with clients too, is we we have advisory on the real estate side. But one thing that’s unique is we offer also offer advisory on the construction side. So a lot of our clients who have the financial means and the wherewithal, let’s say, to want to go through a single family to legal luxury triplex or legal lottery, four Plex conversion, it’s not a trivial thing. Like it’s not like you just, you know, get some plans and submit them to the city where you go, it’s not that simple. And so, you know, a lot of it, you know, navigating CoA, getting the right architect to add engineers, surveyors and understand understanding things like side setbacks, and minimum basement ceiling heights, and two methods of egress and fire separation and, you know, the 1000 other things. So one of the things we do is we handhold clients through that process. So, for instance, the head of our construction department, and she offers a construction advisor to help people step them through that process.

Ming

And even at acquisition, you get some of these things wrong. Like you get, I don’t know you’re looking to a fourplex version. You don’t know that right now City’s pushing for for an amp service on anything. If it’s four units and up. You start to have to upgrade your gas, your electrical unit, your estimates can be off for like 5060 70,000

Matthew

amps, you have to bury. You can’t run that in the air like 200 amps

Erwin

on a regular residential HMO know this. Yeah,

Ming

you can’t get that wrong. You get it wrong. It just kills your business case, right?

Erwin

Well, no, the novice buys it and then they find out later. Don’t be left on the bag. So Toronto is definitely possible. And then I jokingly asked at the beginning. So you guys have kids in Toronto.

Ming

So we did so we have a house that’s technically for our daughter did life plan was actually for us to move down into that area at some point in time. Because it’s in a really good school district. The reality is I’m you know, antisocial country bumpkin. I like being far away. We didn’t bring

Erwin

the farm capital of Aurora. Yeah. Oh, dude.

Ming

There was a point in time where we were living a place with well water and you know, septic systems. I love that. Like I love just sleeping with the windows open and hearing nothing. But I didn’t want like me. Oh, yeah. Oh, man. I didn’t want my daughter to grow up to be socially awkward. And have no friends like that, that like that. Like, oh, we better move into this city. So Aurora is are moving to the city. But yeah, we technically she has a place downtown.

Erwin

Oh, man. We haven’t covered it yet. She’s running on time to. It still makes sense to buy in Toronto, because you know, you’ve seen the same headlines for the last. I don’t know how many years Bubble bubble. Everything’s a bubble.

Matthew

Even a broken clock is right twice a day, right?

Erwin

Which is funny because I feel like sometimes I’ve been right. Oh, I was right. Of course I was. It’s been like once in 12 years. before?

Ming

So, I mean, the short answer is yes, the long answer is, it depends on where you’re investing, right? So if you are buying, you know, a heavily non cash flowing place in a part of Toronto that is not going through gentrification, we don’t have the infrastructure programmes happening, then that’s a bad investment, then you’re just paying inflated values right now. So I think more than ever, like, it really is location, location, location. And, you know, I’ve always spent a premium to get the best locations because that’s, that’s how your real estate improves in value, right. So

Erwin

well, here’s a quick question. For example, like, how big is that four Plex? How many square feet? Roughly?

Ming

Each unit is about 11, or 1200. It’s pretty

Matthew

big. That’s unusual. Yeah.

Erwin

We’re 4000 square feet.

Ming

It’s big. It’s a two and a half million. Yes,

Matthew

my four Plex is not like that. They’re like 800 square feet of

Ming

floor shows three bedrooms plus a common area. So

Erwin

I’m the Asian that field math. listener, I’m sitting across from two Asian engineers, so they’re laughing at me that I have my calculator. The worst businessman

Matthew

you can’t do that that far.

Ming

Gives me a hard time is I’m the one with a math degree and I can’t do mental math, like 625 square foot.

Erwin

That sounds about right. Yeah. Why would someone buy a new precondition condo for like, 1700 square feet or whatever?

Ming

We don’t advise people to do that.

Erwin

Usually triple that, almost triple that and not that much more rent your first four foot.

Matthew

Yeah, yeah, you’re honing in on a very steep concept. And that concept is, Toronto is a very big place. Toronto is not You can’t just say I invest in Toronto, because Toronto, there’s literally we did. We looked this up. There’s like 151 neighbourhoods, 156 neighbours or something like that. We, I think was like a year ago. So we run a monthly meetup group. It has now grown into the largest, the largest real estate Meetup group in Toronto. We have like over 4400 Members, I think it’s the second largest in Canada now. The largest one is run by a buddy of mine out in Vancouver. He doesn’t keep up with it. So which means that we might overtake him wonder. Your largest active, largest active one? Yeah, yeah. Let’s start using that. Yeah, I just that. So but Toronto is a really big place. So I think about a year ago, we delivered a meet up called, I think was entitled, Toronto’s next hottest neighbourhood. So we literally went through a bunch of different neighbourhoods looking for where the opportunity was. So we’ve analysed all these, so you don’t have to, because Toronto is a really big place. So you know, oh, Lee sides a really nice neighbourhood. Does that mean I invest there? Mount Pleasant. Davisville is a really nice neighbourhood dominio investor Yonge and Eglinton insert nice neighbourhood here. Right? You know, we there’s a lot of people or a bit another big one Willowdale Oh, I see a whole bunch of people not buying a 50 foot bungalow, and then knocking down and then building some is that that’s a good investment. Right? Those are not investments. Those are speculative, at best, those are the same as the same as going to Vegas and putting it all in black. Right? Because you’re you’re basically banking on, you’re just hoping for the best essentially. And so those are not investable business models. In our opinion, those are speculative bets. Good investment, good investments entail. You know this, at the end of the day, actually, investing is the wrong word. We are running real estate businesses, every single property we buy is another business. And so due to the fact that we’re buying businesses and operating businesses, we need to know everything about that business, we need to know sales and marketing and advertising. We have to onboard staff and property managers, we need engineers, or we need real estate agents, we need mortgage brokers, we need real estate lawyers, like you’re running a business. If I if this was, if this was purely just an investment, I’d be buying a share of Apple or Google and letting Tim Cook on the show. Right. But this is not just an this is not just an investment. So as a result, you really need to hone in on exactly where an investable business model actually works. So to cut through all the crap, the short answer is in the residential neighbourhoods surrounding the downtown core, so downtown core, all condos, so according to kind of the evolution mindset and where the opportunity is, it’s not in condos, necessarily. It could be a stepping stone but you want to get to land why land is a valuable asset. There’s a tonne of things that go along with this Bilanz that are not making any more of it or whatever whatever it is you want to insert here but land is valuable. And as the Manhattan association of Toronto continues to occur many More condos can go up. But if you own a good parcel of land in the in proximity to the downtown core, that is, that has a lot of upside potential over time. So what you want is a business model that allows you to own land. The problem with owning with real estate is that you also, the land itself is not an income generating asset. So you need a building on top of it, the building is actually a depreciating asset. I mean, you know this better than anywhere else due to the fact that your wife’s an accountant, right. It’s a depreciating asset, but it’s a it’s a necessary evil to make an income producing asset. So what do you want? What do you have to do is put a building on the land or buy a building that’s on the land, and then getting into a rental business model. But the reason we have to get into we have to get several units under one roof is because of densification. The economies of skill allow us to get to cashflow neutral in Toronto, that’s you asked this earlier and you’re like, hey, you know, what is it that people used to buy back in the day, people could buy single families back in the day they could buy duplexes back in the day, those days are long gone, we have to get to triplex and not a lot of high flexes don’t work either the right triplex triplexes fourplexes. The densification is the key to allowing us to generate the income we need to hold the asset over the long term to let time to do its thing. Great. Now, the question is who to read this out to we told you the professional millennials, two to five years at a school, university educated all the rest, right? You know, a good job working in that in Toronto. Why? Because those people pay their rent. It’s highly unlikely that a consultant at Deloitte or an accountant at PwC doesn’t pay their rent to the point where you are getting a court order to garnish their wages and you’re calling up HR and asking them that generally never happens. They pay the rent. Number two, they tear up their credit. Sorry, they care about their credit. But their credit, the reality is these people have the money to pay. The reality is they’re eventually probably going to be homeowners or condo owners themselves one day, right? So the second thing is they take care of their place. They take care of the place. Why this profile, they want nice things, they want it now and they’re willing to pay for it. Do I think that they should pay $2,800 in rent, I don’t think they should, but I’m not their financial advisor. The reality is they do they do, they will pay it. And they want a nice place. They want a nice place they want it now. Because they want to be able to have their friends over and entertain that host and, and they want to impress their girlfriend or boyfriend. So they want a nice place and they’re gonna take care of their place, generally speaking. The third reason is because they’re very transient and profile. They don’t stick around 1218 Master 24 months, they’re moving on life changes for them, right, they’ll move for a job, they’ll move because they’re moving in with a boyfriend or girlfriend or whatever, right? They’re moving on their lives versus lifers. People have a sort of, generally speaking very broad strokes, but people have a lower socioeconomic demographic tend to stay much longer. Why is this important? This is important because as street rents are going up, five, eight, 10%, whatever the number is, we model at 3%. But you know, we know generally it’s a bit higher than that. As street rents are going up, we want to capitalise on those higher rents. Is it because I’m greedy and I just want higher rents? No, actually, if you look at the for example, avulsion business model, part of it is that in every sophisticated investor out there is gonna understand this, you’re gonna want to refinance, do an equity ticket, when you have equity, take out your mortgages, higher mortgages, higher and mortgage payments are higher, you need the higher more you need to hire brands in order to capitalise on the refinance. Otherwise incremental cash flow negative territory, right? It’s not available with a condo, none of this works in the wrong business model in the wrong areas catering to the wrong tenant profile, catering to people who don’t move. Right, right. And so the who we focus on then are the 20 to 25% of those millennials and Gen Zed profile who don’t want to live in the concrete jungle. So in the residential neighbourhoods surrounding the downtown core being being annex Little Italy, Trinity Bellwoods, little Portugal, Dover calls Emerson Dufferin, Grove, Lansdowne, Ron see some of those areas. On the east side, it’s the East York, the river Dales, the Riverside Leslieville, later states, beaches, upper beaches, a bunch of those areas, these are the areas that tend to want to be in. And we know that we know everything about these tenants, essentially, every time a tenant applies for my units, I do the equivalent of a financial rectal exam on them. Right? I know more about the finances than they do, actually. And so I know, I know who these people are, I know what they want. And really, it’s just a matter of understanding who your tenant profile is, what they want, and then giving it to them, and then wrapping that all in a business model that actually makes good financial sense. So that’s essentially the abortion business model. In a nutshell, it is a little bit different than how most people invest where I would say, you know, they throw it up against the wall, see what sticks. This is really the same as in business. And when you’re developing a new product or service, it’s identifying your customer first and then building a business model or product or a service around them, as opposed to just buying hoping for the best It has been a very thought through approach and a very comprehensive business model that accounts for a lot of these different things.

Erwin

In the business models change. We mentioned how single families used to rent out. Last time I had been on the show we talked a lot about triplex conversions. You buy like a two and a half storey semi, you dig out the basement, we’re talking about four plexes today. What’s next? Is there any opportunity for for example, to come to condominiums and these Maltese or or what is next six flexes? So seven blocks?

Ming

The interesting didn’t wasn’t

Erwin

just passed recently like five Plex spire five Plex, right right in Toronto.

Ming